The direct-to-consumer (DtC) shipping channel has been one of the most engaging and dynamic areas of the beverage alcohol market in recent years, with more sellers of all kinds looking to extend their ability to sell remotely. As we enter 2025, DtC shipping will remain a top issue, commanding the attention of state regulators and industry members of all kinds.

Part of this interest stems from the COVID pandemic, when the world suddenly shifted away from in-person sales. But much of it also comes from the real potential benefit that DtC shipping can provide as an alternative for small, craft producers who often struggle to succeed in a strict three-tier system, as shown by the clear success of DtC wine shipping, now a $4 billion annual market.

Consumers themselves also continue to express clear, widespread interest in making DtC shipping of alcoholic beverages more available, particularly for beer and spirits products. Indeed, even majorities of non-drinkers think that state laws need to be updated to reflect how much of modern commerce has moved online.

There is, therefore, a lot to monitor in the DtC shipping channel in 2025, building on the developments that happened in 2024.

State of DtC shipping going into 2025

The DtC shipping channel is effectively a tale of two markets: one for wine and one for everything else.

DtC shipping of wine as of 2024 is a well-established market. After decades of progressive legal changes, 47 states and D.C. allow their consumers to make and receive purchases of wine from producers across the country (only Delaware, Mississippi and Utah have no DtC shipping permissions). A wide ecosystem of services, from fulfillment and shipping houses to tax and compliance software companies, has been built out to provide support and keep the channel humming.

The primary issues that wine shippers dealt with in 2024, therefore, were little different from any other channel in the beverage alcohol industry. While some states tinkered with their DtC wine shipping laws, adopting new restrictions and requirements, wine shippers were more concerned with dealing with increased competition and decreased interest among consumers.

There was some action in Alaska, which implemented a major overhaul of its DtC shipping law in 2024, including a new license requirement along with now obligating DtC shippers to pay all applicable taxes, proactively check consumers’ ages and ship only with approved carriers. Alaska long permitted shipping of all types of alcoholic beverages, however, going forward, only breweries that produce less than 300,000 barrels per year and distilleries that produce less than 50,000 proof gallons per year will be eligible for a DtC shipping license.

The biggest news in 2024 came out of New York, which began allowing DtC shipping of spirits and cider, making it the ninth and largest state to enable its citizens to receive shipments of spirits (most states already allow shipping of cider as a type of “wine”). Spirits producers and guilds have been working for many years now to further open that market, so the success in New York is particularly sweet and is hoped will lead to further changes in 2025.

What’s to come for DtC shipping in 2025

For proponents of DtC shipping of alcohol, 2025 will bring plenty of opportunity to build on recent successes.

The first step will be to stabilize the hard-won spirits shipping permissions in New York. This will mean working with the State Liquor Authority to get the necessary licenses and confirm the specific regulations that shippers will need to comply with. In many ways, New York will be a test case that other states will look to when considering opening to DtC spirits shipping. If the industry can demonstrate the safety and effectiveness of shipping spirits to New York consumers (which I have every reason to believe it can), that will be compelling evidence why more states should enable this market.

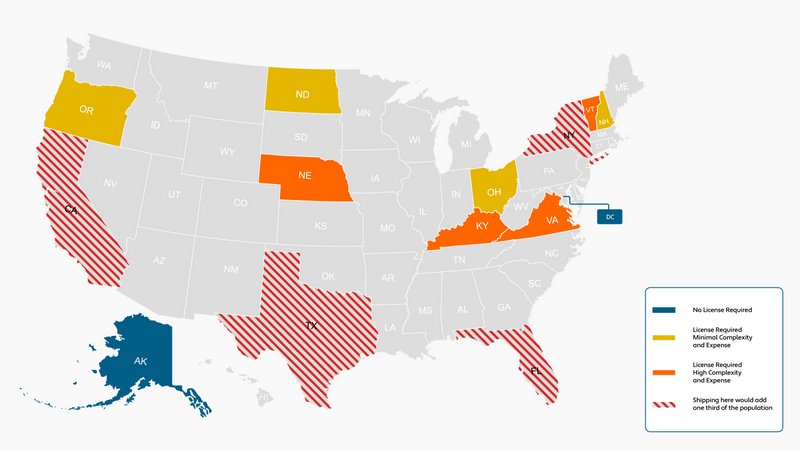

The question then is, which other states might expand their DtC shipping permissions in 2025? About a dozen DtC spirits bills were introduced across the country in 2024, including the one in New York, and it is very likely that many of them will be brought up again in 2025. With some effort and luck, it is possible that spirits enthusiasts in Illinois or New Jersey may soon enjoy similar opportunities as New York consumers to purchase spirits.

However, California presents perhaps the biggest opportunity for new DtC permissions. For the last few years, the state has maintained a rule allowing for DtC shipping of spirits by in-state distillers only, as a hangover from the COVID pandemic. Since this rule applies only to California-based distillers, it is in clear violation of the 2005 Granholm v. Heald Supreme Court case, which established the rule that in-state-only DtC shipping laws violate the Constitution’s Dormant Commerce Clause.

California has said that its current DtC spirits rules are merely “temporary” and so should not be challenged in court, but that claim has been belied by the state’s failure so far to pass a proper, national DtC law. If they cannot manage to do so in 2025, then it is quite possible that non-California distilleries will sue the state to assert their rights.

Of course, spirits is not the only area where DtC is at issue. The beer industry has also been increasingly interested and active in looking to expand their shipping map, and bills will almost certainly be introduced in several states relating to DtC beer shipping (currently, beer can be DtC shipped in about a dozen states). Wine will also be active, working to enable DtC shipping in every state, though the industry’s focus will most likely fall on opening Delaware and removing a cap on the size of eligible wineries in New Jersey.

Concerns for DtC shippers

For their part, state regulators will continue to crackdown on what they see as problematic behavior in the DtC shipping market. Largely, this will focus on the key regulatory issues of shipping without a license, failure to pay taxes and the ever-present concern around sales to minors. Active and potential DtC shippers are highly encouraged to do whatever they can to remain in compliance with all state laws. Loopholes and workarounds may seem like a quick and easy way to avoid the regulatory burden, but are ultimately breaking the law, and the result will not only be fines and potential loss of license but also discrediting the rest of the DtC market, making it harder to open new states.

Beyond law changes and enforcement, the biggest concerns for DtC shippers in 2025 will be the same ones affecting the overall beverage alcohol market, namely where will future growth come from and how can we achieve it? The industry seems to be struggling to capture consumer attention, especially as anti-alcohol sentiments have become more popular. The DtC shipping market may present exciting opportunities for suppliers, particularly small, craft producers, but it is just as subject to market forces as any other channel.

To mangle a phrase, the future is a foreign country, one that cannot be perfectly predicted. However, as we move towards 2025, there is still a tremendous amount of potential for DtC shipping of beverage alcohol—as long as we continue to demonstrate we deserve it.

Alex Koral is Regulatory General Counsel with Sovos ShipCompliant

Leave a Reply

You must be logged in to post a comment.