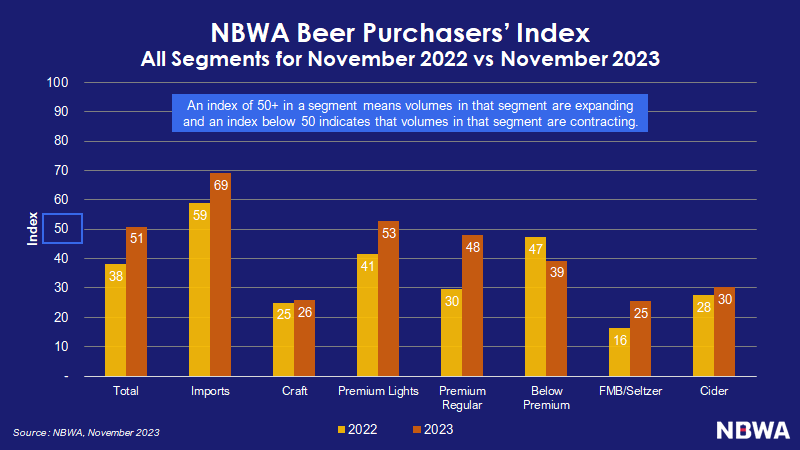

The beer industry is closing a turbulent year with signs of a more stable and predictable ordering environment ahead, says the National Beer Wholesalers Association (NBWA), pointing to the Beer Purchasers’ Index (BPI) 13-point YoY jump in November to 51. The same can’t really be said for craft beer, specifically.

The BPI is the only forward-looking indicator for distributors to measure expected beer demand. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

Coupling that 51 in November with an At Risk Inventory measure of 42, indicating low inventory levels, the data suggests a neutral stance for the industry — a marked improvement over the contractionary reading from last year.

The craft index though, at 26 for November 2023, continues to signal contraction in this segment; the tally is about the same as the November 2022 reading at 25.

Ordering trends were positive for six of the seven measured segments, led by 18-point and 12-point YoY increases for Premium Regular and Premium Lights, respectively. The Imports segment continued its strong year with a 10-point jump from November 2022.

Looking across the segments for November:

- The index for imports continues to point to expanding volumes with the November 2023 reading at 69 higher than the November 2022 reading of 59.

- The premium light index rose to 53 for November 2023, above the November 2022 reading at 41.

- The premium regular index rose to 48 for November 2023 above the November 2022 reading at 30.

- The below premium segment for November 2023 fell to 39 and is lower than November 2022 reading at 47.

- The FMB/seltzer reading for November 2023 at 25 is higher than the November 2022 reading at 16.

- Finally, the cider segment posted a November 2023 reading at 30 compared to 28 for November 2022.

Leave a Reply

You must be logged in to post a comment.