The hop news out of Europe this month is not as glowing as the United States (see yesterday’s USDA Hop Report), according to the BarthHaas Hop Report for June 2021, which provided updates on changes in cultivated acreage, storm and hail reports from the Czech Republic and Poland as well as an up-to-date market assessment. But, on balance, the global hop supply is looking solid. Here are the highlights.

Growing conditions in Europe have been less than ideal this year. A cold spring period in April and May was followed by very warm temperatures since the middle of June with initially low levels of precipitation, and then heavy (but unevenly distributed) rains.

“The cold climate at the beginning of the vegetation period led to a delay in plant growth of about two weeks in comparison to the long-term average,” the report notes. “The rising temperatures have shortened the lag to about one week by the end of June. The risk of bloom before the plants reach the top wire and their full growth potential is real, however.”

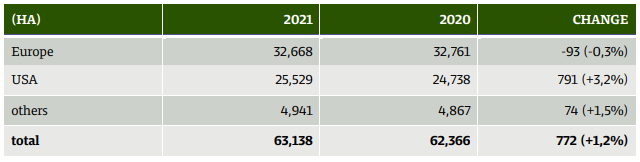

Acreage in Europe mostly declines. The acreage in Europe declined by 93 ha (232 acres) or -0.3%. Germany scaled back 86 ha (215 acres) and the UK went down by 100 ha (250 acres). Slovenia (+55 ha/137 acres) and the Czech Republic (+22 ha/55 acres), on the other hand, increased their acreage.

But as noted, acreage in the United States increased, and same for the Southern hemisphere (New Zealand up 2.6%), Australia up 3.6%). In total worldwide hop acreage increases by 772 ha / 1,930 acres or 1.2%. (HA) 2021 2020 CH.

Storm damage in Poland and Czech Republic. On June 24, a hailstorm ran across parts of the Saaz growing region, and approximately 500 ha (1,250 acres) was damaged to varying degrees, in some cases severely (20 – 100%). Two days later, Polish growing region around Wilków was hit by a hailstorm, also with heavy damage to some hop fields.

“At this fairly early stage of plant development, it is not possible to make a precise prediction of how this damage will affect final yields and the quality of the crop,” the report notes.

Supply remains steady. Provided crop 2021 yields normally, the comfortable supply situation should continue into the new season, partially due to a COVID-caused dip in beer production. BartHaas predicts beer production to return to pre-pandemic levels by 2023, but expects hop demand to normalize earlier as the return to on-premise consumption, especially in North America, will boost hop-centric beer styles. As in previous years, the majority of the new crop is already contracted for (>90%).

“We expect that the industry will once more face a disequilibrium between what is contracted and what is truly needed,” the report notes. “Marketers will be called on again to balance the market by directing available volumes to where they are needed. This balancing exercise will range from fairly easy to rather very complicated, depending on the variety under consideration. Not only will quantities play a role, but possible price differentials will need to be taken into account also.”

Leave a Reply

You must be logged in to post a comment.