According to a new, year-over-year study from behavioral research platform Veylinx, consumer demand is increasing for both non-alcoholic and alcoholic canned cocktails. Using Veylinx’s proprietary methodology—which measures actual demand rather than intent— the study found that demand for non-alcoholic canned cocktails grew by 4%, while demand for alcoholic canned cocktails surged by 20% over last year.

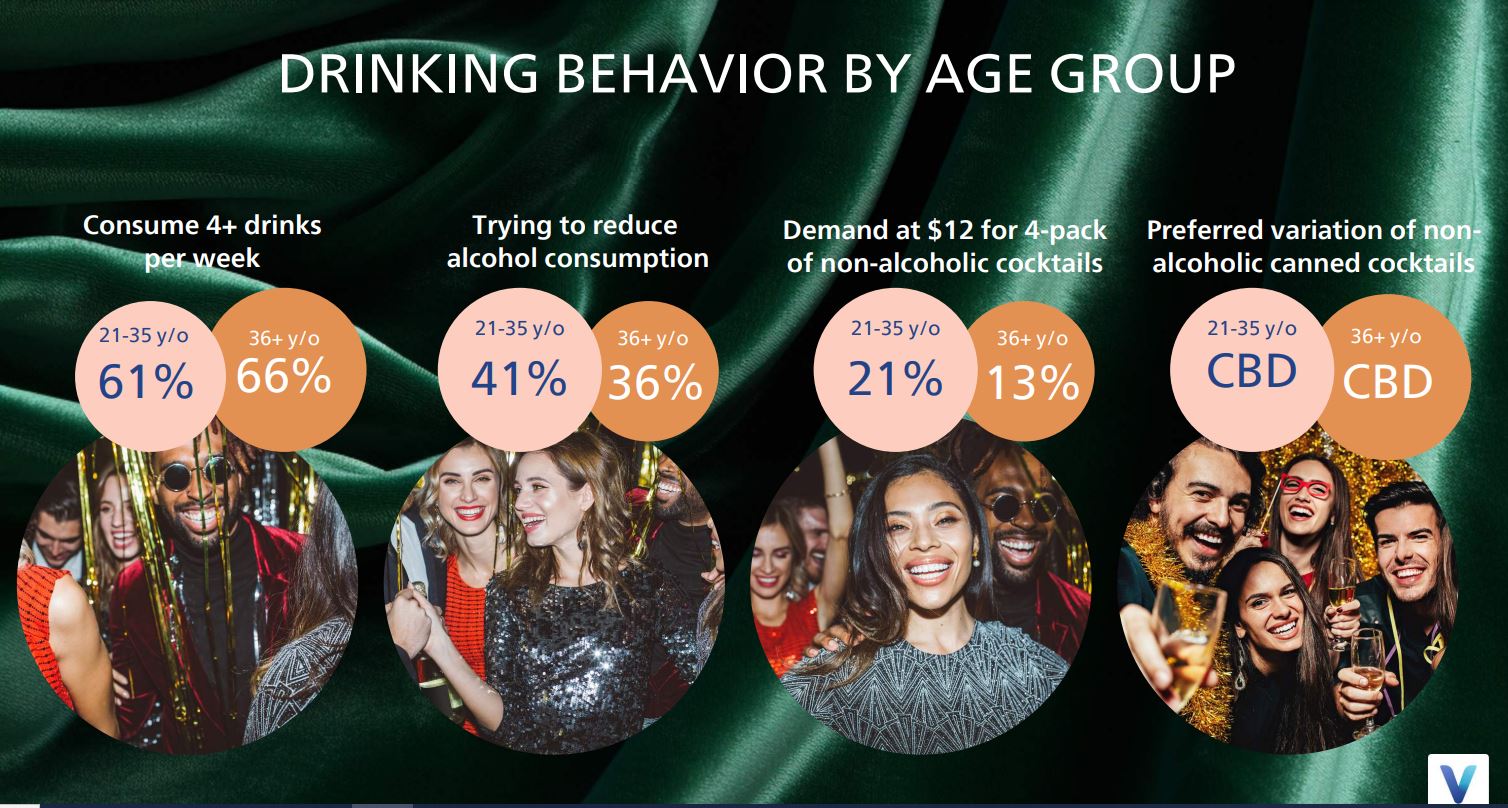

While interest remains strong for non-alcoholic alternatives, the percentage of people trying to reduce their alcohol consumption fell by 18%, to 38%. This decline from 2022 could lead to lower participation in abstinence events like Dry January.

Half of respondents claimed they would drink less alcohol if better non-alcoholic alternatives were available, showing opportunity for yet more innovation in the beverage sector. Those looking to reduce their alcohol consumption are 50% more interested in non-alcoholic cocktails.

In 2022, “Never tried before,” was the top reason consumers gave for not buying canned non-alcoholic beverages. That is no longer the case in 2023, suggesting that non-alcoholic canned cocktails increased their market penetration over the last year. Flavor and price are now the primary reasons people don’t buy non-alcoholic cocktails.

“Even with fewer people trying to reduce their alcohol consumption, demand for non-alcoholic canned cocktails continues to grow,” said Veylinx founder and CEO Anouar El Haji. “Drinkers and non-drinkers alike are receptive to ready-to-drink alternatives that are better for their health and wallets.”

The study also measured demand for non-alcoholic cocktails enhanced with functional benefits like mood boosters, detoxifiers and CBD. Demand for the standard non-alcoholic version increased 14% from last year, while the enhanced variations increased only slightly and the zero-calorie version fell by 1%. This suggests consumers might be losing interest in what they perceive as marketing gimmicks. The CBD version saw a 4% increase in demand, remaining the most popular non-alcoholic variation.

Additional findings:

- The optimal price for non-alcoholic canned cocktails that maximizes revenue for brands is $12 for a four-pack

- The brands consumers have tried the most are: 1) Mocktail Club, 2) Wild Tonic, 3) Spiritless, 4) DRY, and 5) Hella Cocktail Co

- 44% of people expressed support for an additional 10% tax on alcohol as a public health measure for reducing consumption

- For those aiming to drink less alcohol by replacing it with other beverages, energy drinks experienced the greatest increase in popularity

- Physical Health and Cost are the two most popular reasons for reducing alcohol consumption

- Grocery stores are the most popular place to buy non-alcoholic canned cocktails

- Flavor options have the most influence on which brand consumers choose

- A lower price would convince 20% of consumers to buy more non-alcoholic cocktails

Eric D Lussier says

NA is in its infancy. Hold onto your bottles. “Half of respondents claimed they would drink less alcohol if better non-alcoholic alternatives were available, showing opportunity for yet more innovation in the beverage sector.”