The opening general session of the Craft Brewers Conference included a great presentation from Paul Gatza, director of the Brewers Association, on the industry market trends and data. Let’s roll through some of the highlights.

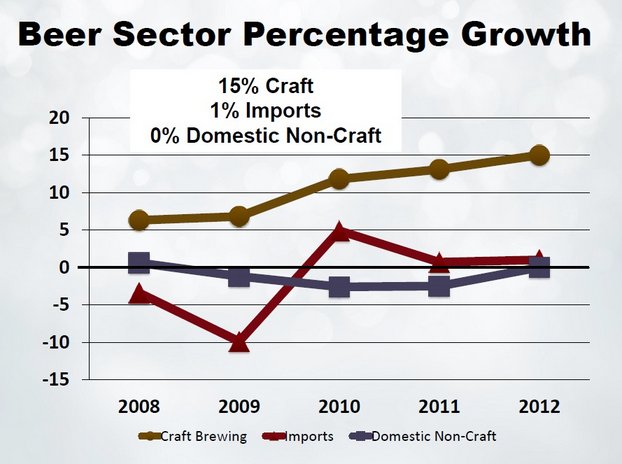

“If you’re not making quality beer, I have some career advice for you – go start a winery or a distillery. If you don’t care about quality brewing first, you will fail.”As bullish as Gatza is on the continued growth in the industry, he did say 2008 might have been the peak for beer, overall. In 2008 there were 210 million barrels of beer sold and in 2012 it was just over 200 million, so despite being a great year, will we ever gain back that 10 million barrels? Gatza had his doubts.

Something to consider in all of these numbers is conversion rate – what is the number of breweries that open in a year compared to the number that were in planning to start the year. To start, 2012 there were 925 breweries in planning and 409 opened, good for 45 percent conversion, which is down from 49 percent the prior year. If that rate drops another 4 points to 41 percent this year, that would mean another 500 breweries this year, which Gatza did not think will happen.

“Doesn’t feel like they are opening as fast as they were a year ago, but there will are going to be a lot of new openings,” he said.

Craft beer by the numbers

Craft brewers sold 13.2 million bbls, a 1.8 million pickup from the prior-year. Craft beer pricing is up 3.5 percent (all beer was up just over 3 percent). Case price went up $1.11, with the average craft beer case price up over $33.

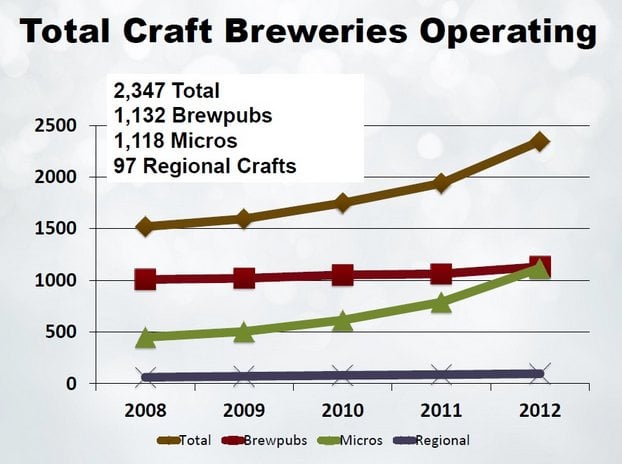

The number of total craft breweries is now 2,347. There were 409 brewery openings in 2012 and 1,254 breweries in planning — this is an updated number that accounts for those that were in planning but now have opted out.

There were 43 closings in 2012, which is up from 40 in 2011. Gatza said he wouldn’t be surprised if next year the number is 50 or 150.

”The mean barrelage out there is 500 barrels and there are probably a lot of companies out there not recovering their costs in a way they are comfortable with and I wouldn’t be surprised to see this number climb with the number of new breweries every year,” he said.

In terms of jobs, in total, there are 108,440 jobs, and all of the openings added about 5,000.

