With the rise of alternative beer categories like hard seltzer, is the IPA fervor beginning to fade? According to Drizly’s BevAlc Insights IPA Forecast for 2021, it definitely is not, due to 1) the rise of new and interesting IPA subcategories, 2) a shift toward more balanced flavors and alcohol levels, and 3) the pandemic-fueled trend for exploration. In fact, the IPA category became even stronger in 2020 and is well-positioned for continued growth in the years to come.

Tracking the Growth of IPAs

“Though IPAs have been a style for many years, they have become more mainstream over the past few years,” says Dave Mevoli, the lead national key account manager for Bell’s Brewery. Consumer palates have evolved to seek out bolder, more nuanced flavors in food, and the same has trickled over into beverage as well.

In 2020, the overall IPA category accounted for 19 percent share of beer sales on Drizly, making it the second-best selling category after hard seltzer. This was up from 2019, when IPAs held 16.5 percent of beer share on Drizly, indicating the category’s strong year-over-year growth.

As the IPA category has grown, it has also become broader and more nuanced. “What started as a fixture of the craft brew category has now grown into its own subset on the shelf,” says Paige Guzman, the CMO of Lagunitas. “With that, there has been a blossoming of IPA sublines that meet a broader set of beer fans’ needs.” Drizly’s overall IPA category includes New England/hazy IPA, imperial/double IPA, session IPA, black IPA, red IPA, and white IPA styles in addition to the standard IPA style.

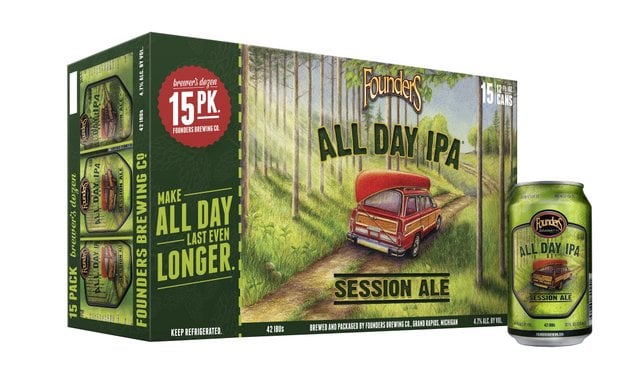

The increasing variety of IPA styles has also made the category more mainstream, rather than just a go-to for avid beer fans. “In the past, IPAs seemed to be geared only toward the craft beer insider crowd, as the flavors and bitterness were deep contrasts to the more mainstream lagers,” says Sandy Anaokar, the VP of marketing for Founders Brewing Co. But in more recent years, he adds, new releases have made IPAs more approachable in terms of ABV and flavor. “These beers have provided a gateway to experiencing IPAs to more beer consumers and have encouraged exploration into the IPA segment.”

Though pandemic-related shutdowns resulted in big sales gains for beer alternatives like hard seltzer, they also increased consumer demand for IPAs, with Drizly’s IPA category share peaking in April 2020. Many individual breweries, including Founders and Bell’s, also noticed an uptick in sales for their most-popular IPAs.

“For many consumers, the pandemic created time and need for experimentation — a result of staying at home,” says Anaokar. IPAs filled this consumer need, offering exploration and discovery, often at a lower price point than wine or liquor subcategories.

“Exploration is a key consumer behavior that has driven IPA share gains,” says Liz Paquette, Drizly’s head of consumer insights, “as customers test out new brands and product innovations within the category.”

Inside the Top-Selling IPA Styles and SKUs

Though the standard IPA subcategory comprises the largest percentage of IPA category sales, there has been quite a bit of growth and movement within the category’s other styles.

New England/hazy IPAs are currently the blockbuster of the IPA category, seeing a 761 percent year over year sales growth on Drizly in 2020. Though the style was first created in the early aughts and made available on the market about a decade ago, it was only in the past couple of years that New England/hazy IPAs really exploded.

“The ‘haze craze’ within the beer industry shows no signs of stopping, and hazy-style beers have never been more popular,” says Guzman, adding that consumers drank more than twice the amount of hazy beer in 2020 than they did in 2019. On Drizly, New England/hazy IPAs now comprise 20.8 percent of IPA share, and Sierra Nevada’s Hazy Little Thing IPA was the third-best selling IPA overall in 2020 after not even making the top 10 list the previous year.

“The hazies provide a differentiated yet familiar taste, typically with less bitterness, higher sweetness, and fuller mouthfeel,” says Anaokar.

Session IPAs have also gained ground in recent years as consumers look for ways to enjoy the flavors of an IPA without having to go all-in with a high-ABV beer. “Consumers still have the opportunity to get the full-flavored experience of an IPA but not intake the calories and alcohol of a traditional IPA,” says Mevoli.

