In recent years, the non-alcoholic (NA) beer market has witnessed a remarkable surge, signifying a pivotal change in consumer preferences and craft dynamics. This shift reflects a broader societal trend towards health and wellness, coupled with evolving consumer tastes. NA products are beginning to transform the beverage industry, presenting both opportunities and challenges for craft breweries, marketers and retailers alike.

Non-alcoholic beer, typically containing less than 0.5% alcohol by volume, has transcended its niche status to become a mainstream option. Initially, NA beers were primarily targeted at consumers who abstained from alcohol for health, religious or personal reasons. Today, the demographic is broader, encompassing health-conscious individuals, athletes and those participating in the sober curious movement. Dry January 2024 showcased this fact. Let’s take a look at what we learned.

Dry January and non-alcoholic beer stats

A recent poll conducted by Morning Consult, commissioned by the Beer Institute, noted that more than half (58 percent) of Americans participating in Dry January are choosing low- and no-alcohol beer to help them achieve their goals. Key highlights from the poll:

- Of those participating in Dry January, 58 percent feel that new options like low- and no-alcohol beer help them moderate their consumption.

- Further, 58 percent say that low- and no-alcohol beer is a good alternative for people who are looking to moderate their alcohol consumption long-term.

- 55 percent say that the quality of non-alcoholic beer has improved over the past few years.

From the press release:

“As many Americans increase their focus on moderate consumption, a growing majority of them are using low- and no-alcohol beer to help them hit their goals,” said Brian Crawford, president and CEO of the Beer Institute. “Brewers are committed to meeting this demand, and as the beverage of moderation, beer’s dominance in the low- and no-alcohol space reflects decades of investment by brewers and an industry commitment to encourage responsible consumption. The beer industry is enabling consumers to enjoy their favorite beers without sacrificing quality.”

According to that same Beer Institute report, the non-alcoholic drink market now exceeds half a billion dollars a year — up 31 percent in the past year. Craft beer, known for its emphasis on flavor, quality and artisanal brewing techniques, has a real opportunity to serve the NA market with great products. Athletic Brewing is proof of the potential. The brand, which exclusively brews NA beer, was the 13th largest craft brewer in the United States in 2022 by sales volume (2023 numbers are not out yet), according to the Brewers Association top 50 list.

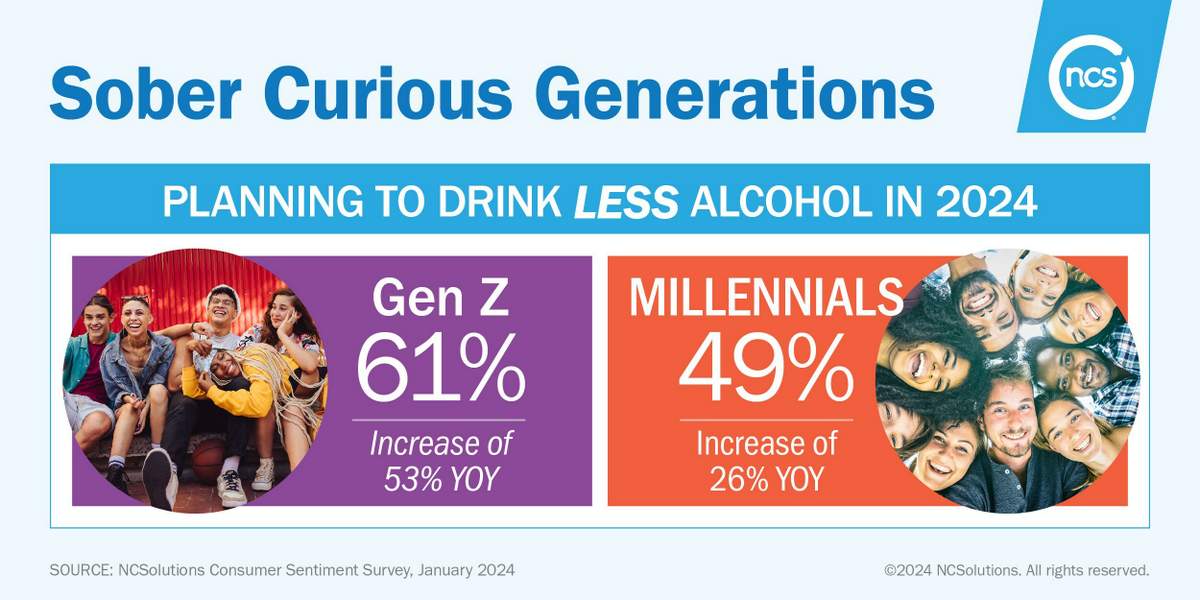

According to a new report on American drinking habits from data and advertising experts NCSolutions, Americans are continuing to cut back on drinking alcohol and seeking alternative beverages. In fact, 41 percent of Americans are planning on drinking less in 2024 — this increases to 61 percent among Gen Z — says the report. From that same report:

