In early 2020 the COVID-19 pandemic reached the United States, and government-issued stay at home orders decimated brewery taproom sales. While alcohol sales are increasing in the US during the pandemic, breweries without established distribution channels are left to improvise new ways to get their product to the market.

Local breweries who had been focused on higher-margin taproom sales with little-to-no distribution have shifted towards to-go orders of crowlers and growlers. However, revenue generated from to-go sales is a fraction of pre-COVID-19 taproom sales. The long-term impact of the pandemic is uncertain.

Brewery taproom sales will likely feel the impact of government restrictions and safety guidelines throughout 2020. As states have started allowing taprooms to loosen up previous restrictions, capacity limitations will likely continue to damper brewery taproom sales.

Several factors present reasons for breweries and the industry overall to be cautious looking forward. To be successful in 2020, breweries will need to continue finding creative ways to bring their products to market while protecting the safety of their customers. Below, we explore notable trends for craft brewery valuations during the second quarter (Q2) of 2020 and their impact on the industry.

Thanks to Moss Adams for sharing this with us.

Market Overview

Large Brewers

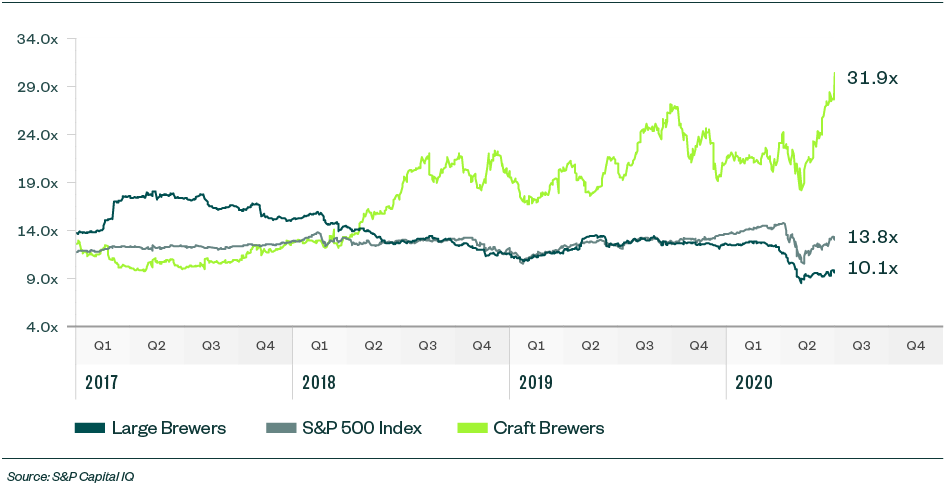

Large brewers are generally trading below the S&P 500 index, reaching a trailing earnings before interest, taxes, depreciation, and amortization (EBITDA) multiple of 10.1 times, compared to a multiple of 13.8 times, while publicly-traded craft brewers are at a multiple of 31.9 times. The few remaining publicly traded craft brewers still experienced higher valuation multiples due to their substantial anticipated growth, which is driven by strong resonance with younger consumers.

The craft brewers segment was led by The Boston Beer Company (SAM). SAM recently acquired Dogfish Head and diversified into hard seltzers with the Truly brand. SAM is forecasting strong growth in the coming years, which is driving their high valuation.

SAM’s level of diversification and established distribution channels separate it from local breweries that rely on taproom sales. However, it provides a good indication of value for breweries with strong distribution.

Public Market Evaluations (Multiple of Enterprise Value to EBITDA)

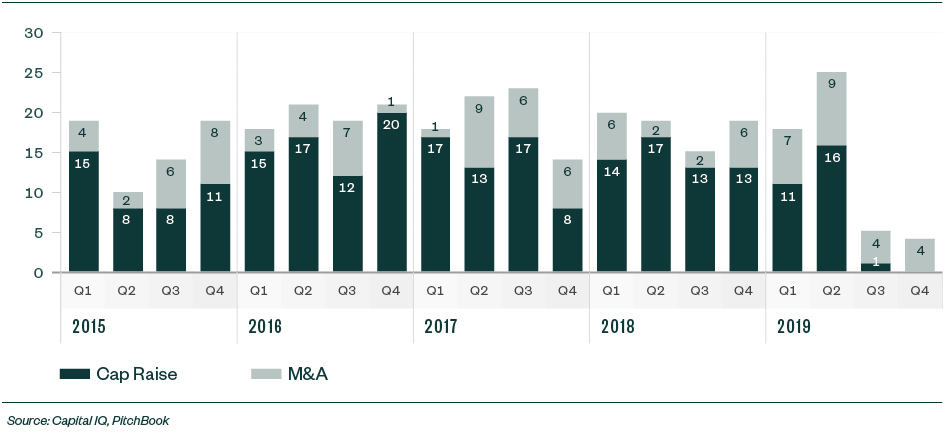

Mergers and Acquisitions

Larger regional and national craft brewers continue to look for opportunities to grow revenue and their market footprint, including considering smaller, growing breweries with strong brand presence to acquire.

