The craft beer industry was in a tough spot throughout 2020. I could fill this opening with all the buzzwords of the year, but instead let’s just dive into what consumers are saying.

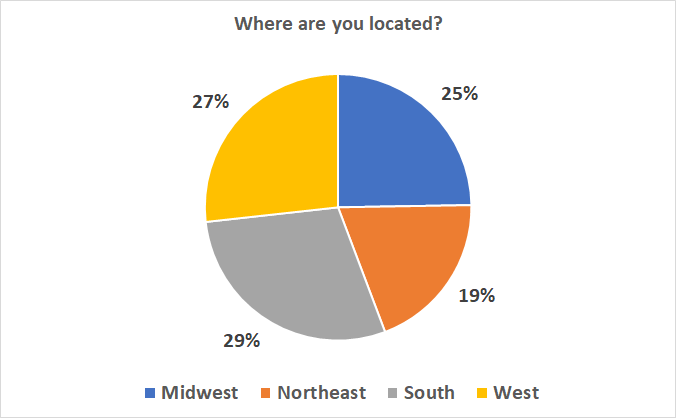

Demos: I conducted a study to get a better gauge of current consumer attitudes and spending habits. This research includes 1,342 unique submissions. 53.3% of respondents identified as male, 45.7% as female, 0.6% as non-binary, and 0.4% preferred not to say. The average age of respondent is 42.0 years old. All data was collected December 1 to 6, 2020. Here is a breakdown of the geographic location of respondents. We define each region as the following:

- Midwest: OH, MI, IN, WI, IL, MN, IA, MO, ND, SD, NE, KS

- Northeast: ME, NH, VT, MA, RI, CT, NY, NJ, PA

- South: DE, MD, VA, WV, KY, NC, SC, TN, GA, FL, AL, MS, AR, LA, TX, OK, DC

- West: MT, ID, WY, CO, NM, AZ, UT, NV, CA, OR, WA, AK, HI

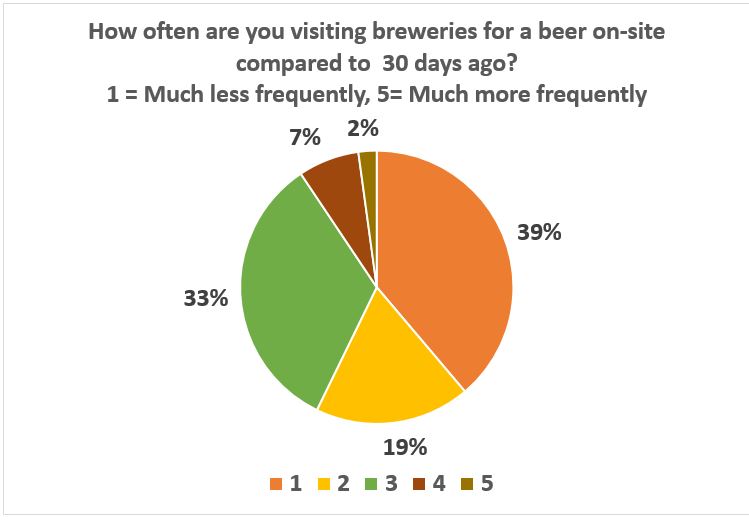

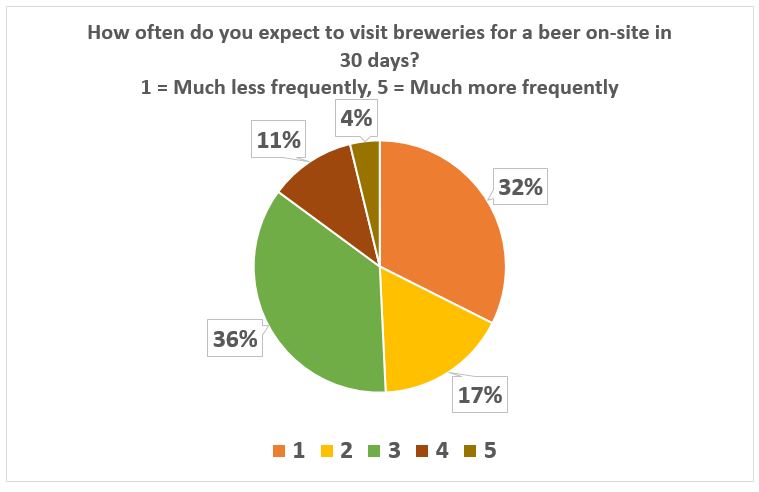

We started by asking “How often are you visiting breweries for a beer on-site compared to 30 days ago?” 57.2% of respondents are visiting breweries less for on-site consumption than 30 days prior. When asked the follow up, “How often do you expect to visit breweries for a beer on-site in 30 days?” 49.3% of those surveyed plan to visit less frequently.