Segment breakdown

Brewpubs

Openings in 2012: 99

Closing: 25

Total operating: 1,132

In planning: 915

Percent increse in bbls: 7.2 percent

Micropubs

Opening in 2012: 310

Closing: 18

Total operating: 1,118

Percent increase in bbls: 33 percent

Regionals

Total operating: 97

Growth: 22 percent

Gatza noted that, for the first time, packaging breweries exceeded the number of brewpubs in the country. He believes that is partly due to the shift to the trend of tasting rooms out front of a packaging breweries and the increase in breweries doing less than 100 bbls a year. He said that the opening numbers for microbreweries is “unprecedented.”

Also, while the regional number (breweries over 15,000 bbls) is growing, there are still cautionary tales there as there have been closings eash of the last two years.

“Just because you get there doesn’t mean you can ignore other business and beer quality issues,” Gatza said.

Contract brewing also grew last year (13 percent), but it’s still a fairly small part of the industry (about 220,000 bbls).

Wheat beers down, new business models, and more

Here are the latest beer style rankings:

1. Seasonal

2. IPA

3. Pale Ale

4. Variety

5. Amber Ale

6. Amber lager

7. Wheat

Of note here is the 39 percent volume growth of IPAs and the three percent and four percent decrease in volume growth from amber lagers and wheat beers, respectively. Amber ales didn’t fare much better at only 2 percent growth.

“One of the things we can expect is that wheat beers will fall off that list and bock beers will enter,” Gatza said.

Bucket beers – or “other specialties” – are trending up and is actually the fastest craft share gainer.

The top five states for brewery openings were: California (56), Colorado (29), Texas (25), Washington (25) and Michigan (19). This is interesting considering how many breweries several of these states already have, which may show that instead of becoming oversaturated, the more developed a craft region is, the more ripe it actually is for more brewing business.

The definition of local has broadened for the buying public to about 350 miles, which could aid in brewers expanding their “local” market.

Gatza also notes that private equity partnerships are trending and public offerings are as well, with 27 breweries recently filing Form D forms.

Other business models popping up out there:

• Tasting room as main place of sales.

• Sustainable farmhouse breweries are trying to do it all themselves.

• reweries working by subscription – customers pay a fee and then once a month you stop by and pick up a new beer, providing more of that exclusive, rare, innovative feel.

• Micro maltsters. – “I have a hope that these micro maltsters help move the industry to where barley malt is grown with craft brewers in mind – to accentuate those flavors rather than reduce their flavor contribution. And also they could provide specs more appropriate for the people in this room.”

• Brewing centers. Facilities where people can make beer under contract or partnership basis, or help gain access a different part of the country.

• On-premise selling, Gatza admitted, has been largely a mystery, but the latest data shows a boom for craft beer here. Beers in bottle, on-premise at retail chains, has gone from 16 share to 24 share. On Draft, in 2009, craft had 33 share in on-premise retail chains sales, and that number is now 59 share –- a 26 share pick up in 4 years.

A problem with wholesalers?

A sentiment that was echoed in the keynote address: Quality. “If you’re not making quality beer, I have some career advice for you – go start a winery or a distillery. If you don’t care about quality brewing first, you will fail.”

Limited whole saler options was another important point Gatza pointed out: “Hard to think that 1,000 new breweries may come to the country — how will the wholesaler infrastructure handle that? They are skeptical about and I think maybe it’s time for BA and the National Beer Wholesalers Association to do a seminar about how to be a beer wholesaler because, in my mind, with such limited options and with that market still consolidating, we need wholesalers.”

There is an FTC ruling on fusion products that affected malt beverage companies, saying they needed to put a large alcohol facts graphic on the back of their packaging and also to incorporate a re-sealable cap. Something like that could be applied in craft brewing, which could be problematic, so keep an eye out for that.

RT @GravityBrewlab: #CBC2013 highlights from Paul Gatza @BrewersAssoc http://t.co/EZAizKxwYi via @CraftBrewingBiz #CBC13 #craftbeer

#CBC2013 highlights from Paul Gatza @BrewersAssoc http://t.co/EZAizKxwYi via @CraftBrewingBiz #CBC13 #craftbeer