Every week, I’m fed a steady diet of data: online beer sales reports, on-premise tap pour charts, consumer trend analyses, product packaging surveys, you get the idea. Soon, I’ll be installing a Matrix headjack for optimal download speed. Over the past week plus, I’ve gotten some interesting abstracts and conclusions from various sources. First up, Drizly recently released its BevAlc Insights’ 2021 IPA Forecast. Drizly is the leading online alcohol deliver marketplace in the United States, and Uber just bought Drizly for $1.1 billion, so expect to hear about the platform a lot more.

Well, in this cool IPA report, Drizly shares its Top 10 IPA SKUs for the site in 2020, and they are as follows:

Drizly’s Top-Selling IPA SKUs, 2020

- Lagunitas IPA

- Founders All Day IPA

- Sierra Nevada Hazy Little Thing IPA

- Bell’s Two Hearted Ale IPA

- New Belgium Voodoo Ranger Imperial IPA

- Lawson’s Sip of Sunshine IPA

- Elysian Brewing Space Dust IPA

- Lord Hobo Boomsauce Double IPA

- Cigar City Brewing Jai Alai IPA

- Goose Island IPA

Drizly’s Top-Selling New England/Hazy IPA SKUs, 2020

- Sierra Nevada Hazy Little Thing IPA

- Lawson’s Sip of Sunshine IPA

- Mighty Squirrel Cloud Candy IPA

- Sloop Brewing Juice Bomb IPA

- New Belgium Voodoo Ranger Juicy Haze IPA

Read the entire report right here. It’s well worth your time. Up next is BeerBoard, which is a technology and data company serving the food and beverage industries with quality info. Its specialty is draft beer data. The company sources and manages data from more than $1 billion in retail draft beer sales. Its digital platform captures, analyzes and reports real-time info related to bar performance, brand insights and inventory. Let’s take a look at its February 25-28, 2021, On Premise Status Report. Most venues pouring beer are back open:

Open Rate (locations open and pouring beer) has come all the way back and checks in at 92% for the period (Feb 25-28) and ties the high-water mark since BeerBoard began tracking this data in early May 2020.

And lots more taps are pouring:

Nationally, Average Number of Taps added one tap for the period (Feb 25-28) to climb to 17 per locations. Six of the 10 states tracked added at least one tap, led by Texas, which added three taps to return to 18 per location. Michigan, which has skyrocketed back (from just seven taps a month ago) to land at 20 this period, and Tennessee (18) both added two taps. Illinois (13), Nevada (19) and New York (18) added one each.

Top beer pour styles continue to be: 1) light lagers, 2) lagers and 3) IPAs. Read that and more right over here. Heading back to online sales, let’s take a quick peak at Tavour’s Craft Beer Report and Trends for February 2021. So you know: Tavour is an app-based delivery service that connects craft beer lovers with hard-to-find brews. The company’s new monthly report covers many things, but this month notes the popularity of tallboys on its site because of the can shortage.

