The business efficiency of e-commerce is slowly being realized by the beer industry. It’s a shame it took a world-altering pandemic to make it happen. Beer makers have always been challenged by online distribution, especially direct-to-consumer transactions, for a variety of reasons ranging from each state’s terribly antiquated three-tier system regulations to just a general slowness to adapt to e-commerce channels.

In my recent interview with Elijah Schneider, founder and CEO of Modifly, an agency that specializes in social media marketing, the ridiculous comparison of wine and beer online sales came up. Schneider and Modifly are currently working with Mason Ale Works to build a social media marketing strategy for the San Diego brewery’s direct-to-consumer sales push. There was a bit of a learning curve.

“There’s the wine industry,” said Schneider in our previous interview. “I’ve known it for years and years, just from family relationships, with friends of mine who are in that category. They all do hundreds of thousands of dollars a quarter, if not millions a year type of thing in e-commerce sales. I thought for beer, it was going to be like that. So, when we started doing research on the legal side, we quickly realized that’s not entirely the case.

“There are a few laws [chuckling] that have been deemed from the early ‘90s up until the early 2010s, which allow for wine to be sold via interstate commerce. Breweries are still excluded from that, which makes no sense because when you get an alcohol license [in California], typically you get beer and wine licenses together, so we would assume that the legality of them would be the same as well.”

Nope. These legal and tech waters are still being charted, and the complexity of this sales channel is certainly not the beer maker’s fault. Luckily, there are some good companies being rediscovered in a big way in 2020, partly thanks to the pandemic and partly thanks to offering good products and services.

Of course, some of these companies are very much focused on the retailer side of beer sales — not breweries — but they can tell us a lot about the potential of online beer sales.

Drizly

Ok, Drizly‘s not for craft brewers right now — it’s for booze retailers — but the company is maybe looking into working with alcohol makers in the future. The company claims North America’s largest e-commerce alcohol marketplace. It has grown more than 350 percent in 2020 as compared to 2019, according to this recent report. That seems like a lot, and it’s not finished. Drizly also recently closed a $50 million Series C funding round, led by Avenir, a New York-based investment firm, with participation by Tiger Global and other cool sounding investors.

According to this press release, Drizly expects 20 percent of off-premise alcohol purchases to be transacted online within the next five years, as compared to less than 2 percent in early 2020. Luckily, Drizly is ahead of the game. It operates in 235 markets across North America through a network of 3,300 independent and chain retail partners. The company is focused on retailers — liquor stores, bodegas, specialty bottle shops, for sure — but breweries, distilleries and wineries are encouraged to go to brands.drizly.com to see how they can maybe partner with Drizly in the future.

But right now, Drizly is focused on partnering with local booze stores to serve millions buying online, delivering to their door.

From the press release:

“As the largest alcohol delivery marketplace in the U.S., Drizly is rapidly bringing the $120 billion off-premise alcohol market online,” said Andrew Sugrue, Co-Founder of Avenir. “With its laser focus on alcohol delivery, Drizly provides a best-in-class consumer experience with the widest selection, best prices and fastest delivery times, while enabling retailers, wholesalers and brands to thrive in the growing online market.”

Drizly says it can work with more than 100 point of sale systems to bring an inventory online. Then it offers a suite of services including training, a driver app (see new orders, monitor activity, track deliveries), ID verification scanner (an exclusive scanner to ensure your team effectively complies with age regulations at delivery), dedicated account manager, market insights (direct access to data and insights on the DrizlyRetailer platform, including reports like the “Top Selling Items I Don’t Carry”) and reporting (reconciliation reports, daily settlement batches and more). Surf over here to read all the details, including pricing options that include a set amount per order, percentage of sale and a fee based on the volume of sales on Drizly.

Tavour

Tavour is a craft beer retailer that currently works with over 600 unique independent craft breweries, bringing delicious craft beer directly from the doors of breweries to the doorsteps of its members across the country. Tavour specializes in trying to connect craft beer enthusiasts with beers that they probably wouldn’t otherwise get in their state. Over the last year, Tavour has tripled its business while working to expand to deliver to even more states across the country.

Customers download an app, build a custom box of craft beers, enroll in a subscription or have Tavour automatically snag the highest-rated beers that suits that customer’s taste. Then it gets delivered. The 600-plus indie brewers that Tavour currently works with range from Austin’s Jester King Brewery to Cincinnati’s Urban Artifact Brewing.

How does it work for brewers? Tavour buys wholesale from breweries and then marks up prices like any regular retailer would, avoiding a lot of legal entanglements. Tavour then sells these beers through flash sales, a discount or promotion offered by an e-commerce store for a short period of time. According to this Forbes article, Tavour has been hitting another gear with the model during the pandemic.

With beer sales soaring during the coronavirus pandemic, Tavour has been thriving. They’ve tripled the number of new users creating accounts each day in March, April and May compared to February 2020. Revenue in March and April doubled compared to February 2020 and in May Tavour hit 2.5 times their February revenue.

