Drizly partners with 2,200+ retailers across North America to deliver beer, wine and liquor right to consumers’ doors, and every now and then they share their sales data and consumer purchasing behavior with us. The “baseline” referenced below is defined as the actuals 8 weeks prior, in January/February of 2020. In other words, the baseline is what Drizly would have expected to see in March of 2020. This report will be updated twice weekly (Mondays and Fridays at 10AM) to track trends across North America.

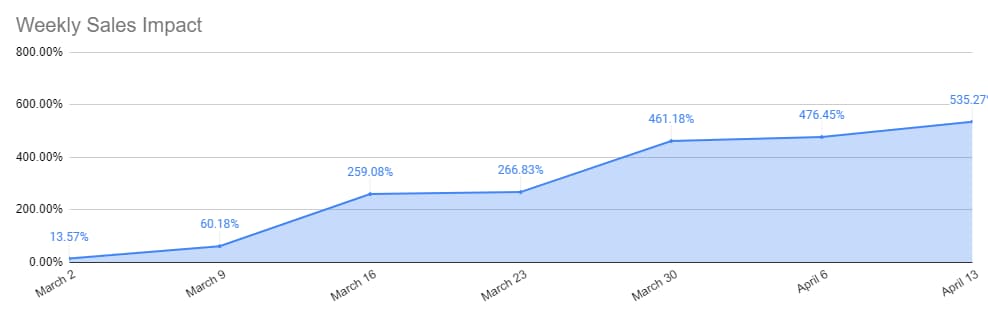

The week of 4/13, sales were up a whopping 535 percent over baseline, or what we would have expected to see during this time.

Drizly reports that it continues to see its biggest day in sales every Friday since 3/20. That growth was driven by new customers who accounted for approximately 40 percent of orders (this is usually closer to 15 percent). This did drop slightly this past week down to 35 percent of total sales, but new buyer sales remain up approximately up 1200 percent y/o/y.

Wednesday though is consistently the highest sales day compared to its baseline.

Returning users have also spiked over the last week, with the 7 day repeat rate doubling. Drizly is also seeing that consumers are placing larger orders, now spending on average 50 percent more than normal on Drizly, which indicates a “stock up” mentality.

Beer in particular isn’t a big winner in the Drizly platform, making up about 18 percent of total sales. Beer categories did make a comeback this week though – with IPAs, ales, porters, and stouts all at ~700%+ growth in sales above the baseline this week. Porters in particular were up 1071% over baseline this week. Hard seltzers have outpaced the national growth above baseline this week.

Leave a Reply

You must be logged in to post a comment.