Corresponding with Dry January, NCSolutions purchase data shows a major decline in alcohol sales from December 2022 to January 2023. Alcohol purchases dropped 24% from one month to the next. It makes sense, especially with more Americans — 22% — taking part in Dry January 2024, up 10 percentage points from 2023. It’s not only alcoholic drinks that are being left on the shelf for the time being. Soft drink sales were down 11% in January 2023 compared to December 2022.

Of course, it’s not just NA beer. There is a growing number of category competitors vying for attention with non-alcoholic variants from NA wine to NA whiskey. From the report:

Mocktails are expected to be a major trend for 2024, as these alcohol-free beverage concoctions are the number one nonalcoholic drink Americans want to try. Others are also interested in THC and CBD-infused drinks. The main reasons people are drawn to these types of alcohol-free drinks are because they want to see what it tastes like, consider it a healthier alternative to alcohol, and like the look of it.

Other interesting data from the report:

- 1 in 3 Americans tried a nonalcoholic beverage in 2023

- Top drinks Americans want to try in 2024: Mocktails, THC/CBD-infused beverages and non-alcoholic beer

- 24 percent of Gen Z have tried a nonalcoholic beverage because it was endorsed by an influencer; 34 percent will try a product marketed towards the sober-curious lifestyle

- 24 percent of Americans did not drink alcohol at all in 2023

Big NA craft beer brands and emerging NA-only beer makers

NA beers offer craft brewers the opportunity to expand their market reach. This segment not only appeals to sober curious individuals but also to health-conscious consumers, pregnant women and people who abstain from alcohol for religious or personal reasons. Moreover, NA craft beers can be consumed in settings where traditional alcoholic beverages might be inappropriate, such as during lunch hours and at family-friendly events.

Almost all the big beer brands are now producing NA beers, including Anheuser-Busch, Molson Coors, Constellation and Heineken. Also, the big craft brands are invested: Sierra Nevada’s Trail Pass brand, Sam Adams’ Just the Haze and Gold Rush products, Shiner’s Rode0 line and Brooklyn Brewery’s Special Effects lineup are all good examples. We also see these big craft breweries investing in beyond beer products. Last September, Brooklyn Brewery announced an investment in Hoplark, a maker of craft non-alcoholic beverages like Hoplark 0.0, a non-alcoholic beer, as well as its HopTeas, Hoplark Sparkling Water and other limited edition hopped beverages.

Craft breweries are also equipping their sales teams. In November, BrewDog USA, which easily makes some the best NA beer around, announced it had launched the first alcohol-free and non-alcoholic certified sales team in the country through the AFicioNAdo Certification Program, which is the world’s first professional training and certification program focused on alcohol-free and non-alcoholic adult beverages. BrewDog noted that its AF Mixed Pack continues to perform above the national trend as the No. 1 AF Beer Variety Pack in the country in a category that has grown 32 percent to $447 million year over year (Nielsen IQ, Sept. 2023).

NA beer makers are also utilizing their marketing dollars to push non-alcoholic awareness. This Dry January, Sam Adams put a big focus on dads, expecting dads and non-carrying mothers with its Due Date, Brew Date competition, where someone could win a 40-week supply of Samuel Adams’ non-alcoholic brand Just the Haze.

RationAle Brewing (now the fifth largest in the NA craft category, according to RationAle) pushed its “Jan’Archy Party” campaign this month, which included giving away the awesome party packs pictured above but more importantly kicking off a year-long partnership with LA’s live music hot spot, Winston House, where RationAle will be the exclusive NA beer available for concertgoers at the venue’s full-service bar. RationAle debuted during Winston House’s month-long event series — “Out of the Blue: 30 Days of 30 Artists” — showcasing its mission to support new artists and the discovery of new music.

What’s really cool about the NA movement has been the emergence of these indie craft brands (like RationAle) that only focus on NA options. Brewed in North California, Best Day Brewing is one of the fastest growing non-alcoholic beer brands in the country, recently announcing a great seasonal rotator brand simply called Belgian White. Best Day Brewing recently noted it is on pace to finish as the No. 4 craft non-alcoholic brand in the United States by the end of the year after only having launched in 2022 (Nielsen Total US x AOC + Liquor Plus + Conv, Latest 26 Wks – w/e 08/12/23). The brand continues to expand its retail presence with several national banners in Alabama, California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Iowa, Minnesota, New York, Oregon, Pennsylvania, Tennessee, Texas, Utah, Washington and Wisconsin.

