Cheers, and on to round three as the Tennessee House Local Government Committee and the Senate State and Local Government Committee approved a reform proposal to rein in Tennessee’s sky high beer tax rate.

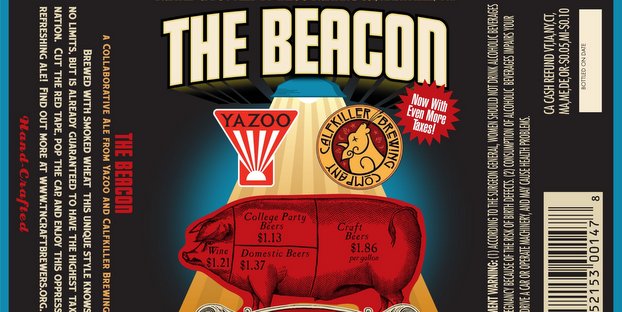

Current price-based tax policy, enacted in 1954, results in a compounding effective tax rate that is 12 percent higher than even No. 2 Alaska and ratcheting higher every year with inflation.

This fact caught the attention of Rep. Cameron Sexton (R-Crossville) and Sen. Brian Kelsey (R-Germantown), leading them to sponsor the Beer Tax Reform Act of 2013.

The legislation proposes a simple change to a more business and consumer friendly volume-based tax— much like wine and liquor are taxed in the state of Tennessee.

“Today was an important step toward reforming a tax that is working against Tennessee,” said Sexton on Tuesday, March 19, after the reform proposal was approved. “The subject may be beer, but this bill is ultimately about creating jobs and growing business.”

A coalition of statewide supporters, including the Tennessee Malt Beverage Association and the Craft Brewers Guild, emerged to back the reform proposal rallying in Memphis, Nashville, Chattanooga, Knoxville and Tri-Cities, with more than 1,000 Tennesseans turning out.

“It’s time to encourage rather than discourage economic investment, and to have a pro-growth policy for businesses like mine,” said Linus Hall, president of the Craft Brewers Guild and owner of Yazoo Brewery in Nashville.

The campaign is on the Web at www.fixthebeertax.com; on Facebook at www.facebook/fixthebeertax; and on Twitter at @fixthebeertax.

Leave a Reply

You must be logged in to post a comment.