Boston Beer’s 2020 earnings report is a pretty good high-level view of the pandemic’s impact on the beer and alcohol beverage market, with huge success driven by certain packaged brands and some soul-searching for more on-premise driven brands. The earnings are not a glimpse at the pandemic’s impact on craft beer though, as the beer corp completely crushed it, reporting net revenue of $1.74 billion for 2020, an increase of $486.6 million, or 38.9%, from the comparable 52-week period in 2019. Seems OK.

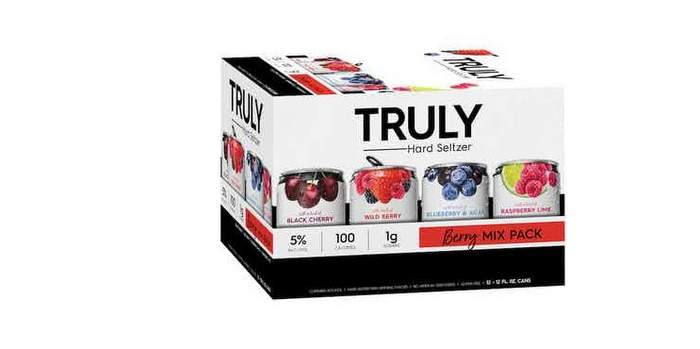

“The success in 2020 is tied to its Truly, Twisted Tea and Dogfish Head brands, which founder Jim Koch said will remain their top priorities in 2021. “Early in 2021, we launched Truly Iced Tea Hard Seltzer which combines refreshing hard seltzer with real brewed tea and fruit flavor. The launch has been well received by distributors, retailers and drinkers, but it is too early to tell if it will be successful.”

The hard work continues to be getting Samuel Adams, Angry Orchard and Dogfish Head back on track for long-term sustainable growth.

“Our Samuel Adams, Angry Orchard and Dogfish Head brands have been most negatively impacted by COVID-19 and the related on-premise closures,” said CEO Dave Burwick.

- Depletions increased 37% from the comparable 52-week period in 2019

- Shipment volume was approximately 7.37 million barrels, a 38.8% increase from the comparable 52-week period in 2019.

- And the hits keep on coming: Year-to-date depletions through the 6-week period ended February 6, 2021 are estimated by the Company to have increased approximately 53% from the comparable weeks in 2020.

- 2021 outlook shows Depletions and shipments percentage increase between 35% and 45% and national price increases between 1 and 2 percent.

Truly Truly’s world

The growth of the Truly brand, led by Truly Lemonade Hard Seltzer, continues to be well ahead of hard seltzer category growth, reports Burwick. Truly Lemonade was the most incremental new product in the entire beer industry in measured off-premise channels in 2020.

“The Truly brand overall generated triple-digit volume growth in 2020 and grew its velocity and its market share sequentially despite other national, regional and local hard seltzer brands entering the category. In 2020, Truly increased its market share in measured off-premise channels from 22 points to 26 points and was the only national hard seltzer, not introduced in 2020, to grow share.”

Twisted Tea also benefited greatly from increased at-home consumption, generating accelerated double-digit volume growth, even as new entrants have been introduced and competition has increased.

Supply chain investments

Sensing the on-coming competition in seltzers — the company is making supply chain investments and has increased its can and automated variety pack capacity. And yet, these capacity increases “keep on getting eclipsed by our depletions growth, resulting in higher than expected usage of third-party breweries,” Burwick says. This third-party stuff decreases their margins a bit, so they are trying to cut out as much as they can. You know, first world problems.

Leave a Reply

You must be logged in to post a comment.