You get what you pay for. It’s a common cliché that fits nicely into the craft beer formula. Small breweries take the extra time, employ more labor-intensive techniques, use extra ingredients (like five times the malt, for instance) and give customers a personal, localized experience that inevitably costs more per beer. But what if the big national craft brands also selling beer in your market start offering the same high-quality style of beer but at lower price point to look more cost attractive? That’s a considerable concern for small brewers.

Over the last few years, we’ve seen the bigs putting more of a focus on price-point craft beer. Oskar Blues has been pushing the SRP of $8.99 to $9.99 six-pack pricing for some time with products ranging from G’Knight Imperial Red IPA to its famous Dale’s Pale Ale. Last year, Founders Brewing Co., not technically a craft brewery by the Brewer’s Association’s definition, released its Solid Gold “premium lager” in 24-packs for $18.99. It started the trend a few years earlier by releasing its uber popular All-Day IPA in 15-pack cans for the same price as a 12-pack.

These cost-savings are subtle, but it looks like the trend is beginning to accelerate.

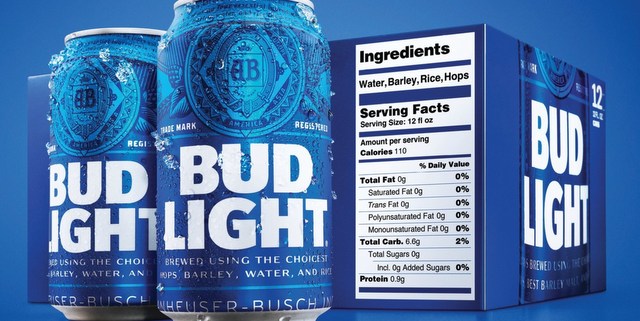

According to Forbes, over the past six months, the average price of beer, ale and other malt deliciousness has dropped 0.5 percent, citing U.S. Bureau of Labor Statistics data. That marks the first six-month period since 1997 that it’s dropped (1997 being the first year the government started tracking). Much of the craft beer market is pushing price-point incentives on large bulk packaging. I highly suggest you read this entire article by Peter Frost on MillerCoor’s Behind the Beer blog, which tracks how Anheuser-Busch is pushing more volume with cheaper pricing on larger pack sizes in 2019. From the blog:

The biggest declines in price per case have come from some of [AB’s] largest or fastest-growing craft brands. Golden Road, Breckenridge, Blue Point and Goose Island are each selling at a discount greater than $2 per case compared with the prior year, per Nielsen.

…

Elysian, Devils Backbone and 10 Barrel, meanwhile, have effectively cut prices by at least $1.25 per case, per Nielsen. Collectively, the company’s acquired craft brands average prices dropped 2.5% to $37.91 per case, according to IRI multi-outlet and convenience data through May 19 cited by Beer Marketer’s Insights.

The trend definitely has a focus on craft lagers, and some of the price cuts have been drastic for that traditionally cheaper-style of American beer. As an example, 10 Barrel Pub Beer is selling under $21 per case, which is down $9.60 from last year, according to the Frost article.

Of course, big brewers can employ larger corporate strategies that can increase efficiency and reduce cost. Anheuser-Busch is famous for its aggressive budgeting strategy, running very lean organizations, controlling precious distribution channels, acquiring new products like craft beer and then applying its efficiency strategies to those brands to lower cost and leverage the synergies between a zillion different players on a global scale to optimize profit. That’s difficult for small operations.

Of course, the low-cost marketing strategy doesn’t always work. Let’s take MillerCoor’s Two Hats, which used the slogan: Good Cheap Beer, Wait, What? The fruity lager targeted at 20-year-olds barely even lasted a year in production before it was nixed, noting that brand had many hurdles to be successful, and good, cheap beer couldn’t save it.

So, how do you personally start to formulate a strategy?

To start, the best way to get an accurate price gauge on your beer products is to know how much that beer is costing you to make and sell. Jump over to this extremely detailed article we put together on how to exactly price your beer, and definitely consider both historical data and where the market is moving in the future when doing so.

Some final insights from Brewers Association Economist Bart Watson, who wrote on the subject of pricing a few years ago.

I’d argue that both the recent data and the longer-run historical experience show you can’t take your brand’s premium positioning for granted, and must constantly work to add value to your brand through quality, consistency, flavor, marketing, and customer interaction. The premiumization wheel has already turned multiple times in the beer industry and will continue to turn in the future. What the next cycle will bring is anyone’s guess, but brewers who proactively recognize that challenge and focus on what they can control (quality and consistency, for instance) will be better positioned to ride the wave rather than watch it crash over them.

Leave a Reply

You must be logged in to post a comment.