The proliferance of these lower-ABV styles has also paved the way for new consumers to become IPA purchasers. “We’ve seen a ton of people out there entering into the IPA category specifically through our azy and sessionable offerings,” says Guzman.

At the other end of the spectrum, the imperial/double IPA subcategory has also experienced sales gains; sales for this high-ABV style grew 446 percent year-over-year, and it currently holds 18.5 percent of category share.

Drizly’s Top-Selling IPA SKUs, 2020

- Lagunitas IPA

- Founders All Day IPA

- Sierra Nevada Hazy Little Thing IPA

- Bell’s Two Hearted Ale IPA

- New Belgium Voodoo Ranger Imperial IPA

- Lawson’s Sip of Sunshine IPA

- Elysian Brewing Space Dust IPA

- Lord Hobo Boomsauce Double IPA

- Cigar City Brewing Jai Alai IPA

- Goose Island IPA

Drizly’s Top-Selling New England/Hazy IPA SKUs, 2020

- Sierra Nevada Hazy Little Thing IPA

- Lawson’s Sip of Sunshine IPA

- Mighty Squirrel Cloud Candy IPA

- Sloop Brewing Juice Bomb IPA

- New Belgium Voodoo Ranger Juicy Haze IPA

Though it’s important for retailers to stock a range of IPA styles in order to meet consumers’ desire for exploration, many of those consumers are looking for this experimentation via familiar brands. “One of the more interesting trends we’ve seen over the past year is that beer lovers are looking for products they can trust,” says Guzman. “Simply put, in times like these, people want brands like ours that are consistently high quality, and just taste good.”

Mevoli recommends that retailers look for IPA brands that are trusted, reliable, and proven; consumers will pay for the quality and value that these brands are known for, and retailers can depend on their supply. “The winners here in the IPA category fit what we call the ‘tried and true,’ those beers that consumers know and can rely on for quality,” he adds.

It’s also advantageous for retailers to consider stocking IPAs that come in larger pack sizes; 12-packs of IPAs are growing incredibly quickly, says Mevoli.

Reaching a Broader Consumer Base

“In the recent past, it was a lot easier to build an archetype for who the IPA consumer was,” says Anaokar. “But as the audience for IPAs has grown, it’s become less about targeting a singular consumer and more about segmenting the consumer based on their needs from IPAs and how it fits their lifestyles.”

Boston is the number one market for IPAs on Drizly, followed by Denver, northern New Jersey, Baltimore, Indianapolis, and Seattle. “As many of the top-selling IPAs are produced by local and craft breweries, market level trends are a key driver of sales,” says Paquette. For example, in Boston, the top three IPAs are from local brands Lord Hobo, Mighty Squirrel, and Nightshift.

“When stocking the IPA category, in addition to national top sellers, we recommend retailers focus on stocking local producers and new product releases to serve customers who are searching for their favorite hometown brewers,” adds Paquette.

A Future of High-Value Growth

“In the next few years, we anticipate the IPA category to continue to be a key driver of beer sales,” says Paquette. “Outside of beer alternatives like hard seltzer, IPA subcategories have seen the strongest sales growth in 2020 in the beer category, and we expect this growth to persist.”

Not only can the IPA category lead to retail success due to its strong growth, but these SKUs also tend to be high-value beer products. “IPAs have outpaced the rest of craft growth by at least 10 percent over the past four years,” says Mevoli, “and generally command a higher average retail price of almost $4 per case.”

IPAs are also valuable because they complement other alcohol purchases rather than competing with them; Anaokar notes that it wouldn’t be unusual to see mainstream beer or hard seltzer, liquor, and IPAs in the same shopping cart. “IPAs not only drive a primary purchase for a growing consumer base,” he says, “but can also incent an incremental purchase based on consumers’ need states or occasions they’re shopping for.”

In the future, expect to see continued innovation and new entrants into a variety of IPA subcategories. “I think we will continue to see the evolution of the IPA segment into two directions: crafty complexity and flavor comfortability,” says Anaokar. “There will be growth in occasions that call for new, more complex flavor experiences or higher alcohol levels, and growth in occasions or consumers that call for more accessible flavor.”

Though the IPA category has already moved away from the notion of “the bitterer, the better” — a notion that often led to palate fatigue, discouraging consumers from drinking more than one IPA at a time — the shift towards drinkability will only continue in the future. This is advantageous, as it allows consumers to reach for IPAs more often, and it widens the appeal of IPAs to new consumers.

“IPA innovation used to be about IBUs and how ‘extreme’ your bitterness could be,” says Mevoli. “Today’s IPA innovation is all about the hops and flavor characteristics that unique varietals bring to the party. The continued growth of the category hinges on a focus towards drinkability and balanced taste.”

[…] to hard seltzer. Paige Guzman, chief marketing officer for California-based brewer Lagunitas, told Craft Brewing Business, “What started as a fixture of the craft brew category has now grown into its own subset on the […]