I indulged a little over the holidays. Egg bake. Meatsa pizzas. Barrel-aged beer. Christmas candy. Repeat. It was the best of times. It was the worst of times. With the new year, I’m back to business mode — smoothies, brown rice, fish and NA beer. It has nothing to do with Dry January. I’ve been drinking non-alcoholic beer for the last couple of years. I love it. There are lots of reasons I turned to NA beer — a five-year old, two jobs, a desire to be healthier — but maybe the biggest reason is that NA beer today is absolutely fantastic.

My two recent favorites have been BrewDog’s NA coffee, strawberry cupcake stout Bake Up Call (only 40 calories!) and the citrus fruity beauty of Big Drop’s Paradiso IPA (only 72 calories!). Apparently, I’m big into craft English NA brands, but both are actually brewed here in the US of A. BrewDog’s U.S. operations are in Columbus, Ohio, and Big Drop just recently announced a big contract brewing and distribution deal with Illinois’ Destihl Brewery. These Euro brands see a thirsty market, and they’re not the only ones.

NA beer has caught the attention of consultants. NielsenIQ’s “Non-alcoholic beverage trends in the US” breakdown (published in Oct. 2022) showed that between August 2021 and August 2022, total dollar sales of non-alcoholic drinks in the United States stood at $395 million, showing a year-on-year growth of +20.6 percent. Beer was the lion’s share of that. NA beer took up 85.3 percent of sales, according to Nielsen, with a market worth $328.6 million, up +19.5 percent from a year ago. To put those numbers in perspective, the U.S. craft beer industry had a market worth of $26.8 billion in 2021, while overall beer stood at more than $100 billion, according to this Brewers Association report.

IWSR is a data and consulting company focused on the global beverage alcohol market. They release these cool reports occasionally. According to its recent Drinks Market Analysis study (released Dec. 2022), the U.S. no-/low-alcohol sector is looking at “double digit volume compound annual growth rates,” and that no/low alcohol products in 2022 surpassed $11 billion globally, up from $8 billion in 2018.

The American beer industry specifically has turned a corner on the idea of non-alcoholic beer. Isaac Arthur said it best in his 2022 Beyond Beer trends report:

In the past, if you were drinking a non-alcoholic beer, it was because you were a recovering alcoholic. It was an awkward scarlet letter. Now, it’s an opportunity to signal that you’re a health conscious and responsible adult. Drinking is no longer all or nothing. Why be on the wagon when you can be “Sober Curious.” From a branding and positioning (and social) standpoint, the destigmatization on NA beer is one of the most amazing aspects of this movement.

Over the last few years, American craft NA beer brands have emerged with great products, taking the category to new levels of drinkability. The standout, of course, is Athletic Brewing Co. The Stratford, Conn.-based beermaker was the 27th biggest craft brewery in America in 2021, according to the Brewers Association Top 50 list, which is the first time an NA-dedicated brand has ever made the top 50 (let alone number 27). In 2020, the company grew almost 500 percent year-over-year for the second year in a row. Athletic was named one of Time‘s “100 Most Influential Companies of 2022” (check it). Then…

One of the biggest beverage companies in North America announced it was investing in Athletic. Keurig Dr Pepper (KDP) announced a $50 million minority stake in Athletic Brewing in early December. That was part of a whopping $75 million Series D funding round. To date, Athletic Brewing has raised more than $175 million, and I can find the brand everywhere — from gas stations and grocery stores to restaurants and my friend’s parties.

In 2023, the non-alcoholic craft beer market is looking busy. Athletic’s ascent has shown us the possibilities. Now we’re seeing lots of new brands emerge that only produce non-alcoholic beer or other NA products. Traditional craft beer brands are expanding their portfolios with NA beer choices. New distribution channels are embracing the NA movement (it’s certainly easier to move than alcohol). With Dry January upon us, let’s look at some of the big news rolling around the industry.

What’s the difference between no alcohol and low alcohol?

This is something I’m running into more on a global scale than an American craft beer scale — no or non vs. low alcohol as separate categories. It can be confusing because the majority of the NA beer I drink has 0.5 or less ABV, and then there are certain breweries that really push 0.0 percent ABV beer (like Hairless Dog Brewing Co.). Is that low or no alcohol?

In this article, I’m going to call anything less than 0.5 percent ABV a non-alcoholic or NA beer. “Low-alcohol” beers usually contain between 0.5 and 3.5 percent ABV, depending on who’s defining them. I don’t see a ton of movement in that market in regards to beer, unless maybe you live in Utah, but I do see interest in the low-alcohol wine sector. According to that global IWSR report (which uses the same definitions):

No-alcohol volumes grew 9% in 2022, increasing their share of the overall no/low-alcohol space in the world’s 10 leading no/low markets to 70%, up from 65% in 2018. “No-alcohol is growing faster than low-alcohol in most markets,” says [Susie] Goldspink, [head of no- and low-alcohol, IWSR Drinks Market Analysis]. “The countries where this does not apply, such as Japan and Brazil, are early-stage low-alcohol markets with a small volume base.”

