Exploring an industry in flux — Brand Architecture, Beyond Beer and Reinvention

This piece was provided by CODO Design, a food and beverage branding firm. Join 5,500+ other beer industry pros who receive the Beer Branding Trends newsletter each month covering trends, currents and actionable advice from the front lines of beer branding.

Hello and welcome to CODO Design’s annual craft beer branding trends review — 2022 edition. This has already been a challenging year for beer and beverage alcohol, complete with supply chain woes, rising ingredient costs, inflation, a lingering pandemic and a continued blurring of beer and non-beer categories.

In this review, we’ll explore the impacts of these challenges and changes through the lens of branding, and specifically, the projects we’re touching from our corner of the beer and beverage alcohol (Bev Alc) industry. While it would be fun to cover specific trends like hop waters, or lagers, or the unsettling trend of breweries calling any non-hazy IPA a West Coast IPA, we’re going to go one step back from specific styles and instead focus on the Brand Architecture, positioning, messaging, business and brand building ramifications and opportunities presented by all of these things.

To make navigating this piece more manageable, we’ve grouped this year’s trends into four big buckets. The first, Reinvention, explores an industry in flux. The second, Beyond Beer, examines the opportunities available to the growing number of brewers who are interested in making non-beer products. The third bucket, Brand Architecture, dives into the downstream effects (and challenges) presented by these Beyond Beer moves. The final bucket is a roundup of all the visual and package design trends that we were able to discern from our travels and field work.

We’ve also included expert opinions from brewery owners and founders, CMOs, distributors, consultants, economists and industry thought leaders, to provide more nuanced commentary on what’s shaping beer today and tomorrow. We’ve got a lot of ground to cover. Let’s dive in.

PART 1: REINVENTION

Rebrands remain a constant

Staying top of mind and ahead of the competition

One of the most consistent inquiries we’ve received over the last several years are breweries looking to rebrand. Common reasons we’ve heard for this include flattening sales, an ever changing competitive landscape, an evolving portfolio (complete with extensions and Beyond Beer offerings), or simply outgrowing your current branding and positioning.

Over the last year in particular, we’ve seen more brewers taking their brand itself more seriously. We’ve worked with more squared away CMOs, sales directors, brand directors and brewery founders over the last year than any time in our firm’s 12+ year history.

