As the craft brewing scene continues to evolve amidst a landscape shaped by economic fluctuations and changing consumer tastes, the National Beer Wholesalers Association (NBWA) remains a critical player in monitoring industry trends. The NBWA, which represents over 3,000 independent beer distributors nationwide, has released its Beer Purchasers’ Index (BPI) for August 2024, offering a unique forward-looking view of the beer distribution channel’s purchasing patterns.

The BPI is a forward-looking indicator measuring expected demand from beer distributors — one month forward. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting. The craft index for August was (cue sad trombone) 23.

Overall in August, the BPI notably dipped to 40, marking a departure from the optimistic streak of 50 or higher seen since March 2024. This reading suggests a shift towards a more conservative stance among distributors, mirroring the cautious outlook that has characterized August readings over the past three years post-COVID. According to the press release:

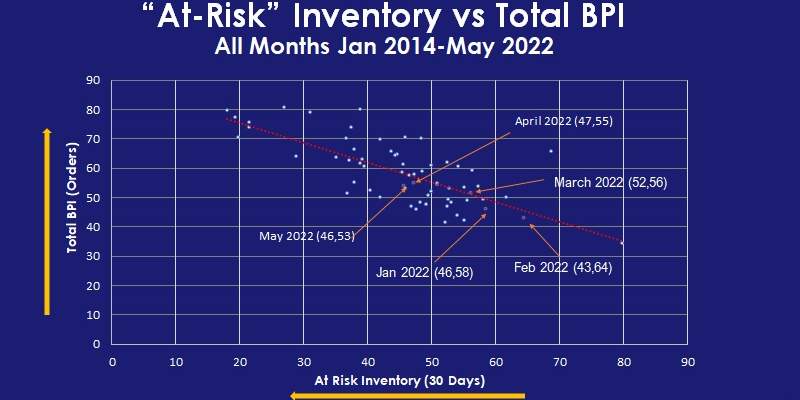

The combination of index readings for the at-risk inventory (48) and BPI (40) indicate a cautious outlook for the beer industry heading into the end of summer.

Looking across the segments for August:

- The index for imports continues to point to expanding volumes with an August 2024 reading of 55, six points lower than August 2023 reading of 61.

- The craft index at 23 for August 2024 continues to signal contraction in this segment and is twelve points lower than the August 2023 reading at 35.

- The premium lights index fell to 38 for August 2024, ten points lower than August 2023 reading at 48.

- The premium regular index fell to 39 for August 2024, one point lower than the August 2023 reading at 40.

- The below premium segment for August 2024 at 45 is slightly higher than August 2023 reading of 43.

- The FMB/seltzer reading for August 2024 at 36 is nine points higher than the August 2023 reading at 27.

- Finally, the cider segment posted an August 2024 reading at 30 compared to 29 for August 2023.

Why the BPI matters

The BPI is more than just numbers; it’s a barometer for the beer industry, offering critical insights that brewers, distributors and retailers use to forecast demand and adjust their strategies accordingly. In a market as dynamic as craft beer, where consumer preferences can shift rapidly, understanding these trends is key to navigating the complexities of distribution and sales strategies.

By understanding these metrics and the broader implications they hold, craft brewers can better navigate the challenges and opportunities that lie ahead, ensuring resilience and adaptability in a sector known for its spirited dynamism and innovation. We’ll keep you updated on next month’s numbers.

Leave a Reply

You must be logged in to post a comment.