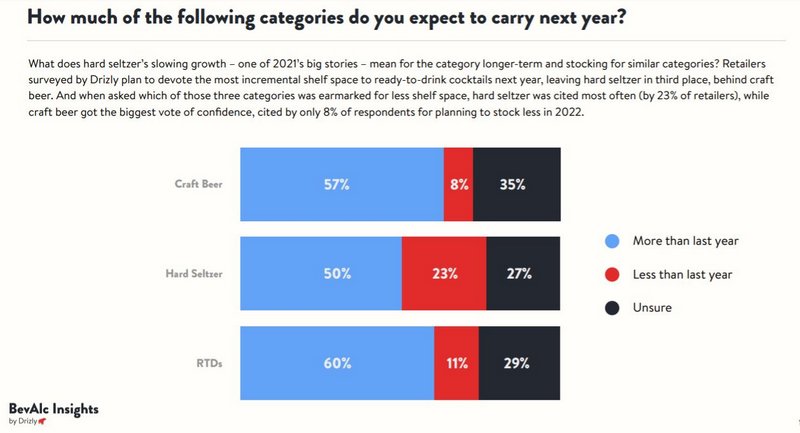

Alcohol e-commerce and on-demand delivery platform Drizly released its third annual BevAlc Insights by Drizly Retail Report, culled from a nationwide survey of over 500 alcohol retailers during November 2021, and it looks like craft beer is poised to reclaim shelf space from hard seltzer in 2022.

Yes, even as half of retailers surveyed see themselves carrying more hard seltzer next year, 57% said they expect to devote more shelf space to craft beer. On the flipside, 23% of retailers plan to stock less hard seltzer in 2022, in contrast to the only 8% who plan to do the same with craft beer. Supply chain issues are another factor to consider (less drama stocking locally produced beverages).

“We know alcohol retailers have a strong pulse on consumer behavior and demand as they see trends and shifts first-hand in their stores day in, day out,” said Cathy Lewenberg, Chief Operating Officer at Drizly.

The report, which also incorporates sales data derived from the Drizly platform in 2021, points to more shelf space for organic and natural products, along with locally produced beer, wine and spirits. And while hard seltzer’s torrid growth levels off, retailers remain strongly bullish about ready-to-drink cocktails’ growth prospects.

More on the report’s key findings:

● 2022 could be the year that tequila outsells vodka. Margs over mules? Nearly 80% of retailers plan to carry more tequila next year, on par with bourbon, and 40 points ahead of vodka. It mirrors sales trends on Drizly, where over the past few years tequila’s share of spirits sales has grown by 13%, while vodka’s share has declined by 2%.

● People want to feel good about what they’re drinking. Asked about special attributes that matter most, 66% of retailers surveyed said that they seek to stock locally made products, followed closely by organic and natural products (60%).

● What’s more, products for health-conscious shoppers ranked close behind (57%), at a time when 90% of retailers on Drizly now stock non-alcoholic beer, wine and other alternatives, and share of such products on Drizly are up 120% since 2020.

● Retailers are very bullish about cannabis- and CBD-infused products. In a landslide, over 50% of retailers believe that cannabis- and CBD-infused beverages have the industry’s biggest growth potential.* That is nearly double those who cited non-alcoholic products (26%).

The full third annual BevAlc Insights by Drizly Retail Report can be found here. Retailers interested in learning more about growing their business and optimizing with on-demand alcohol delivery on Drizly’s e-commerce platform can find more information at joindrizly.com.

Survey Methodology. The third annual BevAlc Insights by Drizly Retail Report is based on a representative sample of more than 500 adults who manage or own an independent liquor store and represent both non-Drizly partners and current Drizly Retail Partners. Respondents were recruited from Drizly’s database and results were gathered in the form of an online survey. This survey was fielded in November 2021.

Leave a Reply

You must be logged in to post a comment.