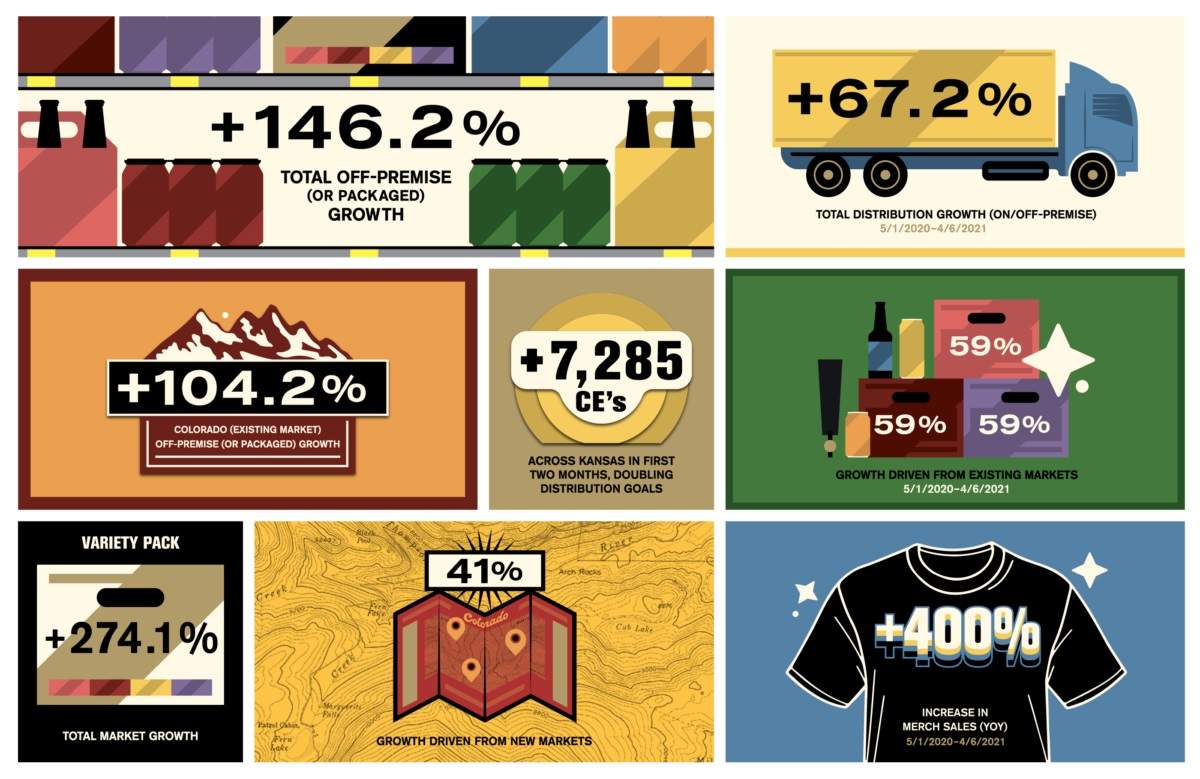

These days when we’re discussing a rebrand with a brewery, the client-side team is thinking beyond an iconic identity and beautiful packaging that billboards on shelf, and is instead looking at potential return on investment (ROI) and key performance indicator (KPI) targets. For example: “We want to increase our beer sales by XXX% through chain retail by the end of the year.”

This has led to a fun series of projects for us where it is far easier to measure how successful our clients are post-rebrand. A lot of branding and design decisions are qualitative (What story are we telling? How will this packaging make people feel?). By kicking off a rebrand with the end in mind, we can make smart decisions without getting lost in the weeds.

While we’re on this topic, it’s worth issuing our usual caveat. A rebrand, or any marketing spend for that matter, will only move the needle if you have all your other internal ducks in a row. Is your beer quality and QC as good as it can be? Is your sales team trained and motivated? Are your Annual Brand Plan (ABP) and distribution partners in alignment? Is your portfolio where it needs to be (or is working through this rebrand a crucial step to moving it there)?

If all of these internal issues are squared away, then a rebrand can be transformational.

Subtrend

Packaging refreshes

A fresh coat of paint

Packaging refreshes are a lighter touch exercise than a formal rebrand. In this scenario, your brand — your story, positioning and messaging — are all good to go. You just want your packaging to work harder for you and need to address some more surface level issues.

Reasons for this are similar to rebrands, though maybe not as pressing. Inconsistency is a big one — you want to rein in and systemize your packaging across the board. Maybe you want to address the hierarchy between your brewery’s brand, beer names and style. Or you want to save money on production and decrease turnaround time for new releases. And sometimes, it’s just time for a new look.

If handled well, a package refresh can reap many of the same benefits as a rebrand (and at a much lower investment). So, if your team is thinking about a rebrand, revisit our thinking on Evolution vs. Revolution and make sure you understand which path is right for your business.

Packaging formats and production in flux

Dealing with the “Ball-out”

In late 2021, Ball dropped the unfortunate news that it was increasing its minimum order from one1 truckload (204,000) of cans to five truckloads (1,020,000 cans) per SKU.

For some context, something like 75% of breweries in the United States make less than 1,000 bbl per year. The median brewer produces about ~400bbl per year). This isn’t even enough beer to put in one order of cans under this new pricing (let alone with just a single SKU). In other words, Ball’s decision effectively eliminates the ability of more than 90% of the beer industry to order painted cans (through them, anyway).

This lead to some last minute scrambling as breweries (including many of our own clients) worked to figure out where they were going to get cans over the next year.

I’m confident the industry will figure this out (I mean, look at what you’ve all survived over the last two years alone). It may be tough for a while, but there may be some interesting externalities and opportunities that that arise from this.

The first is that Ball’s decision dramatically affects any brewery who was planning to, or in the middle of transitioning from bottles to cans. These groups may need to reel that back in for a while until the can supply is sorted. (And maybe count themselves lucky that they didn’t sell that old bottling line just yet?) For what it’s worth, we haven’t had any clients get completely derailed by this, but it’s not too hard to imagine.

We’ll obviously see a lot more pressure sensitive and sleeved cans over the next few years, but beyond that, the second interesting thing at play here is that this may be the push that digitally-printed can companies need to become a more viable option. We’ve seen these groups at the Craft Brewers Conference and through our own work for a few years now, and I bet we’ll see more breweries use this technology, if not bring it in-house entirely, over the next few years.

