Thinking of selling your brew abroad? Did you know there are some tax benefits available for exporters? Uncle Sam wants you to send your delicious American craft beer across the sea, so he made available to you a tax exempt entity known as the IC-DISC, which is relatively inexpensive to setup and maintain.

Intro to the IC-DISC

Its long name is the Interest Charge Domestic International Sales Corporation (IC-DISC). There are two types of IC-DISC entities: a commission agent and a buy/sell DISC. This article will focus on the commission only DISC as it is the simplest and often most cost effective. The commission only DISC acts as a commission agent on behalf of your business. It runs in parallel to your existing operating business and comes into play when your beer is exported. Even if you indirectly export your brew by utilizing a distributor, as long as you know your beer is going abroad, you may qualify for this tax saving opportunity.

What is the incentive and benefit?

By acting as an export agent on your behalf, the IC-DISC entity is entitled to a commission, which is a deduction to your main operating business at ordinary income tax rates. The commission received by the IC-DISC, which is tax exempt, is then paid out as a dividend to its shareholders. Therefore, the IC-DISC is converting a portion of your export net income subject to ordinary income tax rates to qualified dividend rates on the dividends being paid to its shareholders.

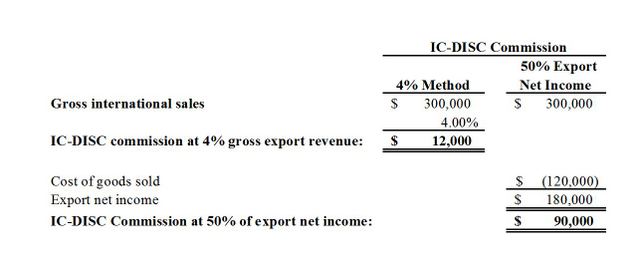

How do you determine the commission and dividend? There are two primary methods. The first method is 4 percent of the qualified export receipts and the second method, 50 percent of export net income. The first method is simple, a straight 4 percent on foreign sales. However, while the second method requires some more work, it often results in a higher commission paid to the IC-DISC and therefore more export income converted into dividends.

RELATED: American craft beer exports top $116 million (we start slow clap)

Illustration of the benefits

Pat is the owner of a brewery who wants to grow his brand abroad. At the advice of his accountant, he created a commission only IC-DISC entity. Pat’s current brewery is as an S-Corp. The beer Pat plans to ship abroad will be his flagship brew that is currently priced to yield a 60 percent gross profit margin. At the end of the year, Pat’s business had international revenue of $300,000.

First, we need to determine the commission to be paid to the IC-DISC. You can see from the table below that using the 50 percent method results in a commission amount of $90,000 which provides a much greater benefit versus the 4 percent method as illustrated below:

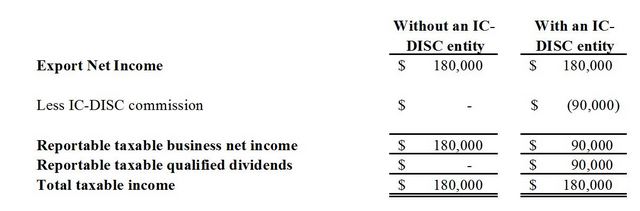

Second, because Pat’s brewery is an S-Corporation, the business income flows through to Pat. By utilization of the IC-DISC entity, you can see how a portion of his reported business income is converted into qualified dividends, however total taxable income remains the same.

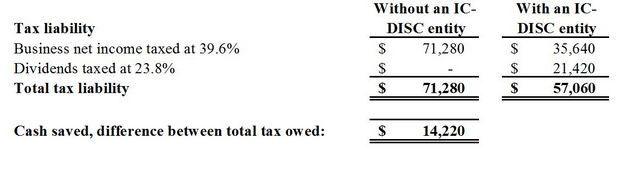

You will notice that in total, taxable income is the same. But, business net income is subject to higher tax rates than qualified dividends received. Now, assuming Pat is in the highest tax bracket of 39.6 percent with a qualified dividend rate of 23.8 percent, his savings at the end of the day is:

Is it worth it?

At the end of the day, Pat saved $14,220, and this is assuming he is in the highest tax bracket! For most, if not all brewers, $14,220 is a lot of cash that can be put to good use. Also, remember this is a fairly cheap way to save cash with very little paperwork or effort.

There are other benefits as well. These include giving key employees or sales team members an ownership interest in the IC-DISC entity, motivating them to sell more abroad and grow those untapped markets. Or, you don’t want to take the dividend and rather keep the cash in your business. Not a problem: The IC-DISC entity can loan the proceeds back to the operating entity, effectively deferring tax. However, the IRS requires that you pay interest, but not to worry — the rates are low because they are tied to U.S. Treasury bills.

Bottom Line

If you are sending your beer or equipment manufactured here in the states to another country, it is worth looking into setting up an IC-DISC entity to reduce your tax burden. There are also more complex IC-DISC planning methodologies that may offer greater savings in cases where the benefits outweigh the additional costs as well. It is important to note that these vehicles cannot be used retroactively and need to be established as soon as possible to start utilizing and taking advantage of the savings offered.

Robert Babine, CPA, a principal in the Boston accounting firm Edelstein & Company LLP, advises craft beer industry leaders, as well technology, retail, professional services, manufacturing and other privately held entities with complex accounting and operations issues.

Sending your craft beer abroad? Here is a tax benefit Uncle Sam wants you to use https://t.co/cNcqS6KxSg via @craftbrewingbiz

Selling #CraftBeer abroad? Consider setting up an IC-DISC entity to reduce your #tax burden. https://t.co/fnpAHP2cWQ

Dixie Larson liked this on Facebook.

Brewers sending craft beer abroad have a tax benefit from Uncle Sam https://t.co/2fvSW8KBZ5

Shannon, you up on this?

Beall Brewery Insurance liked this on Facebook.

Karli Olsen liked this on Facebook.

Good summary of how a DISC functions, but claiming that there’s minimal cost and paperwork is not really true. You’re looking at about 7500-10,000 per year for someone to make sure you meet all of the necessary documentation requirements and tax filings. The calculation also isn’t just as simple as 50% of net income. This article grossly oversimplifies the process.

Thanks for the comment. We asked Robert to clarify and here was his response: “It really depends on the complexity of the company and their size. Our example was a simple one illustrating the concept. I disagree with the $7500-$10,000 a year as every firm charges their own fees and there is really no maintenance for the commission discs. We have done these structures for breweries at lower costs. For more complex planning opportunities, yes, it does get more complex than 50% of net income but for most smaller companies it is still a simple calculation for those with experience.”

RT @CraftBrewingBiz: Sending your craft beer abroad? Here is a tax benefit Uncle Sam wants you to use. https://t.co/Xc9HaS0Jsv

Sending your craft beer abroad? Here is a tax benefit Uncle Sam wants you to use https://t.co/d5PGgDaLF5 via @craftbrewingbiz