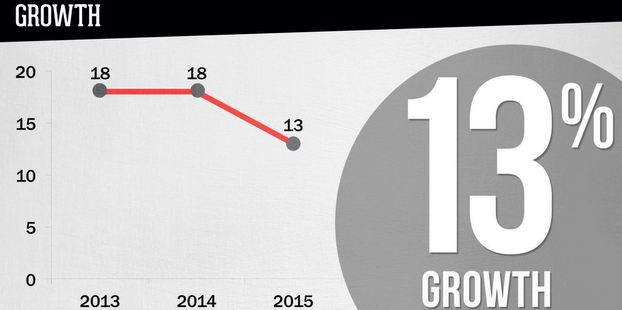

Even though the Brewers Association has a stated goal of craft beer gaining 20 percent market share in the overall beer industry (currently sitting at 11 percent as of 2014), the industry’s challenge isn’t really hitting that target. Some 2014 craft beer stats courtesy of BA chief economist Bart Watson:

- 18 percent increase in volume year over year.

- The overall beer industry only improved by 0.5 percent. Without craft beer, the beer industry would have been down.

- Pricing increased by 3 percent.

- 615 openings in 2014, versus only 46 closings (2013’s closings number was revised to 68).

- 2,051 breweries in planning.

- Exports up 36 percent from prior year.

- Convenience store sales up 20 percent, which is huge because convenience stores are the number one sales channel for beer.

So, 11 percent, 15 percent, 20 percent — whatever the number is, craft beer is accepted as a huge player in the beer world. Mission accomplished.

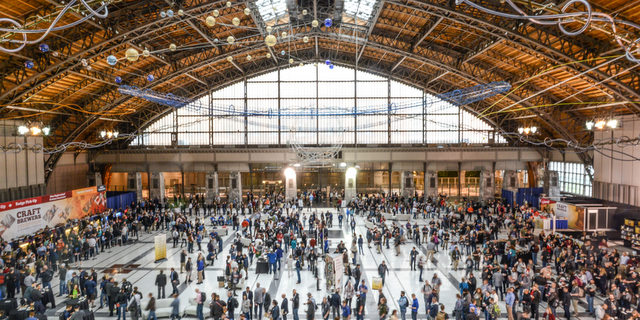

The real challenge is answering the new questions that are just now emerging from the uncharted territory the industry’s success has created. At the 2015 Craft Brewers Conference & BrewExpo America, the leadership of the BA clarified their answers for some of these questions, but it is clear there is still gray area.

One issue that will remain top of mind going forward is quality. A growing industry, especially one made of small businesses, will have its bad pints, and the BA is trying to spread training and awareness so that the whole industry batch isn’t spoiled. Some initiatives here include the formation of a quality subcommittee, the release of a Quality Systems book (coming this fall) that will be distributed to all BA members and the potential addition of a quality assurance ambassador who would travel the country and provide on-site education. More to come on that.

The biggest matzah ball hanging out there though, at least for the BA, continues to be the definitions of “small” and “independent.” Charlie Papazian, president of the BA, setting the tone for the conference and the association’s vision for 2015, focused his opening remarks during the general session on definitions. He emphasized the importance of definitions and the role that defining craft beer has had in the industry’s success.

“The Brewers Association represents small and independent breweries. Those definitions matter. All of these tiers have changing economics and market conditions and have had to reform the way they do business,” Papazian said. “Never underestimate the importance of defining yourself, your company and your uniqueness as a group of small and independent brewers, and don’t let anyone make you think it doesn’t matter.”

These comments both bolster the importance of the craft beer definition but could also give credence to a brewing company that has a business model that runs counter to what the BA has defined as “small” and “independent.”

As the industry continues its success, those invisible parameters will continue to be pushed by private equity and larger craft breweries looking to acquire and expand. Some recent examples of these include Founders and Oskar Blues. These emerging trends can create some awkward definitional distinctions that weren’t really something to consider when the fledgling craft beer industry developed its definition.

The BA is definitely aware of this gray area. Paul Gatza, director of the BA, highlighted “deals” as an industry concern, and one where the outcome is still unclear.

“Private equity … i don’t know how that’s going to play out,” Gatza said. “Is this going to impact some craft breweries, all craft breweries … I don’t know.”

The reality of this money flowing into the industry creates new philosophical questions. How does a craft brewery that sells a majority stake to a private equity firm then define itself? Does this really differ that much from selling more than 25 percent to a Big Beer conglomerate? The answer is obviously subjective, but for industry purposes, the BA has its answer. Watson clarified that this private equity money does not affect the independence of a brewery under the current BA definition, as they are not alcohol beverage companies.

But until a revision of the definition last year, the now No. 1 craft brewer by volume in the land, Yuengling, wasn’t considered a craft brewery. But file all of these under the “good problems to have” category because they all stem from the fact that craft beer is killing it right now. The definition issue, like many others, will be figured out as this industry continues to grow, evolve, shape-shift and take over the world.

Craft beer identity crisis? Industry success leads to gray areas http://t.co/EmXGBK74S0

김준영 liked this on Facebook.

RT @CraftBrewingBiz: Craft beer identity crisis? Some thoughts on how industry success leads to gray areas #CBC2015 http://t.co/AwgMPIMufa

RT @CraftBrewingBiz: Craft beer identity crisis? Some thoughts on how industry success leads to gray areas #CBC2015 http://t.co/AwgMPIMufa

RT @mkanach: Craft beer identity crisis? Industry success leads to gray areas http://t.co/q7he2nPVNu via @craftbrewingbiz

Krones AG liked this on Facebook.

Craft beer identity crisis? Industry success leads to gray areas http://t.co/VD3HtFpLhS via @craftbrewingbiz

Beer Saints & Holidays liked this on Facebook.

Craft beer identity crisis? Industry success leads to gray areas http://t.co/q7he2nPVNu via @craftbrewingbiz