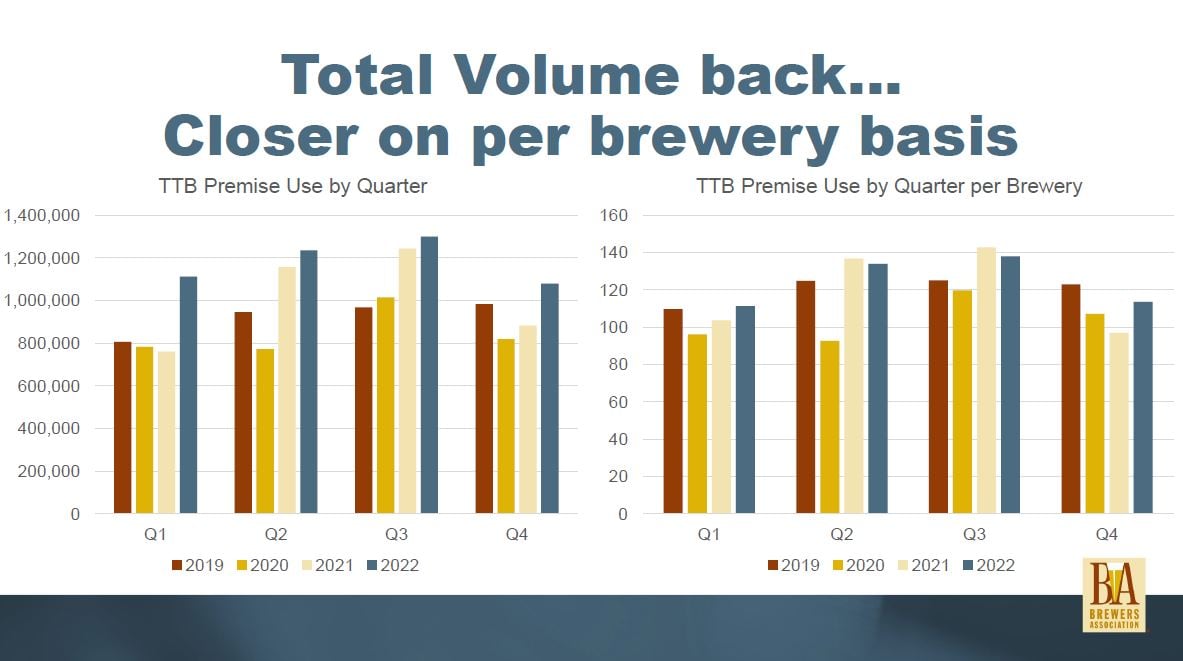

A cautiously enthusiastic horde of over 1,100 California craft brewers and their suppliers filled the halls of the Sacramento Convention Center this week to celebrate the first California Craft Beer Summit in four years. The summit is the once-again annual meeting of the the California Craft Beer Association, representing more than 800 commercial brewers in the state, led by Board Chairperson Laurie Porter of Smog City Brewing Co. While craft brewing is a complicated trade, the larger view of the industry this week is that “total volume is back, [albeit] a closer call on a per-brewery basis,“ according to keynote speaker Bart Watson, the chief economist for the Brewers Association.

Total volume back

Watson was referring to the U.S. Alcohol and Tobacco Tax and Trade Bureau’s (TTB) national barrel numbers for on-premise beer, by quarter during 2022, showing that the volume brewed each of the four quarters in 2022 exceeded the 2021, 2020 and 2019 numbers. At last. TTB derives the Monthly and Quarterly Beer (CA State) Statistics from industry data submitted on the Brewer’s Report of Operations and the Quarterly Brewer’s Report of Operations.