What are the biggest challenges facing the NA beer market right now?

Today, money is tight, and competition is fierce. That’s the baseline. NA beer has lots of market potential, but it also has its challenges. What are the two biggest challenges right now for the NA beer market? According to IWSR:

The biggest challenge facing the no/low category is one of availability: in many markets, no/low products lack visibility in the mainstream on-trade; among retailers, there is often confusion about where they should be displayed — in the beer/wine/spirits aisle, among soft drinks, or on their own. In both channels, the choice of products is often limited.

Cost has become less of a barrier for non-consumers of no/low-alcohol, dropping from 14% in 2021 to 7% in 2022. Despite the cost-of-living crisis, cost as a barrier to purchase currently remains unchanged among those who do consume no/low drinks. Where no/low is established, prices are similar to equivalent full-strength alcohol categories.

Encourage NA etiquette in your hospitality

Sometimes I still get the strange looks when I’m the only one not drinking or when ordering an NA beer. Honestly, I get strange looks for a lot of things I do, but drinkers can certainly be judgey. So, I think it’s a cool idea for a brewery, beer bar or restaurant to create an environment that’s welcoming to non drinkers and NA drinkers.

This comes to mind via a report called “The State of Sober Socializing,” which was produced by Bare Zero Proof, which produces NA spirits. The study has an interesting take on the evolving motivations and behaviors of those who choose not to drink alcohol, and it examines how the hospitality industry is addressing the needs of this emerging community.

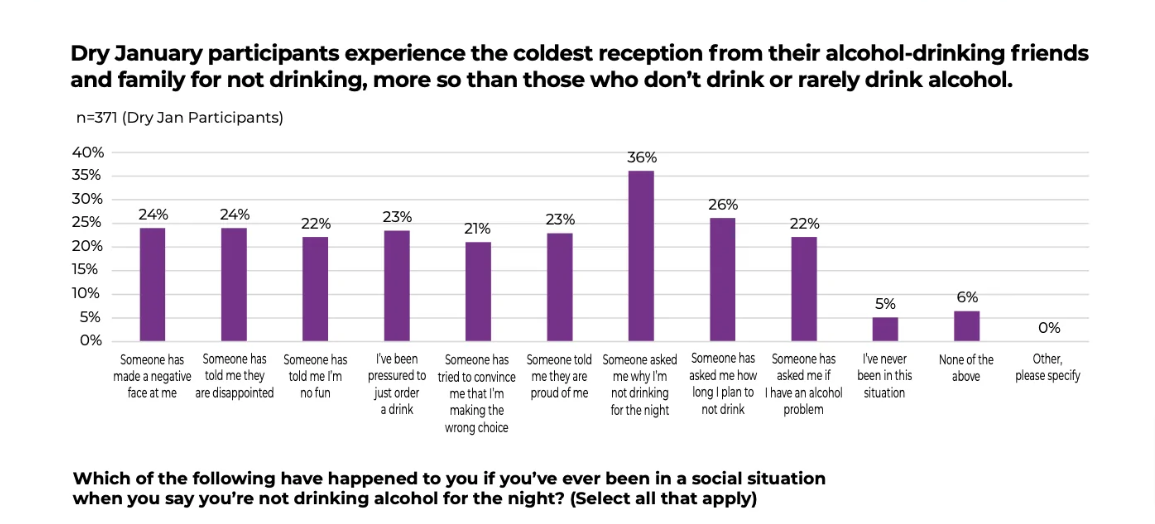

Acceptance and inclusion from friends and family has been hit or miss according the report:

The report calls on bartenders and restaurateurs to support the new dry culture with knowledge, a welcoming atmosphere and a nice lineup of non-alcoholic beverages. Some other interesting tidbits:

- Almost 70 percent of past Dry January participants, 64 percent of regular alcohol drinkers and 46 percent of those who abstain from alcohol wish bars and restaurants had any or more NA options.

- Nearly 7 in 10 of all respondents say they wish social settings were more conducive to accommodating those who drink alcohol and those who do not. The most uncomfortable for non-drinkers are bars and house parties.

- For Dry January, almost 60 percent of participants feel uncomfortable ordering soda or substitutes from a bartender/server.

- 65 percent of Dry January respondents say they wish they could order a non-alcoholic beverage that is less obvious to others that they’re not drinking alcohol.

