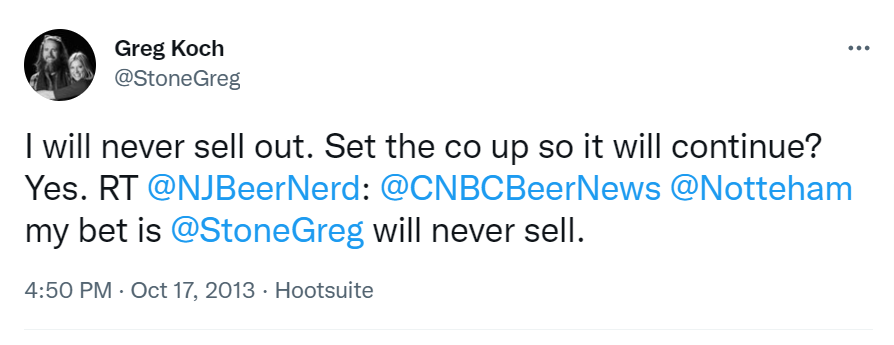

Arrogant Bastard is easily one of the most in-your-face craft beers of all time. To me, both Arrogant Bastard and the company behind it, Stone Brewing Co., always represented that early my-beer-is-just-better-than-your-beer zeitgeist of the craft beverage movement. Cofounder and Executive Chairman Greg Koch was always the face in front of Stone beer, leading the beer revolution — always talking about staying independent, challenging monopoly-sized breweries and of course making great tasting beer that was just better than the corporate lager everyone else was drinking.

Over the years (certainly since the pandemic), that type of rhetoric has toned down, but Koch has consistently made a show of not only embracing a halo of indie beer but also being a thorn in the side of big brewers like AB InBev and Molson Coors. In fact, Stone Brewing was just awarded $56M in a trademark lawsuit against Keystone Light’s “Stone” branded cans (Keystone is a Molson Coors product). Of course, during that trial some bad news came to light. Earlier this year, it was reported Stone Brewing owed investors a lot of money. From Pro Brewer:

San Diego-based Stone Brewing owes its investor VMG/Hillhouse $464 million according to testimony by Stone CEO Maria Stipp in a court case against MillerCoors … The decline in sales in recent years may have led the company to consider selling, according to an article in Courthouse News Service. “Has MillerCoors’ infringement forced you to consider certain options you don’t want to,” a Stone attorney asked when questioning Stipp if Stone Brewing had considered selling the company. “Yes,” Stipp responded.

It’s a sad turn of events. The signs were there. Stone Berlin operations going bankrupt in 2019 and its Napa location closing last year. Does anyone remember True Craft? In 2016, Koch announced the formation of True Craft, a $100 million company aimed at investing in craft breweries. Why? To take minority non-controlling investments in breweries while letting them remain independent. Here is Koch at the time (from The Full Pint):

“Some people start companies to sell out. Some start companies because they are compelled to follow their passion. True Craft is for the latter,” said Greg Koch, Stone CEO & co-founder. “Craft beer needs an alternative model to the one that requires founders to sell their company in its entirety. In a world in which there are constant forces toward homogenization and fitting in, I specifically want to foster a world of uniqueness, depth and character.”

Here’s what happened to True Craft. So, Stone Brewing Co., the company that never wanted to sell out, is selling most of its business to Sapporo U.S.A. for around $168M, according to this report. For old times sake, let’s revisit this:

Sapporo U.S.A. makes the No. 1 selling Asian beer brand in the United States, according to the press release. Stone Brewing Co. ranked No. 9 on the top 50 biggest craft breweries in America in 2021 (measured by sales volume), according to this Brewers Association report. Alas, the company will no longer fit the trade association’s definition of being a craft brewery. According to our recent report, Sapporo was the 27th largest brewery in the world in 2021. It appears that big American craft breweries think selling to Asian beer rollups carries less backlash from customers than selling to AB InBev or Molson Coors. Examples include the sales of New Belgium Brewing and Bell’s Brewery to Lion, an Australian based brewing subsidiary of Kirin Holdings Co. Ltd., and Sapporo U.S.A.’s acquisition of Anchor Brewing back in 2017.

What does Koch have to say about all this? From the press release:

“This is the right next chapter for Stone Brewing,” said Greg Koch, Co-Founder & Executive Chairman of Stone Brewing. “For 26 years, our amazing team has worked tirelessly to brew beers that have set trends and redefined expectations. To have the interest of a company like Sapporo in continuing the Stone story is a testament to the great beers we’ve created and will continue to create for our fans across the globe.”

According to that same press release, Sapporo intends to produce its Sapporo-branded beers for U.S. distribution in Stone’s two breweries, in Escondido, Calif., and Richmond, Va. Sapporo intends to brew 360,000 bbls in the United States by the end of 2024. This will essentially double Stone Brewing’s current production. Stone Distributing Co., Stone Brewing’s distribution business, is not part of the sale, and will become an independent company under the current ownership.

So it goes.

Leave a Reply

You must be logged in to post a comment.