Subtrend

Different formats for specific venues and occasions

Chain retail vs. Bottle Shops vs. C-Stores vs. Large Venues

We’ve worked with older breweries and startups alike over the last year who were diversifying their packaging formats, often within the same brand.

Offering your beer in a few different formats is nothing new, but we’re seeing a wider array of formats intended to target different occasions and channels specifically. For example, a popular IPA brand might be put in six-pack of 12-oz cans, four-pack of 16-oz cans and 19.2-oz cans. The latter two are there for single serve options, or maybe even signaling (in many markets, a beer isn’t craft unless it’s in a 16-oz can). And the 12-oz cans might be sold primarily through chain retail.

This was happening before the Ball announcement, but I imagine that it will accelerate diversification in packaging formats. We might even see bottles be (re)introduced into the mix.

Lifestyle brands go mainstream

Starting lean and laser focusing on your audience — so hot right now.

Pinning down a proper definition for what constitutes a lifestyle brand is challenging. It has to be part aspirational (i.e. by supporting this brand, you are embodying the values of and living some sort of desired lifestyle). It has to be hype-worthy (otherwise, people won’t line up to get it and brag when they finally do). But most importantly, it has to tap directly into a subculture.

What role does brand play in lifestyle positioning? Even more than any other non-lifestyle brand, I think the most telling feature is that the brand goes out of its way to embody a particular set of values so that the consumer can, by purchasing and interacting with the brand, signal that they too share those values. It allows your customers to signal in-group identification. In other words, I’m one of you guys. I’m cool too.

All brands inherently have values, but for a lifestyle brand, the values that the brand embodies are as important as the product for sale itself because it allows the consumer to find belonging. The thing you actually purchase is secondary to this end.

We’ve been trying to delineate between a regular old brand and a lifestyle brand for a few years and have determined that you just kind of know one when you see one. To wit, your average brewery probably isn’t a lifestyle brand (no matter how much cool merch they pump out). But if that local brewery targets a niche demographic that centers around a specific activity, interest, locale or specific ethos, then they may be headed in that direction.

We’ve received several inquiries from breweries in planning who wanted to make a lifestyle positioning play out of the gate over the last year, and with an ever increasingly competitive landscape, we think this can be a smart move. Paradoxically, it seems like lifestyle brands end up gaining more press and following the more narrowly they focus on their audience and sub culture.

A few examples:

- If you’re a

hipstercool, urban young professional, you drink PBR. Or increasingly, Hamm’s. - If you’re a skater / metal head who cares about the environment (and maybe sobriety?), you drink Liquid Death.

- If you’re all about that Montana lifestyle, you shotgun Montucky Cold Snacks.

- If you want to signal that you care about your health and are also conspicuously wealthy, you can grab a Peloton.

- If you want to signal that you’re outdoorsy, and only value high quality adventure equipment, then you grab a YETI Cooler.

A few observations about successful lifestyle brands

- This isn’t always the case, but they tend to be digitally native to start (no brick and mortar location). For product brands (Pit Viper, Chubbie’s, Duke Cannon), this means you’re built primarily through digital ads and well-curated Instagram and TikTok channels. For breweries, this means you’re probably contract brewed.

- They target a niche subculture exclusively. You need to speak your audience’s language (usually through memes) and values (through actions and charity support). And ignore all outsiders — your group is the only one that matters. After all, not everyone can be your audience.

- They create branded content and make it so compelling that people will watch hours of it despite knowing that they’re being advertised to. (e.g. YETI Presents).

- They often use influencer marketing (or “Brand Ambassadors”) as a corner stone for scaling. This can be through social media, podcasts, even television and movies — wherever your audience consumes content.

- They use merch to foster in-group identification. They give people the tools they need to signal that they’re on board (and drive solid revenue along the way).

- They meet their people where they are. Field activation is key to making this all work. You need to be wherever your fans are — music venues, bars, tattoo parlors, barbershops, skate shops, conventions, sport venues, festivals, libraries, marathons, ski slopes, etc.

I think lifestyle brands will become an increasingly common strategy for launching new Bev Alc brands over the next several years. The ability to start lean and create something that speaks directly to a well-defined, ardent audience may be a safer bet than opening yet another taproom in a city full of taprooms.