Valuation multiples for completed mergers and acquisitions (M&A) transactions, both public and private, continued to decline over the past few years as competition, growth, and distribution expansion proved more challenging. These multiples also declined as a result of the slowing of overall industry growth and the smaller pool of interested buyers and investors. However, in the past month, we have started to see increased interest in potential transactions and business valuations across the entire spectrum of beer producers, investors, and minority shareholders.

Multiple large transactions took place towards the end of 2019 with New Belgium selling to Kirin Group, Carlton & United Breweries selling to Asahi Group, and Ballast Point selling to Kings & Convicts for a fraction of the price that Constellation Brands paid for Ballast Point in 2015.

Selected Activity for M&A and Financing Transactions

Brewery Growth

According to a study by the Brewers Association, total brewery sales were down 30.5% through May of 2020 compared to the prior year. This statistic is primarily focused on smaller breweries. Sales are expected to increase in the coming months as taprooms start to reopen, but total sales for 2020 will almost certainly be down from 2019 total sales.

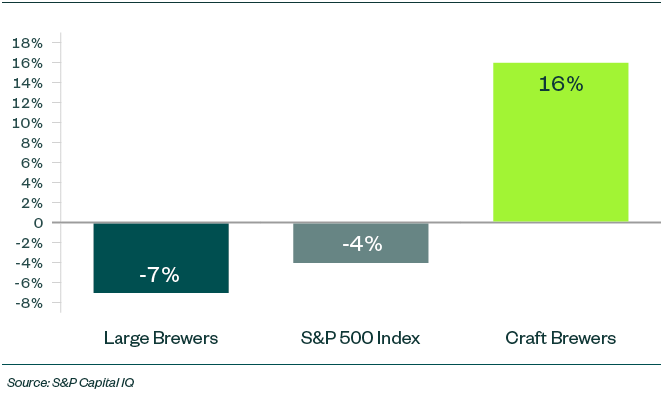

The following chart outlines sales forecasts for large brewers, craft brewers, and the S&P 500. The craft brewers in this chart are again led by SAM, which is expecting significant growth over the next 12 months largely due to the acquisition of Dogfish Head Brewery.

Estimated Sales Growth for Q2 2020–Q2 2021

Additional Trends

According to a study performed by the Brewers Association, optimism among brewery owners increased significantly from April to May 2020. Increasing optimism is mostly due to more states allowing breweries and taprooms to reopen. While most breweries are becoming more optimistic, 24% of those surveyed are less optimistic than they were in April.

Reduced optimism is driven by sales declining more rapidly than expected as well as the strict reopening standards that make it more difficult to comply than previously expected. Based on observations and conversations with industry professionals, however, an increasing number of breweries are starting to consider exit options, such as selling their brewery and equipment.

Future Outlook

Influence of New and Smaller Breweries

Not surprisingly, brewery valuations are being severely impacted by the rate of new brewery openings, compared to closings, as well as the growth rate of smaller breweries.

While these breweries don’t represent a significant percentage of overall craft production volume, their performance could move craft beer’s overall industry growth rate up or down slightly.

Economic Uncertainty

As previously noted, state and local economies are starting to emerge from stay-at-home orders and brewery taprooms are beginning to reopen. Even though the economy appears to be moving in the right direction, it could be a long road to recovery for breweries. It wouldn’t be surprising to see a significant number of breweries closing or looking for exits in 2020.

Investor Behavior

Investors will likely continue to largely sit on the sidelines as growth slows and more investment opportunities, such as breweries being put up for sale, arise in the industry.

Additionally, as industry challenges increase and valuations decline, investors will likely wait for more advantageous opportunities to invest, should they choose to in the craft beer industry. That being said, there will likely still be significantly increased consolidation in the coming years as industry and economic challenges persist.

Derek Groff has been providing consulting and financial advisory services since 2001. Derek has worked with dozens of craft breweries and distributors on a variety of valuation, consulting, and complex litigation matters.

Leave a Reply

You must be logged in to post a comment.