Many of these NA brands embrace the wellness vibe. Kit NA Brewing is an excellent indie NA brand founded in 2021 by cofounders Rob Barrett and Will Fisher. It’s recent variety pack personified a holistic wellbeing, fun and charitable feel with a limited edition “Kit.” This exclusive Dry January offer was available to consumers who donated through the brand’s website throughout the month of January — with all proceeds going to Kit NA’s Mental Health Organization Partner — Sound Mind Live — fostering awareness, conversation and community around mental health through the power of music.

NA-only brands are also definitely attracted to sports and nutrition. Partake Brewing was founded in 2017, and its 30-calorie non-alcoholic beer is available in North America, with distribution in major retailers across Canada and the United States. The Association of Pickleball Players (APP) recently announced the addition of Partake Brewing as its official non-alcoholic beer of the APP Tour, combining the brewery’s award-winning selection of low-calorie, non-alcoholic beverages with the fastest-growing sport in the United States.

NA beer on premise?

The demand for NA beer opens up new avenues for innovation in the craft beer industry. Brewers are experimenting with various brewing techniques to remove or prevent the formation of alcohol while maintaining the rich, complex flavors characteristic of craft beer — arrested fermentation, vacuum distillation and reverse osmosis. These NA beers and beverages are now finding their way onto store shelves, but how about on-premise venues?

CGA by NIQ recently released a market report exploring the implications of on premise for brands, suppliers and operators that added Dry January to their New Year’s resolutions. According to its research, Dry January participation among consumers saw 44 percent of active consumers (+10pp versus 21–34-year-olds) very likely or likely to participate, and only 14 percent of those intend not to visit on premise during Dry January. From the report:

For those abstaining at bars and restaurants, 62% will opt for soft drinks, 30% sparkling water, and 26% hot drinks. Less than 10% specified mocktails and alcohol-free beer, wine and spirits. But more than 10% of consumers who are likely to take part in Dry January said they’re motivated by a better range of non-alcoholic options available than in previous years. This represents a key window of opportunity for creative strategizing and product development, in order to entice more Dry January participants from the sofa to the bar.

Also interesting….

CGA’s Global Bartender Report reveals that 15% of bartenders include no/low in their top trending drinks at the moment. This popularity can explain why it isn’t one side of the bar that are eager to learn about the category – over half of consumers (58%) want to get closer to no/low, making this the no. 1 drinks category consumers would like to learn more about. Despite this popularity amongst consumers, no/low category knowledge is still relatively low (46%) amongst bartenders when compared with the likes of spirits (87%) and cocktails (93%). To bridge this knowledge gap, drink suppliers can play a crucial role in supporting operators and their bartenders during slow periods

What about NA beer on draught? Interestingly, the Brewers Association (the trade org representing craft brewers) released resources on the safety of non-alcohol beer on draught this past January. Producing and serving non-alcohol beer is inherently different from traditional alcohol containing styles. Alcohol limits the survival and growth of pathogenic bacteria. However, little scientific research has been published on the growth and survival of pathogens in non-alcohol beer, which is what makes this BA resource so important. Here’s some text from the BA page:

A “food safe” non-alcohol beer can be produced at the brewery for packaging in a can or bottle through pasteurization. However, in keg, non-alcohol beer moving through the three-tier system is subject to circumstances beyond the brewer’s control, such as elevated temperatures during transportation and storage, or being served from a poorly maintained long draw draught system. These and other pathways such as a contaminated food product stored in beer service areas, can possibly introduce contamination and/or stimulate bacterial growth with potentially human harming consequences.

There is already a challenge for craft brewers to create NA beers that retain the complexity and depth of traditional craft beers, so adding the hurdle of safely serving it on draught might be a bridge too far, but there is still research to be done, according to the Brewers Association. While the potential for NA craft beers is significant, there are challenges to consider.

Non-alcoholic is not a fad

The NA beer sector is more than a passing movement. It represents a fundamental shift in consumer preferences and lifestyle choices. For the craft beer industry, this movement offers an opportunity to innovate and reach a broader audience. However, it also requires a thoughtful approach to ensure that the quality and integrity of the product are maintained. As the industry adapts to these changes, we can expect to see a diverse range of high-quality NA craft beers that cater to this growing segment of the market. By embracing initiatives like Dry January and the sober curious movement, the craft beer industry is not only responding to a market demand but also promoting a more inclusive and health-conscious approach to social drinking. Sounds like a win-win.

Leave a Reply

You must be logged in to post a comment.