The Brewers Association (BA) — the trade association representing small and independent (1) American craft brewers — just released annual production figures for the U.S. craft brewing industry (2). In 2022, small and independent brewers collectively produced 24.3 million barrels (bbls0 of beer, on par with 2021’s numbers (3), and craft’s overall beer market share by volume grew to 13.2%, up from 13.1% the previous year.

The overall beer market* shrank 3% by volume in 2022. Retail dollar value was estimated at $28.46 billion, representing a 24.6% market share and 6% growth over 2021. Sales growth was stronger than volume due to pricing, share shift to smaller brewers — who are more likely to sell onsite and via distributed draught — as well as the continued channel shift back to on-premise, which has a higher average retail value. Craft brewers provided 189,413 direct jobs, a 9% increase from 2021, driven both by growth in the number of breweries and a continued shift to hospitality-focused business models.

“2022 presented small brewers with a number of challenges, including rising operating and material costs and increasing competition, particularly in distribution,” said Bart Watson, chief economist, Brewers Association. “In this maturing and competitive market, collective growth for the category is hard to come by.”

The number of operating craft breweries continued to climb in 2022, reaching an all-time high of 9,552, including 2,035 microbreweries, 3,418 brewpubs, 3,838 taproom breweries, and 261 regional craft breweries. The total U.S. operating brewery count was 9,709, up from 9,384 in 2021. Throughout the year, there were 549 new brewery openings and 319 closings. Openings decreased for a second consecutive year, with the continued decline reflecting a more mature market. The closing rate increased in 2022 but continued to remain relatively low, at approximately 3%.

“The relatively low closure rate reflects both the solid demand for fuller flavored local beer as well as the versatility and flexibility of small brewers,” added Watson.

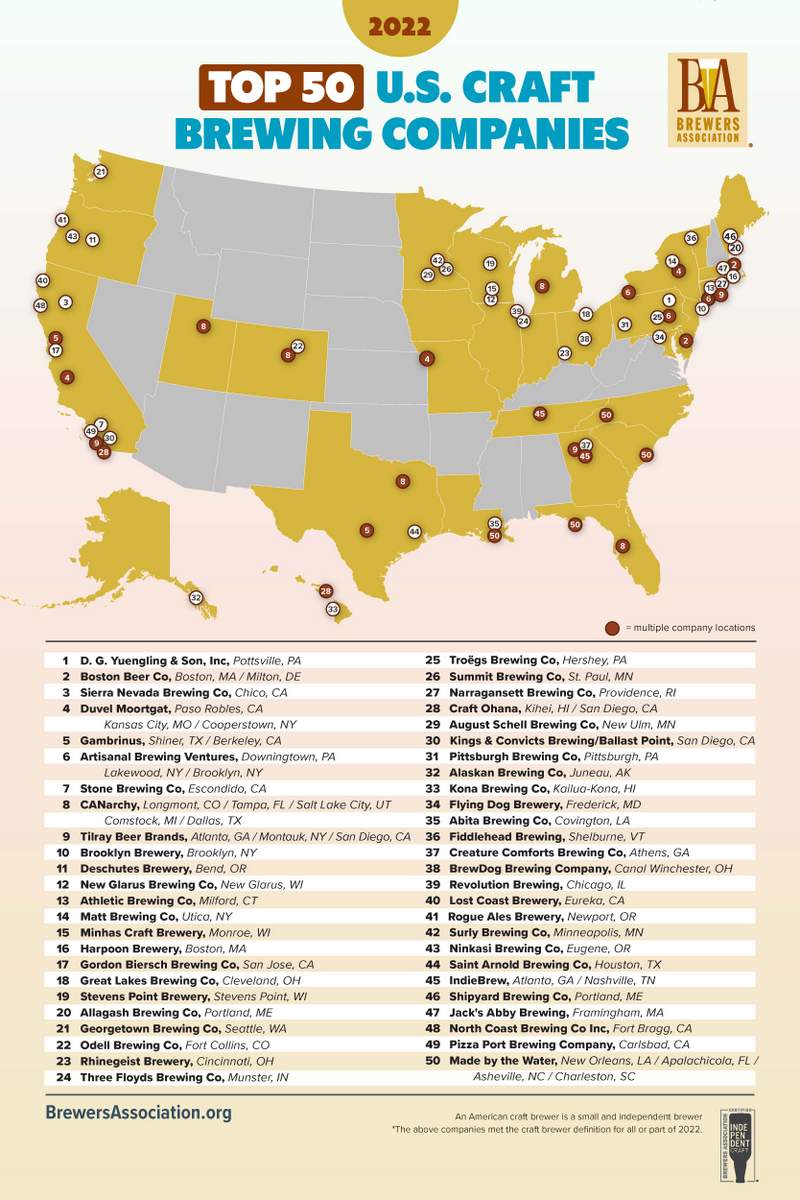

In addition, the Brewers Association also released its annual list of the top 50 producing craft brewing companies and overall brewing companies in the U.S., based on beer sales volume. Of the top 50 overall brewing companies in 2022, 40 were small and independent craft brewing companies (4).

“Breweries that managed to move up the list organically are often those that are adding incremental growth to the category,” said Watson. “Both beer and craft need to create new occasions and new beer lovers to find growth.”

Note: Numbers are preliminary. For additional insights from Bart Watson, visit Insights & Analysis on the Brewers Association website. The full 2022 industry analysis will be published in the May/June 2023 issue of The New Brewer, highlighting regional trends and production by individual breweries.

* Does not include FMBs/FSBs. With those included, total taxed-as-beer products decreased 4%.

- (1) An American craft brewer is a small and independent brewer. Small: Annual production of 6 million barrels of beer or less (approximately 3% of U.S. annual sales). Beer production is attributed to the rules of alternating proprietorships. Independent: Less than 25% of the craft brewery is owned or controlled (or equivalent economic interest) by an alcoholic beverage industry member that is not itself a craft brewer. Brewer: Has a TTB Brewer’s Notice and makes beer.

- (2) Absolute figures reflect the dynamic craft brewer data set as specified by the craft brewer definition. Growth numbers are presented on a comparable basis. See full methodology.

- (3) Volume by craft brewers represents total taxable production.

- (4) Figure based on companies that met the craft brewer definition for all or part of 2022.

Leave a Reply

You must be logged in to post a comment.