On eCommerce (beyond convenience)

Building a “National Taproom”

Every brewery that has survived the last two years knows that ecommerce (or as the Internet continues taking on an outsized role in our lives, maybe just commerce?) is an important channel to get right. We took a deep dive on this subject in last year’s beer branding trends report and don’t need to go into too much detail now because a lot of the same moves and conversations are still happening (e.g. ecommerce as a “Fourth Tier,” where do Cocktails-to-Go fit into all of this? etc.). But we have a few additional takeaways to offer.

The real magic of ecommerce isn’t just in the sales you can make online, but in the consumer data you can collect along the way. This allows you to understand your customers’ behaviors and preferences, which you can use to offer new tailored products down the line.

The second big takeaway is that the beer industry is still basically at zero when it comes to this space. Legislation and cultural acceptance will take years to catchup. And this is exciting because the Bev Alc industry is just starting to talk about Gen Z now. How about the next cohort? What will beer and beverage purchasing habits look like for the new drinker in in 2035? Perhaps we’ll all be drinking Synthehol in the Metaverse?

If you’re not moving on this front yet, it’s not too late. But you need to get in gear.

Legacy craft breweries and acting your age

Making smart, bold moves to stay relevant

It would be tough to be a regional/national brewery right now. You’ve dealt with thousands of new breweries opening up over the last decade, many of which are closer in proximity (that is, more local) to your potential customers. You’ve dealt with recession(s). And zero sum competition from Big Beer. And navigating a complex distribution environment as you scale. Oh, and major channel shifts brought on by the pandemic.

Perhaps worst of all, you’ve become a victim of your own success. Because of your hard work, an entire industry was born. And year after year of continued brewery openings has created so much variety and so much choice that today’s beer drinkers are spoiled. There’s so much great, local beer (and now, Beyond Beer offerings) to choose from that it’s easy to forget about the Old Guard.

If your brewery has been open for 15 or 20+ years today, you are in rarefied air. But the moves you make over the next five years may dictate whether you’re still around 20 years from now, because what got you here may not get you there.

This begs the question: how can your brewery stay relevant to its current customers while recruiting an entirely new class of fans?

It comes down to acting your age.

And this is a matter of framing. Are you old, tired and becoming irrelevant? Do you stubbornly refuse to evolve with the times (and consumer tastes)? Do you rest your hat on just having been around for a while and keep pumping out the classics even though sales keep declining?

Or, are you getting better with age? Are you wiser and more measured? Are you making smart portfolio moves, making the most of your distributor partners and working to understand where your brand can, and cannot, credibly play with new consumers (while keeping old fans engaged and loved)?

This isn’t necessarily a visual thing, but a mindset shift.

Acting your age means you’re mature enough to realize that your parent brand, as it stands, might not have the ability to recruit new drinkers. But you have the innovation and QC capabilities, and marketing and sales resources, and the raw material buying power and the distribution network to fundamentally reimagine your portfolio. And you have the clout to build the best team in the industry and quickly innovate and launch relevant new products.

We’re going to explore this idea in more detail in the Brand Architecture section, but a few quick examples here would include the run-away success that New Belgium is seeing with its Voodoo Ranger brand. Or that Sierra Nevada is seeing with its Little Thing brand. Or that Boston Beer has achieved with its diversified portfolio (DogFish Head, Truly, Twisted Tea, Sam Adams). These breweries are all making smart moves that will shape beer and beverage alcohol over the next decade.

One of the most compelling through lines we’ve seen from all of these craft pioneers is a focus on Brand Architecture. Particularly, a focus on building deep, relevant Sub / Endorsed Brands, and edging closer and closer to becoming a true “House of Brands,” where the parent brand might not really matter all that much.

Acting your age means giving people something to cheer for. And I believe legacy breweries will always [have a chance to] be relevant because Americans love a winner. And they want you to succeed, even if they do forget about you from time to time.

It’s up to you to make sure they remember who you are.

Read the rest of this post over on CODO’s site right here.

Join CODO’s Beer Branding Trends newsletter for monthly field notes covering trends, currents and actionable advice from the front lines of beer branding.

Royce Horigan says

Re-brand in style, Downtown Los Angeles.