When asked to choose the 3 most important aspects when selecting a brewery for a to-go purchase, 72.2% of respondents selected the “brewery’s current menu.” This is interesting, as in our October 2020 study, we asked “which are the most important aspects of visiting a brewery for on-premises consumption,” and 62.4% included the brewery’s current beer menu. Thus, a higher percentage of craft beer drinkers are more concerned with beer selection when drinking off-premise than on-premise.

| What are the 3 most important aspects of choosing which brewery to purchase to go from? | |

| The brewery’s current beer menu | 72.2% |

| Distance from my home | 54.2% |

| How well the brewery is showing adherence with COVID-19 protocol (i.e. cleaning, sanitation, social distancing, etc.) on social media | 43.3% |

| A positive prior, in-person pandemic experience at a brewery | 39.8% |

| Ability to easily order online | 23.4% |

| Food options on the menu | 20.6% |

| A positive prior, to go pandemic experience at a brewery | 18.0% |

| Curbside pickup | 12.4% |

| Contact free payment options | 5.7% |

| Delivery | 4.2% |

Rounding out the top 3 aspects are “distance from my home” and “how well the brewery is showing adherence with COVID-19 protocol on social media.” 57% of respondents to our October study included the “COVID-19 protocol on social media” as part of their top 3 aspects, while 43.3% included this criteria in their most important to go aspects. From this we can take that either guests are already comfortable with brewery to-go protocols and no longer need to see it online, or that some guests see adherence with COVID-19 regulations as slightly less of a deciding factor when picking up beer to go.

Looking back over the past 30 days, nearly a third of respondents have not visited a brewery for either to-go or on-site consumption. In our study, the majority of respondents (25.7%) purchase to-go from a brewery once every couple months.

| How many different breweries have you visited over the past 30 days? | ||

| Number of Breweries | To Go | On-Premise |

| 0 | 29.9% | 31.2% |

| 1 | 24.5% | 20.0% |

| 2 | 22.4% | 18.6% |

| 3 | 10.6% | 13.0% |

| 4 | 6.2% | 5.8% |

| 5 | 3.1% | 5.2% |

| 6 | 1.3% | 2.0% |

| 7 | 0.4% | 0.9% |

| 8 | 0.1% | 1.0% |

| 9 | 0.2% | 0.1% |

| 10+ | 0.0 | 0.0 |

| How often do you purchase to go from a brewery? | |

| I do not purchase to go from breweries | 11.4% |

| Several times a week | 2.2% |

| Once a week | 15.8% |

| Once every two weeks | 20.3% |

| Once every three weeks | 7.7% |

| Once a month | 16.9% |

| Once every couple months | 25.7% |

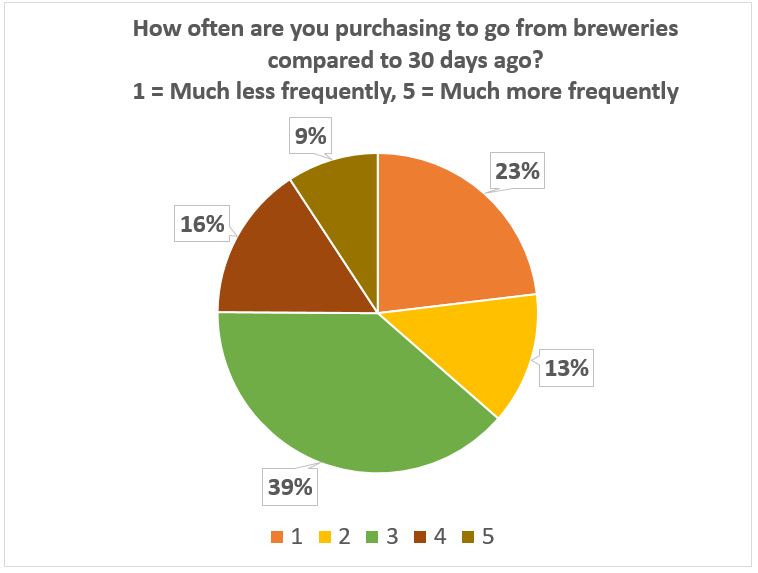

A data point worth diving into is on “How often are you purchasing to-go from breweries compared to 30 days ago?” While 36.4% of respondents are purchasing to-go less frequently, we are also seeing 24.9% purchasing to-go more frequently. We can only hope more consumers continue to support and choose their local brewery when making a beer purchase.

I want to go back to the below pie chart. Nearly 50% of guests believe they will be visiting breweries less frequently for on-site consumption in 30 days. While this may not be a surprise given the continued rise in cases and increased statewide regulations, it is absolutely a concern for most brewery owners.

Earlier this year, most breweries didn’t have online stores. Now they are a must. With fewer guests and less consumption at breweries, breweries must be shifting their focus and investing in other channels. It’s the holiday season, and the more outlets that have your beer, the merrier. Make each on-site experience as memorable as possible. Stay top of mind to the consumer in every way possible. Maximize spending for both to go and on-premise visits.

Most importantly, stay positive. You’ve nearly made it through 2020.

[…] For the full survey results, click here. […]