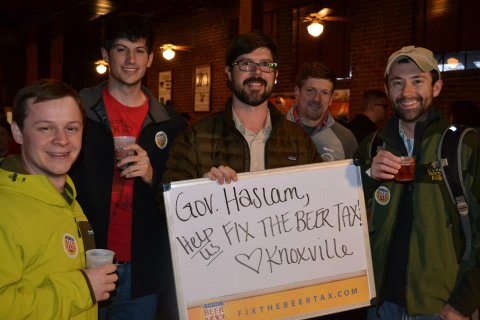

Following successful rallies in Memphis, Knoxville and Johnson City, the statewide campaign to reform 1950s era beer tax policy that is the root cause of Tennessee’s dubious rank as the nation’s highest beer tax state will conduct a Chattanooga rally at Mellow Mushroom, March 1, at 5 p.m. Participants will include legislative sponsor Cameron Sexton, Chattanooga area beer distributors and brewers and hundreds of beer enthusiasts.

(If you need a primer on the Tennessee Beer Tax issue, be sure to check out our Beer Tax facts.)

To find out how the campaign was going, Craft Brewing Business checked in with Rich Foge, president of the Tennessee Malt Beverage Association, a top supporter and advocate for the campaign.

Craft Brewing Business (CBB): Thanks for taking the time to chat Rich. How’s the campaign going?

Foge: There is a lot of momentum in the General Assembly to reform this old, broken tax. So far, more than 1,500 people have written their local lawmakers, resulting in more than 6,000 emails sent — and they are definitely hearing us on Capitol Hill. On our website, you can enter your ZIP code and a brief message, or simply accept our forum message, and it will be sent to every lawmaker associated with that address. In a recent Johnson City Press article for instance, Rep. Micah Van Huss (R-Jonesborough) said he was unfamiliar with the bill, but also said, “I know my email box is flooded, and I will be communicating with my constituents on this.”

With that being said, education is key — which is what we hope to accomplish by traveling around the state and hosting these rallies to tell our story and to get this message out there. The subject might be beer, but this is really about a tax-policy problem. Tennessee should not lead the nation in beer taxes by so much. It is also about staying economically relevant, and encouraging those with dreams of starting a brewery or of growing their operation to do so.

CBB: Sounds like some solid support. How have the turnouts at the rallies been?

Foge: The turnout has been incredible, and we have met so many people who have been affected by this out-of-date policy in so many different ways. I have met a lot of good ole’ tax-paying, hard-working citizens who say this is above all else a consumer issue. These 60- to 70-year-old laws affect the choices they have when they go to get beer at the store and how they pay. I wish I had a dime for every person in Johnson City who told me that they go across the border to buy beer and groceries because there is a better, more reasonably priced selection. Even staff at the different venues at which we held rallies told me that their plans for that night were to drive into Virginia and have a beer — apparently there is a local brewer on every corner just across the state line.

I also hear a lot from people who are trying to start a brewery or expand a current operation — even by just a couple employees, who are discouraged by this crippling tax. Elizabeth Conway Williams recently wrote this on our Facebook wall, and we have since had some great conversations:

“Just wanted to briefly share our story on this page, as I think it illustrates why this issue is so important for Tennessee’s economy. My husband and I live in Erwin, Tenn., just south of Johnson City. He has been a brewer for years, and in October 2011 we finally had the opportunity to open our own brewery. Because we were already settled here, our first choice would have been to open in Johnson City, Erwin, or another local area. However, we were quickly deterred by the state taxes, and instead opened Brevard Brewing Co. in Brevard, N.C., in April 2012. There we have contributed to local and state tax revenue, helped grow the local economy via increased tourism, and have created three new jobs, with more positions planned in the future. Although it has worked out well for us, Tennessee lost the opportunity for our business because of the state beer taxes.”

“These 60- to 70-year-old laws affect the choices they have when they go to get beer at the store and how they pay. I wish I had a dime for every person in Johnson City who told me that they go across the border to buy beer and groceries because there is a better, more reasonably priced selection.” — Rich Foge, president of the Tennessee Malt Beverage AssociationErich Allen of Studio Brew told me he was worried about whether there would be a family business left to leave his daughter that she could be proud of and continue to build on. From the microbrewer, to the distributors and wholesalers, to the national brewers— the stories of jobs lost and dreams lost to other states are endless, but thankfully the supporters of tax reform are widespread and incredibly vocal.

CBB: We’re glad to hear that Tennessee is coming together to make a change. What’s the best way for someone to get involved with the campaign?

Foge: People can take two minutes to ask their legislators to support the Tennessee Beer Tax Reform Act of 2013. We’ve made it easy by providing a short form at www.fixthebeertax.com/legislator. Check it out and ask friends to do the same. They can also connect with us on Facebook and Twitter. With every new share, like and follow, we are feeling the vast support of the Tennessee Beer Tax Reform. And finally, raise a glass and spread the word! People can tell their friends about the issue. We’ve included some facts on our website that we’d people to share.

Here are the latest rally details:

What: A rally in support of the Beer Tax Reform Act of 2013

Where: Mellow Mushroom – 205 Broad St, Chattanooga, TN 37402

When: Friday, March 1, 5 p.m. – 7 p.m.

Who: Rep. Cameron Sexton (R-Crossville); Tennessee Malt Beverage Association; Tennessee Craft Brewers Guild; National brewers and importers, and hundreds of beer enthusiasts.

RT @CraftBrewingBiz: Exclusive @FixtheBeerTax campaign update from Tennessee, plus another rally in Chattanooga. http://t.co/wusbrNLsH6