The analysts are seeing growth opportunities in on-premise. The Brewers Association (BA) recently noted taprooms drove growth in the craft sector last year with taprooms up 9 percent in volume in 2022 over the previous year. The BA defines taprooms as breweries that sell over 25 percent of their beer onsite and don’t offer significant food service, but it’s not just taprooms — all types of drinkeries and eateries are equally busy.

According to NIQ (formerly NielsenIQ), on-premise venues that served alcohol saw more traffic in the first part of 2023 — sports bars, polished casual, neighborhood bars and quick service restaurants. According to that same report, on-premise total alcohol in the United States was up about 18 percent in the last 52 weeks in dollar sales vs. a year ago, noting that report was from April.

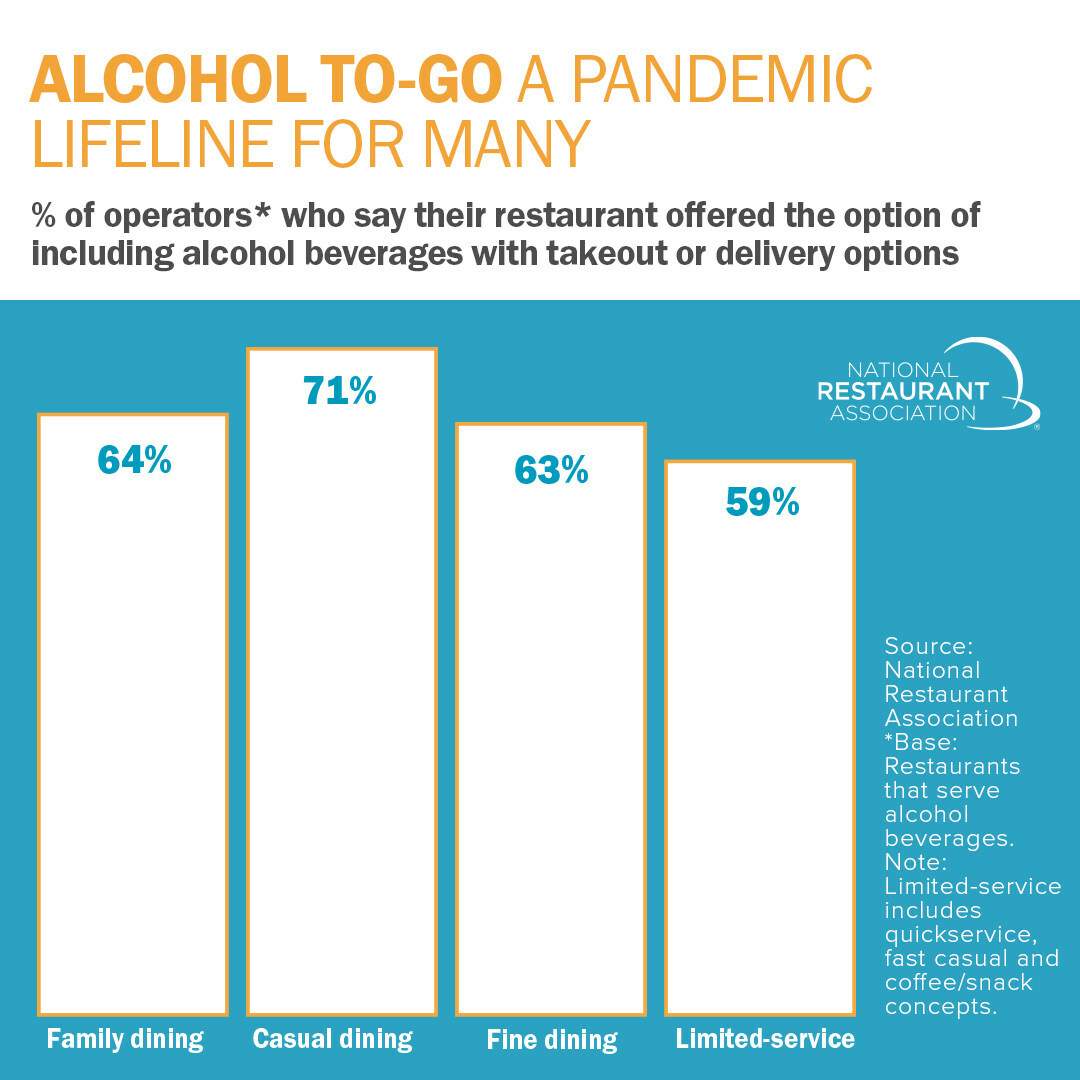

Here comes another interesting factoid about on-premise — alcohol to go is still a thing — maybe. As a result of the pandemic, lots of new alcohol laws got put into place around the country allowing wine, beer and cocktail orders to go, but how much demand is there since the pandemic officially ended? Well, there’s an interesting dynamic at play, according to a recent report from the National Restaurant Association. The report noted that despite more than half (54 percent) of delivery customers stating that the availability of alcohol beverages would make them more likely to choose a restaurant, and the growing number of states extending or making permanent the to-go options for restaurants, only one-quarter of adults who opted for takeout or delivery from a restaurant during the last six months included an alcohol beverage in the order.

That trade org thinks that leaves significant growth opportunities for restaurants, particularly in how they market, package and differentiate their offerings, according to the report, which provides several examples and interviews from culinary innovators in several states leading the way on alcohol sales. According to the report, casual dining leads the way in to-go alcohol options, but nearly all restaurants that serve alcohol include it as a takeout offering (90 percent) and over a quarter (26 percent) offer it via a third-party delivery option.

From the press release:

“The innovation we are witnessing right now in beverage programs of all kinds is exactly why restaurants are some of the most resilient and impactful businesses in this country. These incredible operators have turned a survival tactic into a major growth catalyst for their businesses. Consumers are taking note and if we can continue to stay in front of their preferences, there is no limit to how far beverage trends can move the needle for the restaurant industry,” said Michelle Korsmo, President & Chief Executive Officer of the National Restaurant Association.

Interesting events are a growing opportunity as well for restaraunts and craft brewers. The report noted that local “experiential events” would be this year’s hottest trend. For example, both wine (81 precent) and beer (79 percent) drinkers say they would participate in tasting events at restaurants. Finally, the report emphasizes the trust between consumers and restaurants, with most (82 percent) of adults that drink wine, beer and liquor saying they trust the staff at local restaurants to make good drink recommendations. Even if it’s to go.

“The new alcohol to-go laws modernized state alcohol policy, and consumers can now enjoy more of the restaurant hospitality experience in the comfort of their own homes. As this report demonstrates, operators who innovatively connect the experiential aspects of their alcohol programs with a clear off-premises strategy are seeing enormous success with customers,” said Mike Whatley, Vice President of State Affairs and Grassroots Advocacy, National Restaurant Association.

Founded in 1919, the National Restaurant Association is the leading business association for the restaurant industry, which comprises nearly 1 million restaurant and foodservice outlets and a workforce of 15 million employees.

Leave a Reply

You must be logged in to post a comment.