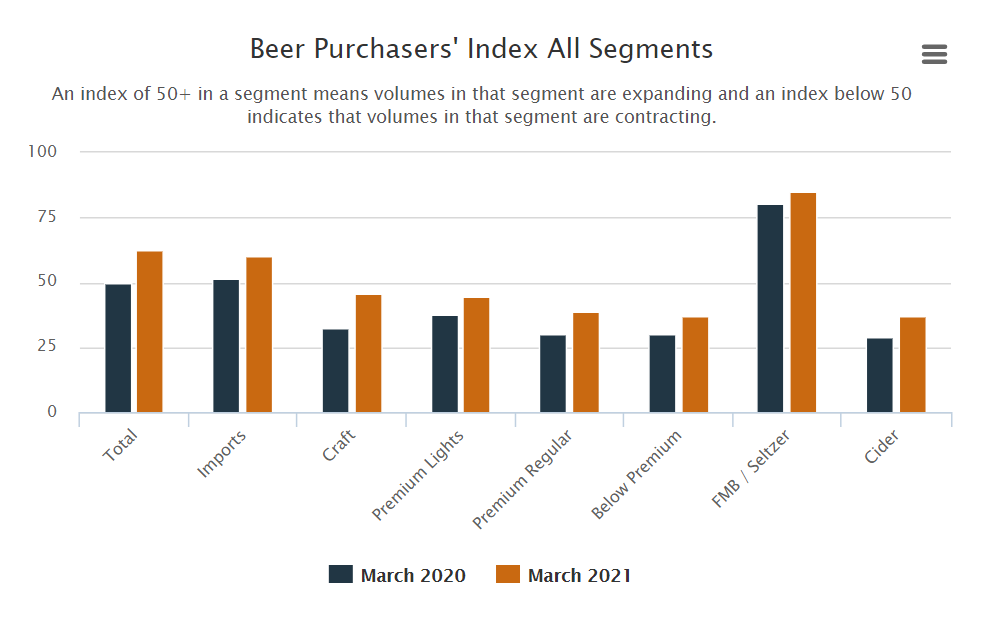

The Beer Purchasers’ Index (BPI), a forward-looking indicator for distributors to measure expected beer demand from the National Beer Wholesalers Association (NBWA), shows a reading of 63 for March 2021. This remains significantly above the March 2020 reading of 50, but the trend over the past couple of months still shows a continued, albeit slow, return to the long-running average total BPI of 57.

The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting. The “at-risk” inventory (going out of code in the next 30 days) measure for March 2021 is 37, a significant decrease from 57 in March 2020.

“In this month’s BPI, we see the comparison to data from March 2020, completed right before the widespread shutdown of the U.S. economy because of the COVID-19 pandemic,” said NBWA Chief Economist Lester Jones explained. “Looking at the ‘at-risk’ inventory, we see the impact of two significant recent events: the severe winter weather during week 8 that slowed many distributor operations and the recent cyber-attack that disrupted supply chain operations throughout the Molson Coors network.”

Across segments

The index for imports continued into expansion territory for a reading of 60 in March 2021, well above the 52 reading from March 2020.

The craft index posted another below 50 reading of 46 for March 2021, compared to a dismal reading of 33 in March 2020. This is the fourth monthly reading below 50 for craft as the segment continues to struggle to gain momentum with the slow reopening of on-premise activity.

The premium lights segment finally moved into contraction territory with a reading of 44 after 10 consecutive months of above 50 readings.

The regular domestic beer segment is also reverting to its long-running average, hitting an index of 39. While it is above the March 2020 reading of 30, the index has fallen below 40 for the first time since April of 2020.

The below premium segment reading also fell in March 2021 to 39 but remains above its March 2020 reading of 30.

The FMB/seltzer segment continued to outperform all other segments in March 2021, reading of 85 compared to 80 from March 2020. Note that this is the third instance of the FMB/Seltzer index dropping below 90 since May 2020.

Finally, the cider segment remains below 50 with a reading of 37 in March 2021, compared to 29 in March 2020.

Leave a Reply

You must be logged in to post a comment.