I took most of last week off, which means I got to unplug that Matrix headjack thingy that hangs from the back of my head, where beer news and data funnels directly to my brain. Freed from my online chains, I read a book, napped on random couches and played lots of dinosaur hunt with my three-year old son. Of note: We have a concerning dinosaur problem here in Strongsville, Ohio, which is my first factoid of the week.

[Plugs brain back into computer.]

Here we go … Every week, I’m fed a steady diet of data: online beer sales reports, on-premise tap pour charts, consumer trend analyses, product packaging surveys, you get the idea. Over the past week plus while I was unplugged, it appears I’ve received a few interesting abstracts and conclusions from various sources. First off, it was St. Patrick’s Day last week, and hey, did you stay home? I did. Well, for on-premise beer sellers, St. Paddy’s Day did not compare well to year’s past.

BeerBoard recently released its 2021 St. Patrick’s Day Report. BeerBoard is the draft king of data. The company sources and manages data from more than $1 billion in retail draft beer sales (via varying partners from B-Dubs to AB InBev). Its digital platform captures, analyzes and reports real-time info related to bar performance, brand insights and inventory. The annual St. Patrick’s Day Report looked at March 17, 2021, compared to same-store data against March 17, 2019.

Across the nation, St. Patrick’s Day 2021 was down 20.9% when compared to the holiday in 2019. Down? Yes. But when looking at performance over the past year, on-premise volume has been down anywhere between 48-51%. This could be a sign of good things to come as the holiday brought customers back and drinking beer. Light Lagers and Lagers saw a healthy bump on the day, as compared to 2019. Light Lagers were +8.8%, while Lagers saw an even bigger climb at +17.9%. IPA saw a slight dip, falling -14.3%, while Stouts/Porters realized a surprising -8.0% decline for the holiday.

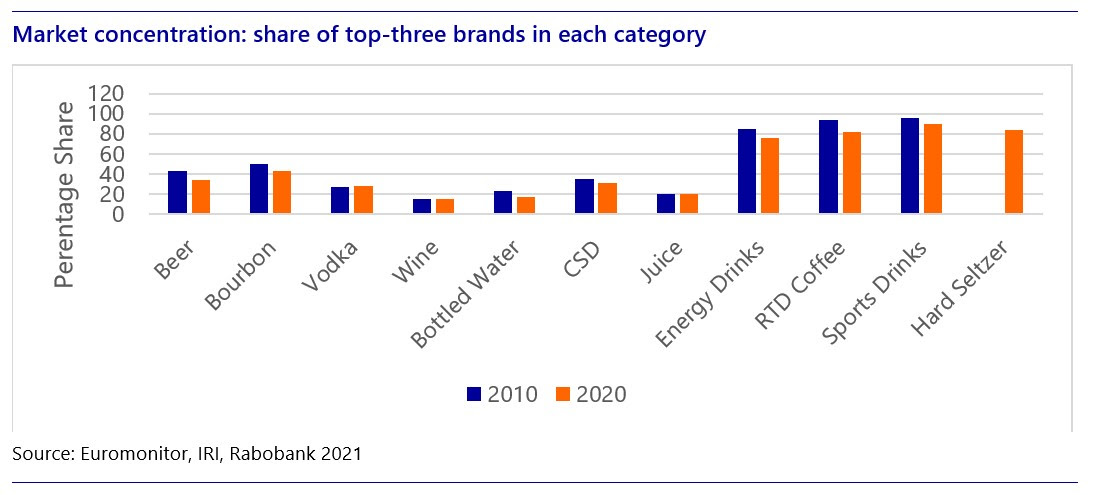

If they weren’t drinking light lagers, IPAs or porters, they were probably drinking seltzers. Hard seltzers continue to win market share from beer. Just ask Rabobank. Wait, who? Rabobank is Dutch-based multinational banking and financial services company, of course, and it does something called the Rabobank Beer Quarterly report. The recent Q1 2021 report focuses on hard seltzer’s growing popularity around the world but especially in the United States. Here’s a flavor…

“We expect significant sales growth in the US hard seltzer market and could see this category reaching 20% of total beer over the next five years,” says Jim Watson, Senior Analyst — Beverages for Rabobank in New York. Predictions from the industry are equally bullish, so the industry is investing not just in marketing, but putting large cap-ex into production capabilities to keep up with surging demand.

It’s not just the current size of the category, which is attention grabbing enough, but the fact that it can sustain significant growth for many years to come. With the seltzer category already accounting for USD 4bn in sales, 50% growth next would represent massive gains. In fact, household penetration for seltzer remains far below that of light lager.

“For many brewers, seltzers provided a notable tailwind in a challenging 2020 — and virtually every player in the U.S. beer space has major plans for new products in 2021,” according to Watson. However, the category boundaries are rapidly blurring, and the marketplace is getting very crowded,

Here’s a chart on the subject to peruse at your leisure.

Next up, Drizly recently released a BevAlc Insights report on how the pandemic has affected the booze industry over the last year plus. If you didn’t know, Drizly is the leading online alcohol deliver marketplace in the United States, and Uber just bought Drizly for $1.1 billion, so expect to hear about the platform a lot more. One year after the lockdown, some lasting shifts in how Americans drink and shop for alcohol have definiltey emerged, according to Drizly’s new report.

First off, liquor has took over Drizly’s top beverage alcohol category during the pandemic. Historically, wine has been the online retailer’s largest category, followed by liquor, beer and extras. In February 2020, wine accounted for about 41 percent of category share on the site. However, during the peak pandemic period of March to May 2020, liquor overtook wine and as the largest category. Now at 41 percent in March 2021, liquor continues to reign supreme. The report has lots of similarly interesting info, so here’s another one.

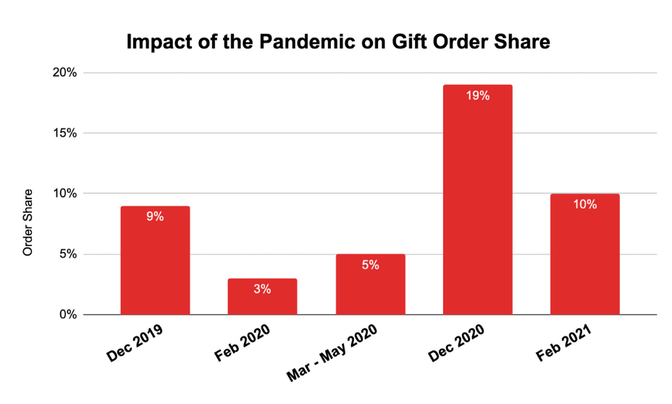

Prior to the pandemic, gifts represented about 3% of all orders on Drizly, with a typical holiday surge to around 9%. When large gatherings and in-person celebrations were curtailed throughout spring of 2020, share of gift orders increased by about 2%. Holiday 2020 represented an all-time-high for gifting, at an unprecedented 19% of order share. With the COVID restrictions tighter than ever in Q4, consumers looked online to spread love from afar, with alcohol serving as a perfect, special gift. Since then, gifting has maintained a significantly higher-than-baseline share, at 10% of all orders. Whether a special holiday or a typical Tuesday, consumers have now adopted a new way to spread cheer: The gift of Drizly.

That’s all for right now. I’m sure I’ll find lots more data nugs after further sifting through my inbox from last week. Stay tuned.

Leave a Reply

You must be logged in to post a comment.