A common joke made this year on the interwebs was “Go home 2016, you’re drunk.” This is in reference to a variety of awful / insane things that happened within the calendar year — Prince and Bowie dying, the Cubs and Cleveland Cavs breaking historic sports curses, a reality show fascist bumbling his way into the nuclear codes, and so on.

Anyway, if 2016 was in fact drunk, you can assume craft brewers played their part in making it happen, at least when we step back and consider the big beer storylines from the year.

1. Beer sales are stagnant — but consumers continue to demand quality

2016 was the year the explosive craft beer growth stalled, due mostly to the tippy top of the industry. Small, localized craft brands still have substantial growth potential while the big dogs are maybe scratching at a ceiling. As Bart Watson, chief economist for the BA and CBB’s Sexiest Man in Craft Beer for 2016, pointed out on Twitter (@BrewersStats):

New IRI data has craft up “only” 6.5% YTD by volume. But take out Blue Moon (-4%) & Shock Top (-9%) and growth goes up to 8.9%.

If I’m pulling it correctly – I get BA craft up 10.4% in IRI scan data YTD through 5-15-16.

.@BeerBizDaily reports that Nielsen “craft” weekly numbers reported yesterday only included 2 BA craft brands. Rest were AB and MC brands.

Nearly half of all craft breweries (49 percent) increased capacity by at least 10 percent in 2015. Even better: More than a quarter increased capacity by 50 percent or more. So all of those hundreds and thousands of breweries that have started popping up over the last few years aren’t just fun throw-away stats; they are prospering, growing businesses. But if you are still more excited about massive brewery opening numbers, fear not, as the TTB is showing 6,000+ active licenses at the end of 2015.

Brewery closings clocked in at 67 for 2015. Considering the number of openings, this is still a fairly impressive number. However, previous years’ closing numbers have been revised to show slightly higher counts than was initially announced in those years (2013: 68; 2014: 73). So, there may be a few more closings under the radar.

Anyway, in our book, the only real slowdown out there is that of traditional Big Beer brands, as there is a real movement out there for local and/or quality beverages. For example, dollar sales continue to increase as consumers gravitate toward more premium spirits, wine and beer products.

“Consumers are favoring more expensive selections such as craft and imported beer and higher-end whiskeys when ordering drinks and do indicate they’re spending more now on drinks in restaurants and bars,” said Donna Hood Crecca, associate principal at Technomic Inc. “Drink price increases also play a role — nearly half of on-premise operators report raising adult beverage menu prices in 2016, and many expect to do so in 2017.”

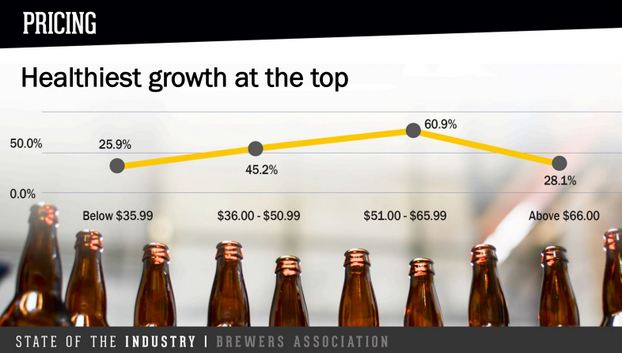

Pricing increased 3.9 percent in 2015, with the average case price coming in at $36.58. Further, that number is pumped up by the growth at the top-end of the pricing scale (see below) — $51 to $65.99 cases grew 61 percent, which was the highest of the four segments listed. Even the highest tier, above $66, grew 28 percent while below $35.99 only grew 26 percent.

But yea, there are certainly other challenges at different craft beer saturation levels. For that furtherest of far extremes, we look at some of the economic hurdles craft brewers are running into in that beer utopia of Oregon. Read that smart analysis here. Just remember to not trust any one saying that marijuana is having a negative impact on craft beer sales.

2. New craft beer business plans

Big Beer acquisitions were still steady throughout 2016, but that storyline feels so 2015. This year, we were interested in some of the new growth strategies out there.

The first big move of 2016 happened when Victory Brewing Co. and Southern Tier Brewing Co. formed a big-time craft beer alliance, Artisanal Brewing Ventures (ABV), in order to defend the universe (or at least their separate business universes) from the forces of Beer Voltron.

“The craft beer community is at its most critical moment since its inception as larger brewing corporations have bought into our grassroots movement, irrevocably changing the marketplace. Like-minded brewers such as Victory and Southern Tier can preserve our character, culture and products by banding together. Allied we can continue to innovate and best serve the audience who fueled our growth through their loyal thirst.”

As the first major craft beer transaction of 2016, this artisanal venture presents a new model for craft beer partnerships by preserving brewery independence while pooling deep collective resources.

Speaking of pooling resources, the news that got CBB most excited was the founding of maybe the first real-deal craft brewery co-op. Here is our original, exclusive, long-winded feature on it.

At that time, it was just a spit-balling idea in a small hotel meeting room. As we enter 2017, the Independent Brewers Alliance is officially up an running. Its mission is to help member brewers work collaboratively to stay strong and thrive in this increasingly competitive industry – while staying completely independent. It works by leveraging the strength and resources of the group to negotiate discounts on materials like packaging, malt and cans, and to reduce operational expenses like freight, warehouse supplies and credit card processing fees.

