The big story in beverage alcohol for 2023 so far is on-premise sales. Despite increasing prices for everything and whispers of a possible recession, folks are going out for food and drink. Cheers to that.

“On-premise visitation. There’s been so much euphoria around people finally getting back to the on-trade. Nobody wants to give that up,” said Jon Berg, vice president of beverage alcohol thought leadership at NIQ. “Going through all that lockdown. Everything it meant to people. They realized how important the social fabric of being in the on-premise actually is. So, you see things like St. Patrick’s Day number of consumers up 40 percent. You see March Madness driving people to the on-premise to be with friends and to have that social setting which so many people have really learned to revel in.

“This issue here though that is kind of a watch-out is how long will this kind of growth be sustainable. People from a discretionary income standpoint don’t have some of the money in their pocket that they had a year ago — maybe a year and a half ago.”

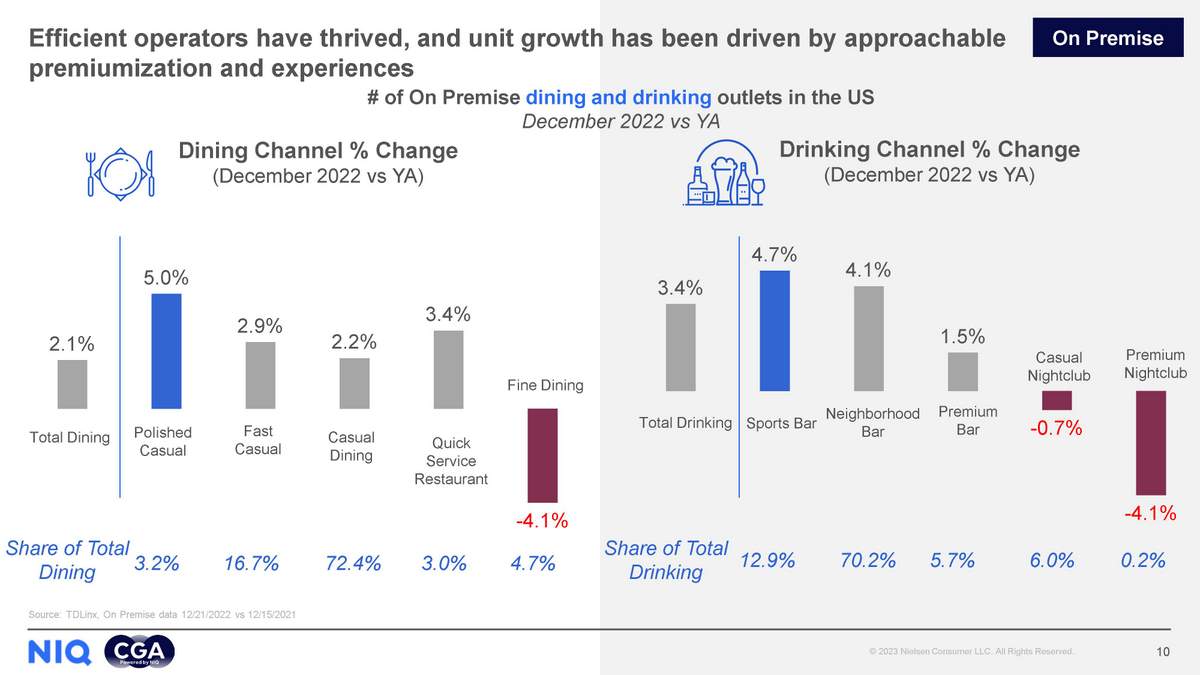

That quote comes from NIQ’s latest beverage alcohol webinar. You may know NIQ (recent rebrand) as NielsenIQ, but the company is a global leader in consumer intelligence and data, including beverage alcohol. According to its latest beverage alcohol webinar, on-premise total alcohol in the United States was up about 18 percent in the last 52 weeks in dollar sales vs. a year ago. Many of the categories of on-premise dining and drinking that NIQ tracks across the United States are seeing significant upticks in customers — especially polished casual dining and sports bars.

“Those particular growth outlets are what’s helping drive particular categories,” said Berg. “So, it definitely makes sense from a consumption standpoint that we see beer and spirits leading the way [in on-premise].”

