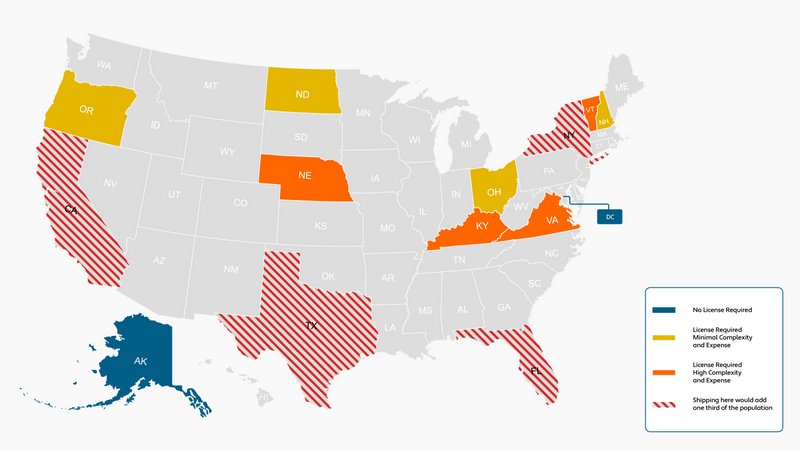

Let’s be honest here: The current state of affairs for shipping beer direct to consumers (DTC) is not that great. Breweries in the United States can only ship to nine states plus the District of Columbia, which equates to only 17% of the U.S. population. For comparison, U.S. wineries can ship to 47 states and 97% of the U.S. population. Beer DTC is still in a state of infancy, but the good news for breweries is there’s a tremendous amount of untapped opportunity.

In 2021, no new states were added to the beer DTC roster. Although several bills were considered, no state DTC law for beer crossed the finish line.

And to make matters worse, a new law in Nevada actually resulted in one less state for breweries. Unfortunately, legislative progress will continue to be slow for breweries, and it may take 15 years or more for breweries to achieve parity with wineries in the U.S.

When it comes to DTC shipping destinations, however, not all states are created equal. Just by adding the four most popular shipping states, breweries could add shipping capabilities for one-third of the U.S. population. California, Florida, New York, and Texas would add a significant number of accessible consumers to the fold. Although it took the wine industry decades to gain the DTC access they enjoy today, breweries may have a slightly easier path since the foundation has been laid. Picking and choosing the battles and evaluating legislative priorities will be a key to success.

Before adding a new state to your DTC roster, it’s important to understand the basics of compliance.

Most states require a direct shipping license with the state Alcohol Beverage Control (ABC) department for the manufacturer of the products being shipped. Prior to receiving the direct shipping license from the ABC, the majority of states will first require registering your business for sales tax remittance with the department of revenue. Direct shipping licenses require many other compliance considerations. For example, on top of periodic excise and sales tax returns, many states require a listing of all the shipments you made into the jurisdiction. It’s also important to be aware of which states have dry areas, volume limits, and age verification requirements.

For breweries just getting started, begin with your home state (if your state allows intrastate shipments) by learning the compliance basics and how to handle shipping operations. Once you feel comfortable in your home state and start to build a waiting list of customers outside of your state, you can begin to expand one state at a time.

We compiled this list of compliance requirements for the states below to help you evaluate your expansion strategy.

No Licensed Required

Alaska

- Direct Shipping License Required: No

- Sales Tax Required: No

- Excise Tax Required: No

- Volume Limit: A “reasonable quantity”

Washington, D.C.

- Direct Shipping License Required: No

- Sales Tax Required: Yes, if annual sales exceed $100,000 or 200 transactions

- Excise Tax Required: No

- Volume Limit: 24 bottles per person per month

License Required, and Minimal Complexity and Expense

New Hampshire

- Direct Shipping License Required: Yes

- Sales Tax Required: No

- Excise Tax Required: Yes

- Volume Limit: 27 gallons per person per year, with each container not exceeding 1 liter

North Dakota

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes

- Volume Limit: 288 fluid ounces per person per month

Ohio

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes

- Volume Limit: 24 cases per household per year

Oregon

- Direct Shipping License Required: Yes

- Sales Tax Required: No

- Excise Tax Required: Yes

- Volume Limit: 2 cases per person per month

License Required, but High Complexity or Expense

Kentucky

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes, two different tax types (gallonage and wholesale)

- Volume Limit: 10 cases per person per month

Nebraska

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes

- Volume Limit: 9 liters per person per month

Vermont

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes

- Volume Limit: 36 gallons per person per year

Virginia

- Direct Shipping License Required: Yes

- Sales Tax Required: Yes

- Excise Tax Required: Yes

- Volume Limit: 2 cases per person per month

Note: Inspiration for this post came from Jason Haas, who’s excellent blog post titled Wine Shipping State of the Union, 2021 Edition is worth a read.

Jeff Carroll is General Manager of Avalara for Beverage Alcohol

Leave a Reply

You must be logged in to post a comment.