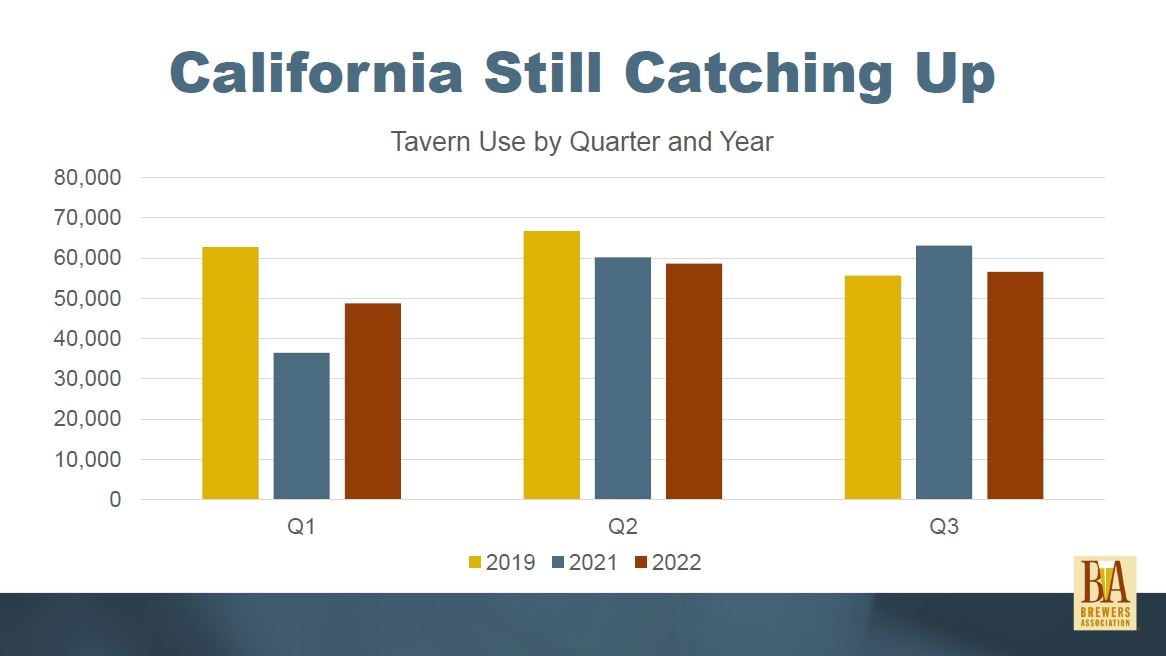

California still catching up

California state volume news was less lustrous: “California is still catching up,” Watson said. He showed that Q1 and Q3 2022 tavern use of beer had risen over the same Q 2019 periods — hovering close to 60,000 bbls — but not against 2021 numbers. Q2 2022 numbers lost ground to both prior years.

“For California, from 2020 to now — once we control for inflation — that [volume[ is minus 10 percent vs. where it used to be. California is clearly lagging,” Watson said.

He is still optimisic, as were all the speakers at the Summit. “Hopefully the Q4 numbers are also going to be strong and explain why we’re seeing good strong numbers in our survey,” said Watson.

Beverage alcohol competition

The California craft beer production growth effort is not merely about recovering fully from the Covid crisis and inflationary measures. It’s also about beyond-beer innovation, reckoned Watson. The competition is moving in that direction.

“The challenge for all of us, and I think the biggest reason here, is competition from other beverage alcohol. The shelf sets have grown and grown for decades, as we’ve offered consumers more and more choices, a wonderful variety,” said Watson.

However, “we are now starting to get pared back as craft sales slow and total beverage alcohol offers more new, shiny flavors and all sorts of different beverage alcohol solutions,” Watson cautioned.

The CA distribution danceathon

Getting craft beer to market is not getting easier. The California beer distribution market has been consolidating rapidly with large acquisitions lately by Constellation and Reyes, so craft brewers need to modify their distribution strategies to keep pace.

“If you’re a distributor, and you have one category that’s lagging and other categories that are growing, you’re going to shift your allocation of resources. And that’s what we’re seeing, with craft losing 5 percent to 10 percent of its space nationally,” said Watson.

The loss in distribution warehouse space for craft beer is not the only product distribution challenge facing brewers today. There’s also the question of how much and what kind of service to expect when a few monolithic beer distributors begin controlling most of the state volume.

“We’re entering into a phase right now in California, where we’re going have one distribution company [Constellation] with an incredible share. That changes the fundamentals of how all everyone else’s businesses are going to work, because now the distributor’s going to dictate what service looks like for everybody. They’re going to push things around and make the landscape look different than it was before, and not necessarily in a better way,” observed Kevin Luckey, the executive director of California Family Beer Distributors.

“I’d say now we’re kind of bouncing off the bottom,” said Luckey. “Unfortunately a lot of wholesalers in the state have made the decision to exit the space completely.”

CA legislation update

The California craft brew industry enjoys some of the strongest legal rights among brewers in all U.S. states, CCBA folks are happy to point out. This year, the California Craft Beer Association has several bills before the legislature, following three that were signed into law last year, notes Lori Ajax, the executive director of the CCBA.

Among these bills one strengthens public access to beer production data, after a three-year hiatus of data reporting by brewery, in the name of privacy protection. The second removes a high-volume-production hurdle for parallel cider production at a beer brewery.

SB 388, sponsored by Bob Archuleta (D – 32nd District), requires that “beer manufacturer tax returns filed on or after January 1, 2024, would require the board, upon request, to make public the names and addresses of taxpayers filing a beer manufacturer return, as well as any information in a beer manufacturer return and schedules,” according to a summary by FastDemocracy.com.

“This non-controversial bill simply would make data production numbers more transparent. In 2019, the state government adopted very, very rigorous privacy protections. And what they did was to anonymize the information, so all of a sudden historic data that was apples-to-apples went to apples-to-bananas,” said Chris Walker, a CCBA Lobbyist from Walker Strategies.

SB 788, sponsored by Angelique V. Ashby (D – 8) and Cecilia Aguiar-Curry (D – 4), would remove the 60,000-bbl production requirement that a licensed beer manufacturer must meet in order to engage in the manufacturing and sales of cider or perry on the same premises, and to sell cider or perry to any licensee authorized to sell wine, according to FastDemocracy.

The CCBA works to further a broad palate of legislative goals, amid much competition for attention. “It’s no secret that many [other alcohol industry] groups have significant impact where they support legislators in their efforts to get re-elected. Getting re-elected in California is no small feat, and it costs lots of money. CCBA doesn’t have a PAC, but I consider you all as a PAC — a pack of wolves,” said Walker.

Ajax and Walker led a group of 40 brewers to the state capital during the summit to meet with their representatives. Other brewers in the state are encouraged to open up their brewing sites to legislators and staff for tours and fund-raisers to help further the goals of the CCBA.

Leave a Reply

You must be logged in to post a comment.