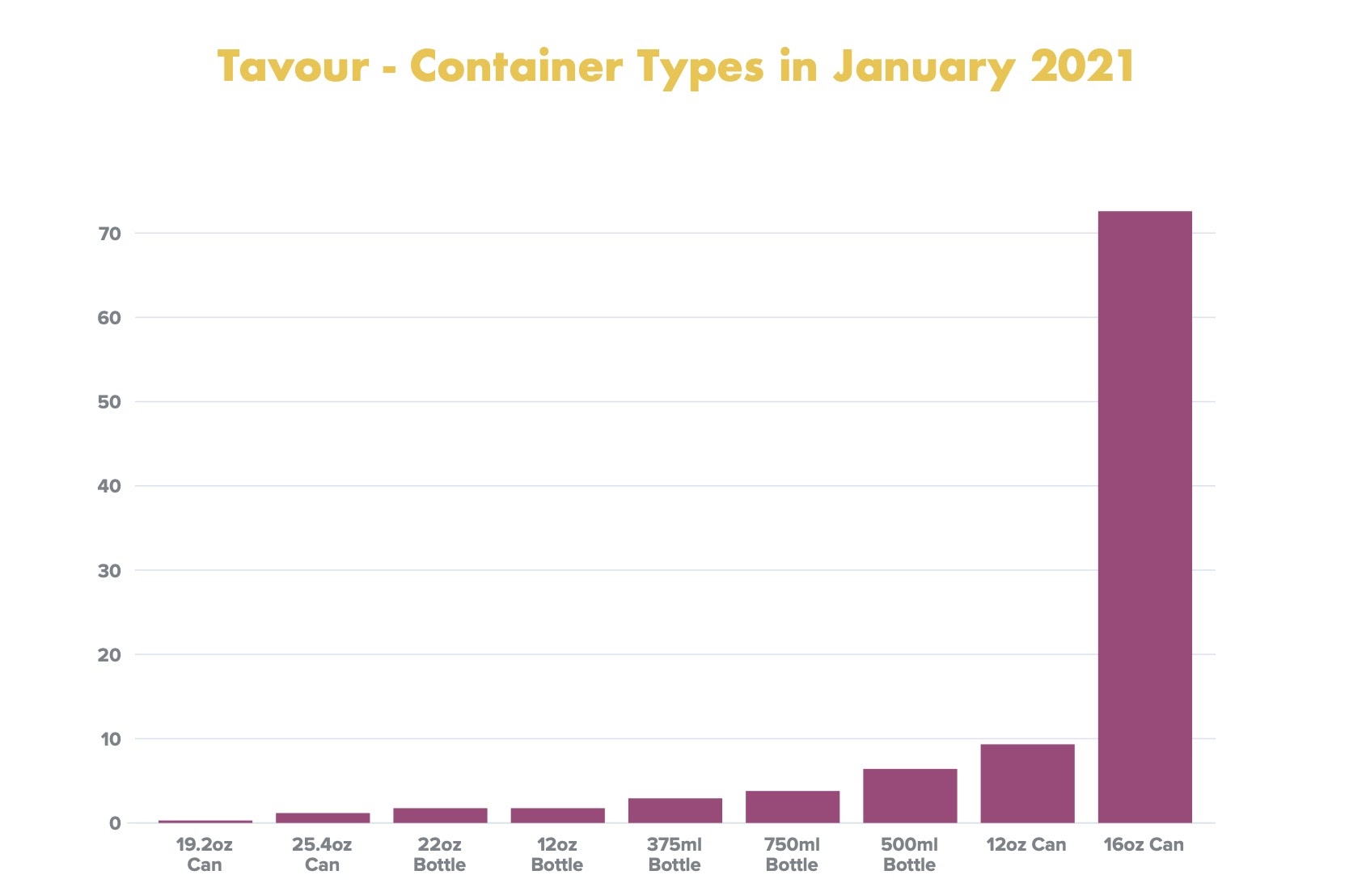

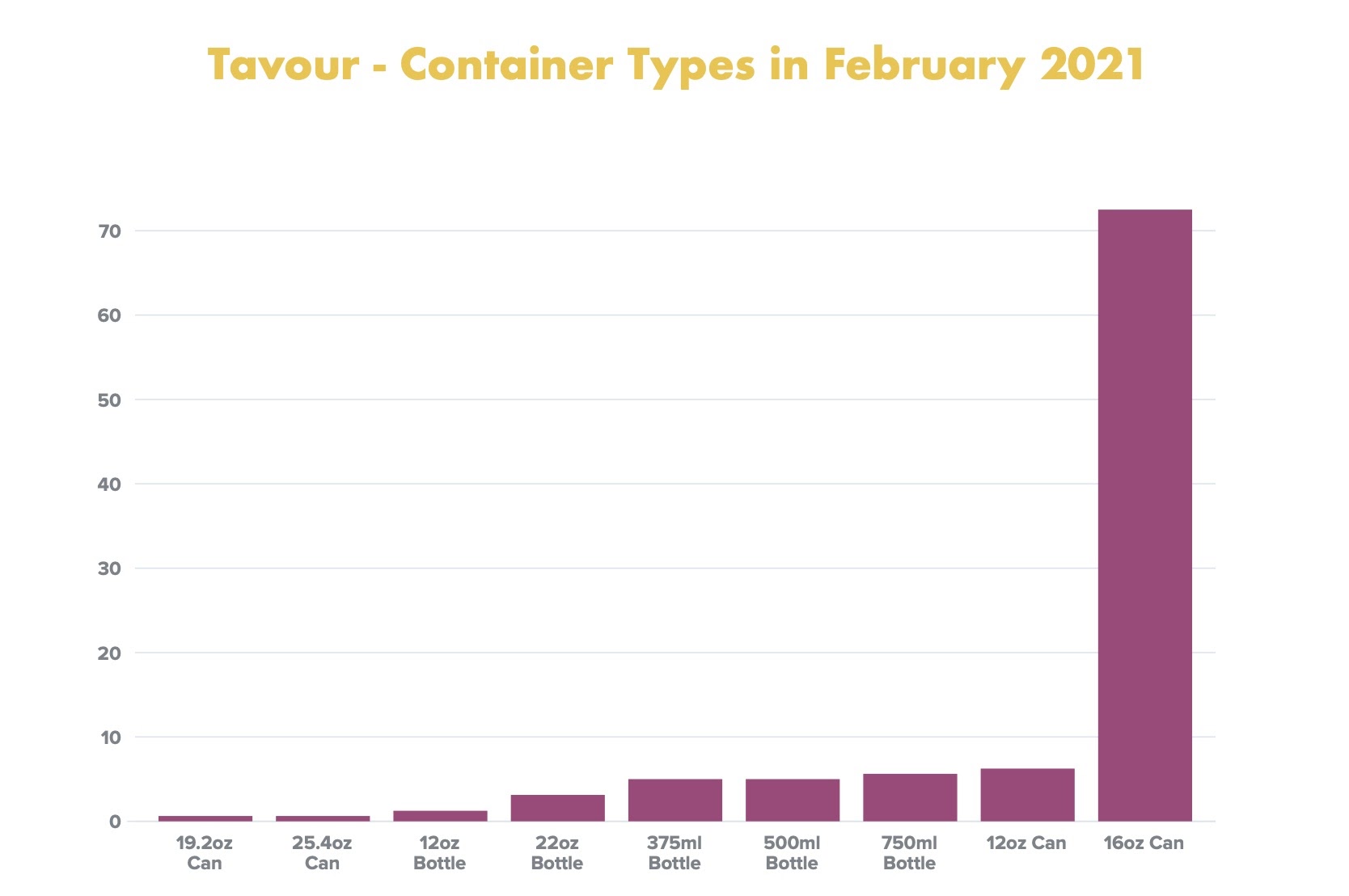

The COVID-19 crisis sparked a can shortage last year that is ongoing. As the Tavour team learned from communications with breweries, however, the shortage is specifically centered around 12 oz. cans rather than other sizes. Some breweries, like Colorado’s Odd13 and Texas’ 903 Brewers even switched from their traditional 12 oz. cans to 16 oz. cans by the end of 2020 as a result. Other brewers, like those at New York’s Evil Twin and Ohio’s Hoppin’ Frog, even distributed beers in 8 oz. cans in late 2020. There was little change at the start of the year in terms of the leading container type seen on Tavour, with 16 oz. cans holding strong at 72.6% in January and 72.5% in February.

Only time will tell whether or not 16 oz. cans remain as strong a trend throughout 2021 and into 2022. So far, the canning shortage is a result of canning facilities being unable to keep up with the spike in demand. However, Aluminum giant Ball Corporation announced a new canning plant in September, set to begin production in Pennsylvania in mid-2021, and another in Europe set to open in 2022.*

Here’s some charts coming at’cha

Ok, here’s my last data nug for the day. The Brewers Association is, of course, one of the best resources in all of beer for industry insights, but you have to be a member to really mine gold. Luckily, I’m a member, so I’m constantly going through BA Economist Bart Watson’s market breakdowns. In early February, Watson put forth the question: Are flagship beers selling better during the pandemic, and are people retreating to tried and true?

What I found, simply put, is that flagships did almost exactly as well in 2020 as they did in previous years, which is to say they lost share at about the same rate. Now, I’ll note that saying flagships lost share is not the same as saying all small brands did super well (again, read my previous post), but that flagships themselves didn’t see any stronger trends.

Well then, I guess that’s all for today.

Leave a Reply

You must be logged in to post a comment.