NA-only retailers: Boisson and Drizly team up for new distribution opportunities

Boisson is a non-alcoholic dedicated beverage shop chain in New York City that has expanded its footprint to Los Angeles and San Francisco. It claims to be the largest national non-alcoholic beverage retailer, and it’s a cool example of how the distribution channel is changing to accommodate NA products. Boisson announced its recent availability on beverage alcohol e-commerce shop Drizly, which is owned by Uber, to deliver non-alcoholic beverages to consumers in New York, California and beyond.

Boisson has a catalog of more than 125 NA brands, which will be available on Drizly’s on-demand delivery in NYC, LA and San Fran. Also, through Drizly’s shipping services in 28 states, consumers can access Boisson’s selection of NA products for delivery in two to five days. Here’s Boisson’s story (from the press release):

Launched in 2021 in NYC by Co-Founders Nick Bodkins and Barrie Arnold, Boisson was born with the mission of providing non-alcoholic spirits to consumers in a welcoming, judgment-free zone that sparks curiosity. Since then, the company has rapidly expanded its retail footprint to six stories in NYC, three in Los Angeles and one in San Francisco. Additionally, the retailer has grown its e-commerce platform, raised $12M in a seed round and launched an on-premise business to offer elevated non-alcoholic options at restaurants and bars across the nation.

The release also noted that non-alcoholic beer, wine and spirits have seen significant growth on the Drizly platform over the past few years. In 2022, non-alcoholic categories on Drizly grew 29 percent year-over-year compared to 2021. Drizly’s recently released 2022 Retail Report further found 22 percent of retailers citing that non-alcoholic products overperformed their expectations in 2022, underscoring continued growth for the non-alcoholic category.

The NA brewpub: Visit Go Brewing’s Illinois taproom and/or take its Go Dry January Challenge

Let’s hit the NA beer bar, shall we? Go Brewing opened in 2021 as the first non-alcoholic taproom in Illinois and has since grown into a nationwide online retailer. The brewery, located in Naperville, Ill., is open to the public and offers lower-calorie, no- and low-alcohol craft beers on tap. That is outstanding. The brewery is also positioning itself as a wellness thought leader.

Since Jan. 1, Go Brewing has been hosting its Go Dry January Challenge to encourage Americans to take a break from alcohol and/or try some NA products. To join the challenge, anyone who texts “gobrewingdryjan” to (331) 272-3577 will get daily texts with tips, exclusive access to virtual and in-person events, a discounted Go Brewing survival case featuring new brews and a downloadable “Go Dry Survival Kit.” Go Brewing is also taking it to the next level with a series of health-focused events. From the press release:

As part of the buzz-free challenge, Go Brewing will be presenting a wide range of health and wellness programming — both virtually and in-person — to help participants get through the month. For local residents, the Naperville taproom will be open six days a week with a full schedule of fitness events, cold plunges, breath training, live music and more. The taproom will also be available for remote workers looking for an alternative to working from home or a coffee shop. And, to start the year off right, the brewery will be offering a meal service as part of a partnership with Insainly Fit Meals. Out of towners can also join in the month-long festivities via virtual nutrition workshops, live streamed events, among others.

Cool stuff. For those outside the Chicagoland area, Go Brewing also has an online store with shipping available to 43 states. The online selection includes five of the brewer’s most popular signature craft beers, which have kickass branding:

- Burn it Down IPA — A hoppy IPA with citrus and tropical notes (.48% abv | 56 cal)

- Prophets Hazy IPA — A smooth, hazy IPA with a fruity and creamy balance (.39% abv | 72 cal)

- Suspended in a Sunbeam Pilsner — A fresh, light pilsner with floral notes (.42% abv | 43 cal)

- Street Cred Nitro Bold — A smooth dark brew with espresso and cocoa (.35% abv | 60 cal)

- Head on Witbier — A clean and crisp witbier with orange and spice (.46% abv | 30 cal)

NA beer on premise is a growing opportunity overall

In December, BrewLogix, a hospitality software and services company, released its year-end insights for 2022 and market predictions for 2023 in the hospitality technology and bar and restaurant industries. Along with rising keg costs, rising consumer expectations and an emphasis on group sales, the report pointed out the growth potential of non-alcoholic beer in on-premise. According to our previous post:

With the rapid growth of the non-alcoholic and “beyond” beer categories (cider and kombucha, for example), BrewLogix expects even more local and regional players to enter the field of non-alcoholic beverage options early in 2023. Now thoroughly destigmatized, more bars and restaurants will include a dedicated non-alcoholic section on their beverage menus. These emerging products are expected not only to be offered as packaged goods in the on-premise, but they will take their place in the coveted draft program, especially where “local craft” is featured. Non- and low-alcohol options are a great way to increase ticket averages and responsibly upsell. This is a favorable trend customer-centric bars and restaurants will embrace.

Draft NA beer? Ok, I’ll take the sampler, please.

Leave a Reply

You must be logged in to post a comment.