The new group continues to gain steam, recently hiring Jeff Glynn, former Supply Chain Manager at City Brewing Co., to manage its purchasing programs.

We are also intrigued by the real estate over distribution growth strategy, playing more to the true local spirit driving the craft beer movement. The biggest, most extreme example of this is BrewDog planning to open BrewPubs in any U.S. city where at least 500 people invest in its Equity for Punks USA crowdfunding.

That’s a pretty incredible statement. BrewDog is putting the choice in the hands of consumers and investors, which is a pretty cool concept. In the United Kingdom alone, BrewDog has nearly 30 of its BrewPubs. The Aberdeenshire, Scotland-based brand has another 17 peppered throughout the world — from Barcelona to Hong Kong. Will have to see how this plays out in the U.S.

Lastly, there is the idea of “if you can’t beat ’em, leverage ’em.” New Holland Brewing Co. signed a deal with Pabst Brewing Co. to distribute its craft beer nationally. “We are excited to be joining forces with Pabst as we combine the strengths of two great American companies,” said VanderKamp in a release. “Pabst’s management of our wholesale network will help us accelerate growth and drive success at the shelf.”

Pabst read our story and Simon Thorpe sent us over a quote, expressing how unique this kind of deal really is:

“To my knowledge, this is the first deal in the history of craft beer where a large supplier is getting into a partnership with a small brewer without taking any ownership or receiving any option to buy the shares,” said Thorpe. “This is a long-term agreement setup so that it can last for the next 20 years and beyond. It is not about Pabst simply selling some New Holland beer for a fee — there is a bigger idea in what we are building together that speaks to mutual trust, true partnership and a long-term vision of what we can accomplish.”

Oh, there was also the very Stone-like strategy of just doing something completely different and opening a hotel.

3. Asian Beer expansion

This is one is mostly theoretical still, and largely something for the big guys to ponder at the moment, but it’s worth noting and monitoring.

The biggest Asian craft beer connection from 2016 was Brooklyn Brewery issuing new shares to Kirin Brewery Co., giving the Japanese brewing roll-up a stake of about 25 percent in the Brooklyn-based craft brewer. Kirin has been pursuing the craft beer market pretty hard for a few years now. Check out this accompanying article — it’s an overview of how Kirin sees craft as a way to bolster the sliding sales of its traditional beer offerings.

Our question: Is there room for American craft beer in China? New York’s Empire Farmstead Brewery thinks so. The Cazenovia-based brewing brand began shipping kegs of its Slo Mo IPA and White Aphro to China in August (the latter is a wit beer made with ginger and lavender). Empire Brewing last year hired Jing Zhang-Insel, a native of China, as its export specialist.

We like the idea that the beer will be branded with the “I ❤ New York” tourism logo to help call attention to the growing number of craft breweries and agritourism destinations in New York State. It is projected to arrive in China in February.

It’s a super interesting sales strategy, as we’ve been watching how the Asian markets have really developed over the last few years (just look at Brooklyn Brewery in Japan). The Brewers Association reported that American craft beer exports topped $116 million in 2015, but most of that beer was going to Canada (51 percent of exports).

But Thailand and Taiwan were among the fastest growing markets in 2015 for American craft beer exports, and China has been hovering in the top 10 for some time; No. 6 in exports in 2013. For years the Brewers Association has seen growth potential in China, and last time we checked the BA’s Export Development Program had an office in Shanghai.

Thinking of selling your brew abroad? Did you know there are some tax benefits available for exporters? Uncle Sam wants you to send your delicious American craft beer across the sea, so he made available to you a tax exempt entity known as the IC-DISC, which is relatively inexpensive to setup and maintain. Details here!

4. Will the South open itself up to craft beer, already?

Early in 2016, things looked promising as several Southern states were looking to change some of their antiquated craft beer regulations. But it really felt like every time we posted one of these news items, the very next followup was about a last second reversal or change that either kept everything the same or made the situation worse. Proof (note the dates):

Oklahoma

Oklahoma craft breweries can now sell higher ABV beers on premise (if this bill is signed)

June 1, 2016

Oklahoma craft brewers nearly get screwed out of on-premise sales at last second by alcohol commission

August 24, 2016

Georgia

Georgia breweries win regulatory battle (I guess)

January 27, 2016

Georgia lawmakers continue to be a joke, avoid forming special committee to study beer regs

March 30, 2016

Alabama

Starting June 1, Alabama’s craft brewers can sell directly to customers

April 4, 2016

Alabama WTF? State’s beverage control board wants brewers to collect weird personal info from buyers

August 8, 2016

Texas

Judge throws out Texas law that banned brewers from selling distribution rights

August 30, 2016

Texas appeals judge’s decision, hopes to still screw craft breweries

November 28, 2016

Ugh. Sorry to end on such a downer, but it is perhaps fitting that a 2016 recap ends on such a note. Here’s hoping for more common sense for all in 2017.

[…] Top 2016 beer trends […]