When I started attending the Craft Brewers Conference as a member of the media in 2013, the most thrilling part was the brewery openings and growth numbers. There was an unspoken pride in the room. Craft beer was about to explode and everyone felt like part of an actual movement. A sea change of the marketplace from bland Big Beer to a horde of local, independent businesses.

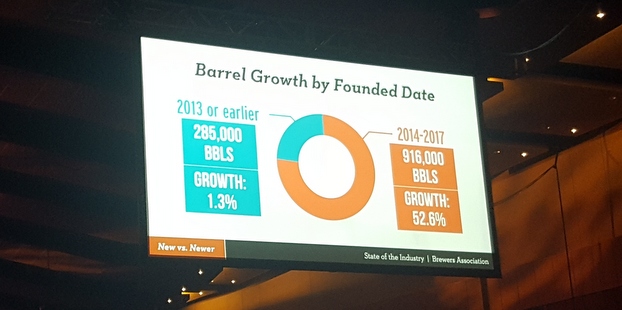

Since then, industry growth has dropped year to year from 18 percent to 12 to 6 and now 5. Here are the full stats, released earlier in the year. Here in Nashville, when that opening number flashed up on the screen during the State of the Industry presentation — 997 openings in 2017, which, somehow, is the most yet, not to mention the 9,175 licenses documented by the TTB — there were audible groans around me. The vibe felt nervous or fatigued instead of enthusiastic. The brewing community is still convivial, to be sure, but slowed growth and increased competition is upping anxiety. And with good reason. Check out this chart, for example:

Of the 1.2 million bbls of industry growth in 2017, breweries that opened since 2014 made up nearly 1 million bbls of that growth and grew at 50 percent. The established breweries (yes, a brewery founded in 2013 is now old timey) only grew by a combined 285,000 bbls, or 1.3 percent.

The category breakdown tells a similar tale. In 2018, it pays to be new and small. Microbeweries grew 17 percent, at 5.7 million bbls — making bank on taproom sales, which remains the clearest path to sustained brewery success. Larger, established brands, as noted, have hit a wall. Regional breweries, a 17.9 million bbls chunk of the market, were only up 1 percent in 2017.

So, staring at that unbalanced chart, and the stark divide between old and new, I am curious how this will look over the next five years. Some random questions:

- Will newer breweries constantly be churning and leading growth?

- Will the new car smell wear off and the scales will tip back, where newer breweries who started out hot burn away quickly anticipating too much growth, while older breweries were better able to weather a setback and wait out short-term trends?

- Is the apparent cap on growth at the top of the craft world more a function of the current market’s intense interest in what’s new, rather than a ceiling on the general concept of a large-scale craft brewery business model?

- And if so, is this current demand for newness possibly just a blip, driving an overabundance of new breweries?

“Don’t expect that you’re going to beat the odds when so many older and more experienced breweries were not able to,” Bart Watson, chief economist of the Brewers Association, cautioned from the stage.

“That’s a different picture for some of the older brewers,” said Paul Gatza, BA director. “We’ve kind of started thinking that it’s tougher to be bigger, the original craft brewer, when all of these new local players are coming in. And that’s true. But there does seem to be an age thing going on right now too. If you’re a newer brewer you might not be the new shiny thing in another couple years. So, be cautious.”

Spoiler alert: You will not get any answers to these questions in this post. Pretty much everything that is happening in the craft beer market has no precedent. Growth rates the last decade have been insane. Even with an uptick in closings, the number is still way above expectations for small businesses (165 closings in 2017, or less than 3 percent of the industry). So, there is no real data from which to sketch out probabilities of outcomes. But I do think this message emerged above the noise: Proceed with caution.

“A few years ago, at those larger growth rates of 18 percent, there were a lot of people looking at this as a way to make quick money and either sell out or grow a brand and bring in partners, but I’d say those opportunities are less than perhaps they once were. If you’re looking for a quick buck, I think you’ll have better chances of going to Broadway [Street in Nasvhille] and opening up a honky-tonk.”

Leave a Reply

You must be logged in to post a comment.