From bars vs. breweries to beer vs. wine vs. spirits, tax rates are an ongoing point of tension and controversy in alcohol. The most recent controversy, according to a public policy research group, involves that trendiest of beverage categories, the ready to drink (RTD) cocktail.

According to an analysis by Public Sector Consultants, two state laws that were passed to lower taxes on the RTD segment – that were argued for largely as a measure to lower costs for consumers – have resulted in no such victory for consumers. In fact, RTD price points are far outpacing all other alcohol segments.

In May 2021, Michigan enacted Public Act 19 of 2021, which revised the definition of and lowered the tax rate on RTDs. These newly defined “mixed spirit drinks” can be 10 percent or less alcohol by volume (ABV), or between 10 percent and 13.5 percent ABV if they are filled in a closed metal container that is the “general shape and design of a can” and do not exceed 24 ounces per unit. The tax on these drinks were reduced by 37.5 percent, from 48 cents per liter to 30 cents per liter (approximately $1.82 to $1.14 per gallon) for RTDs sold in bulk and by a proportionate amount for lesser quantities.

Nebraska enacted Legislative Bill 274 in May 2021, creating a new category of hard liquor–based RTDs, which had previously been taxed at the same rate as distilled spirits like whiskey or vodka. The $3.75 per gallon (approximately $0.99 per liter) tax rate was reduced by nearly 75 percent to $0.95 per gallon (approximately $0.25 per liter).

Public Sector Consultants finds that despite the tax decrease in these states, prices have actually risen by a significant margin in the RTD segment: a 44 percent jump in Michigan and a 65 percent jump in Nebraska since the legislation passed.

“When Nebraska and Michigan passed measures in 2021 to reduce taxes on ready-to-drink cocktails (RTDs), industry supporters of the legislation claimed consumers would benefit,” the group says. “Despite these claims, consumers are not benefitting from lower prices in either state.”

Pro-liquor tax carveout bills failed big earlier this year in seven states: Alabama, Arizona, Hawaii, Kentucky, Maryland, Washington, and West Virginia.

What to make of this

The push for these laws to define RTD as separate from the spirits category makes sense in terms of comparing ABV content and container sizes. But the talking point that correlates state tax rates with the retail price point is questionable.

The RTD category is largely paced by national, corporate beverage brands, and if the price point is going up across the country, I’m not sure how much to expect any state’s policy to influence that. The Beer Institute has been banging the drum against these tax cuts for a while arguing that “lowering of the excise tax rate for these products gives an unfair tax advantage to out-of-state companies.”

To be fair, Michigan’s RTD price point, according to the study’s last data point of August 2022, is a full dollar lower than the U.S. average. Nebraska’s though is higher by 10 cents and has been consistently higher than the U.S. RTD price point overall.

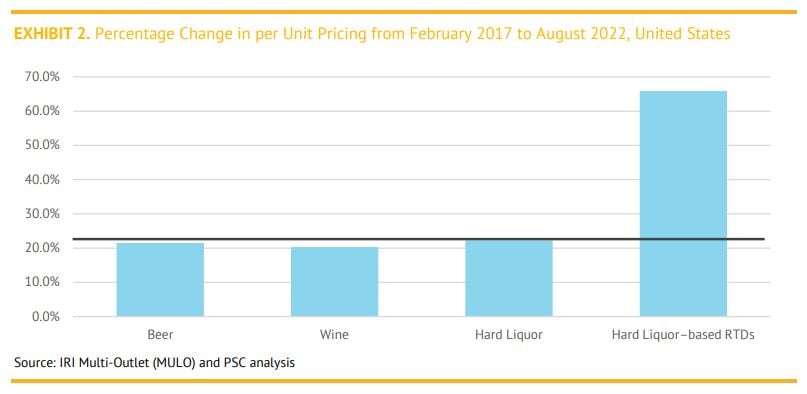

The bigger story for the industry here is that seemingly no matter the state, RTD pricing is out of whack compared to any other alcohol beverage when you drill into unit pricing. The study noted “these increases far outpaced inflation and the rapid overall increase in the consumer price index.” Check out this chart:

“While hard liquor–based RTD retail prices in the United States increased 65.9 percent from February 2017 to August 2022, the retail price of beer rose by just 21.5 percent, wine by 20.3 percent, and spirits by 22.3 percent. The horizontal line marks the level of inflation (22 percent) over this period,” the authors note.

“Let’s bring this debate to an end: tax cuts for spirits are entirely unnecessary, do nothing for consumers, and hurt local beer businesses. Local beer businesses bring significant economic value to communities across the country. There is no good reason to increase liquor profits and threaten millions of good local beer jobs.”

Leave a Reply

You must be logged in to post a comment.