Craft as a category continues to struggle. The Brewers Association noted this recently. The not-for-profit trade association dedicated to small American craft brewers by its definition released a recap of the last 12 months in the indie brewing sector, noting craft beer production was down in 2023 (the first time outside of that unique 2020 COVID economy that independent brewers had seen such a decline).

Both iconic breweries (think Anchor) and small local brewhouses seemed to close at an accelerated rate in 2023, but at the same time new breweries continued to open. From that same BA recap: 420 craft breweries opened in 2023, while 385 closed by the association’s estimates. That’s creating an ultra competitive business landscape — in an environment where beer demand is low (at least packaged demand) — which is squeezing a lot of brands on shelves and in bars and restaurants.

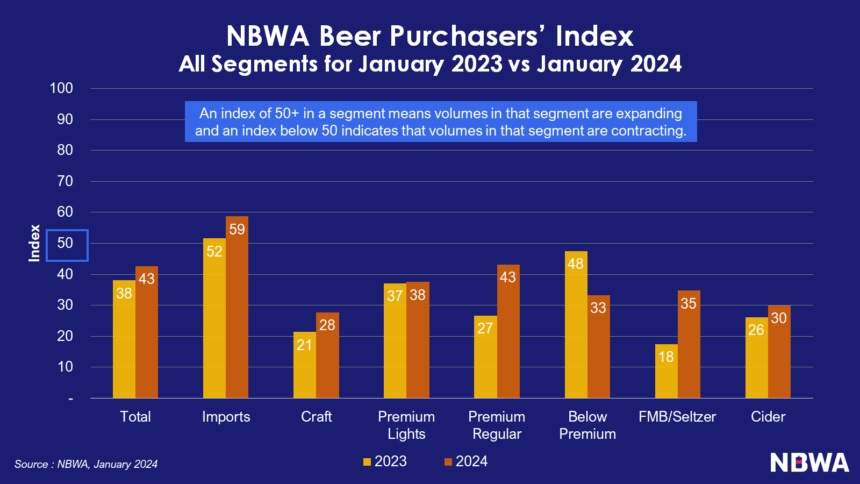

The National Beer Wholesalers Association (NBWA) recently released its always-helpful Beer Purchasers’ Index (BPI) for January 2024, and it showed the craft category continued to bottom out when it came to packaged demand. The BPI is a forward-looking indicator measuring expected demand from beer distributors — one month forward. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting. Guess what the craft BPI score was for January 2024?

28!

But there is (maybe) some good news here: A) that’s actually some growth from 2023 and B) beer demand overall is on an upswing compared to last year — noting every sector was still contracting (less than 50) last month. According to the report, there continued to be year-over-year improvement for nearly all market segments, led by a nearly 20-point upward swing for the flavored malted beverage/hard seltzer category. In an inverse of January 2023, in which only one segment (below premium) recorded a higher reading compared to the previous year, the January 2024 report shows increased YoY ordering volumes for all segments except below premium. It’s a crazy world. This also marks the eighth straight month in which at least five of the seven measured segments saw increased ordering compared to the previous year, according to NBWA. From the press release:

The readings for all categories except imports remained below the contraction line (50), with the BPI (43) and at-risk inventory (42) measures indicating that ordering levels remain cautious as the industry puts a turbulent 2023 in the rearview mirror.

Here’s looking across the segments for January:

- The index for imports continues to point to expanding volumes with January 2024 reading at 59 higher than January 2023 reading of 52.

- The craft index at 28 for January 2024 continues to signal contraction in this segment; however, it is slightly higher than the January 2023 reading of 21.

- The premium light index is mostly flat at 38 for January 2024 compared to the January 2023 reading of 37.

- The premium regular index rose to 43 for January 2024, above the January 2023 reading of 27.

- The below premium segment for January 2024 fell to 33 from 48 and is the only segment lower than its January 2023 reading.

- The FMB/seltzer reading for January 2024 of 35 is higher than the January 2023 reading of 18.

- Finally, the cider segment posted a January 2024 reading of 30 compared to 26 for January 2023.

It’s not all doom and gloom. This is just an overall view of packaged beer last month moved through distributors. There are still plenty of opportunities and plenty of success stories still happening in craft. To put you in a better mood: Just take a look at these eight stories.

Leave a Reply

You must be logged in to post a comment.