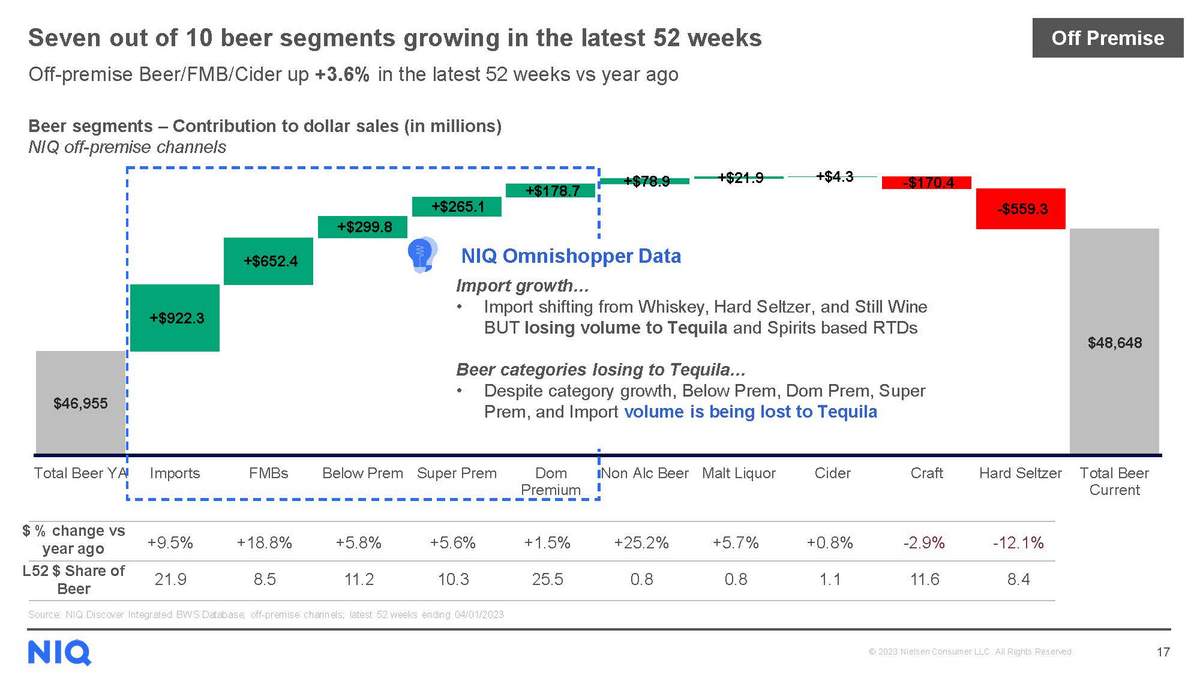

Off-premise total alcohol was up about 2 percent over that same period — especially beer. Seven out of 10 beer segments had significant growth in the latest 52 weeks in off-premise — but not craft beer (-2.9 percent) or hard seltzer (-12.1 percent). If you’re not in those segments, this all sounds great.

“This is probably one of the most positive stories that we’ve seen for beer across segments in a long time,” said Kaleigh Theriault, NIQ, beverage alcohol thought leadership manager, during the webinar. “We can see really strong growth coming from imports, FMBs and some of those other premium and super premium segments on this slide [below].”

Despite all this, craft beer is struggling. We’ve been seeing other signs of craft’s lack of growth lately. The National Beer Wholesalers Association‘s (NBWA’s) Beer Purchasers’ Index is a forward-looking indicator for the industry, measuring expected beer demand — one month forward. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting. The March 2023 craft BPI reading was 28! Only seltzer was worse. Again.

Success is always specific to your company and regional factors are usually more important than national trends, but craft beer sales could very well continue to contract in 2023 — for a variety of factors — inflation, less beer consumption overall, fierce competition from other craft breweries, fierce competition from other beverage alcohol (spirits to ready-to-drink cocktails) and an aging out of hardcore fans (a reason the non-alcoholic segment is growing). In fact, non-alcoholic beer saw +25.2 percent growth in the last 52 weeks off-premise. On the Brewers Association recent Top 50 U.S. Craft Brewing Companies list (craft brewer defined here), non-alcoholic beer maker Athletic Brewing Co. jumped up to No. 13 from No. 27 last year. Last year being the first time an NA beer maker ever made the list. Of course, NA beer still made up less than 1 percent of beer consumption in the last 52 weeks in off-premise, according to the chart above.

Probably the No. 1 reason people are drinking less craft beer these days is that they are drinking something else. According to NIQ, that seems to be a lot of tequila and tequila-based RTDs — which recorded +23 percent growth on-premise and +7 percent growth off-premise over the last 52 weeks dollar change vs. a year ago. It’s not just on-premise for these RTDs or ready-to-drink cocktails either. Spirts-based RTDs were up +57.9 percent vs. a year ago for off-premise sales, and those spirits RTD consumers are shifting from seltzers, wine and beer.

“Not only [are RTDs] a growth driver, but [they are] morphing and changing all the other elements of beverage alcohol right now. It’s a really big deal to say the least,” said Berg.

It’s just another reminder that alcohol is an ever-changing landscape. For craft beer right now, off-premise distribution growth is going to be tough, but on-premise still has big opportunities. That’s at a 30,000-ft view. Local and regional factors will always play a bigger role in a craft brewery’s business plan, but the more you know…

Leave a Reply

You must be logged in to post a comment.