Here’s a cool case study involving Tavour. Anchorage Brewing Co.’s highly sought-after A Deal with the Devil (ADWTD) Barleywine has historically drawn massive crowds to Anchorage when the brewers release a new limited edition at the taproom. This year, everyone flocked to Tavour. Tavour saw the highest traffic numbers in its six-plus-year history during the pandemic as craft beer drinkers jumped at the chance to get one of the best beers in the country. In this feature by CBB scribe Chris Crowell, Tavour bragged about how people abused the system:

Although there was a one can limit, some folks went to extremes to work the system — using multiple accounts under different emails, convincing friends to order for them, and hitting the purchase button repeatedly until the entire stock sold out, in hopes of tricking the queue. Someone even posted a photo of their fingers hovering over the ‘Get It’ button on 4 different phones, simultaneously!

Anchorage postponed its onsite release party and, apart from a small reserve it stowed away in the brewery cellar for locals, the entire batch came to Tavour. The beer sold out in 15 minutes. Jump over here to see how you can sell craft beer on Tavour.

Bevv

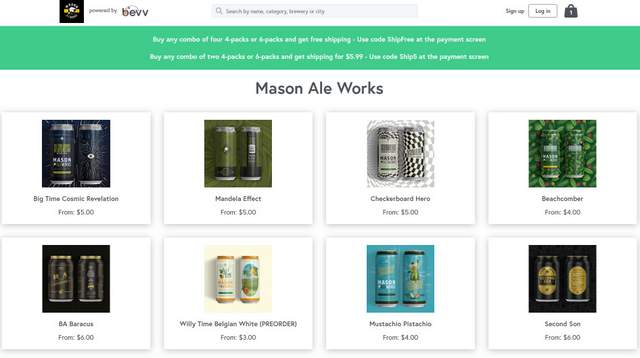

Bevv is an online marketplace that provides a platform for breweries and cideries to sell their products online, directly to consumers, adding e-commerce as an extension of a brewery’s taproom. The platform was featured in our recent article on building a direct-to-consumer sales model during the pandemic with a savvy social media strategy.

Unlike Tavour, Bevv is not a retailer. Bevv does not hold the product. Bevv is the technology between the buyer and seller. It is an online e-commerce and end-to-end logistics solution for breweries, cideries and niche bottle shops — pick up/delivery, label generation, reporting and instant payment. Brewers get a cool site, assurance of legal compliance and the tools to market their product online. There is both a vendor’s website and Bevv’s master marketplace where customers can shop.

A key message and one of Bevv’s big differentiators is that it’s a fully integrated logistics solution as well. Bevv provide the following and breweries can choose to use them all or some. It’s all built into each vendor’s dashboard:

- Curbside

- Local Self-Delivery

- Local Third-Party Delivery

- Long-Distance Shipping

Bevv takes a fee of 10 to 15 percent of each completed order of alcohol, and it’s currently waiving any monthly fees for the foreseeable future. How does all this work for shipping out of state? From the Bevv FAQ:

Currently, we are operating under the direct-to-consumer laws. If you are currently selling out of your brewery/cidery/meadery then most likely you have the proper licenses for your state’s direct shippers retail sales (check with your state ABC). Direct shippers permits are required for most states to allow for out out-of-state breweries to ship into their state. The annual fees vary by state along with each state’s volume limitations and reporting requirements for such direct shippers. Bevv will provide links to each vendor containing state’s permit requirements upon registration.

Cider and Mead can ship in and out of 44 states.

Beer is more restrictive based on your state. Some states can ship out of state but not within. Others can ship both within and out of a state. Some states are only receiving states. We have navigated this fishy water by doing the legal research, speaking to lawyers, state ABCs.

Kombucha falls under beer laws.

Working on spirits laws now.

To learn more, check out this story we did on a playbook that Bevv helped produce, about embracing online beer sales. Then jump over to its website.

Bottlecapps

Bottlecapps is a SaaS (software as a service) company specific to the beer, wine and spirits industry, focused on alcohol retailers. It is an online alcohol delivery mobile app that helps businesses with beer and wine delivery. Bottlecapps’ niche is its pricing model, which it notes is a “counter approach to many of its competitors whom charge a fee (percentage or flat) per transaction on their platform — instead, Bottlecapps’ pricing is a low, flat, monthly rate, with no transaction fees,” according to this press release. Earlier this year, Bottlecapps joined forces with Spec’s Wine & Spirits — the largest wine and spirits retailer in Texas — to create an on-demand, mobile shopping app for its customers. That’s the kind of thing it does.

Bottlecapps currently does business across 40 states in the United States and is looking to expand its services into the Canadian market very soon. The company has also seen some meteoric growth of late, experiencing a major increase in platform sales year-over-year, with some months pacing out 800 to 1,000 percent higher than the same period in 2019, making Bottlecapps “the Fastest Growing Beverage Alcohol Platform in the Nation,” according to this press release.

Also from the release:

Online sales of alcoholic beverages — which peaked at 551 percent year-over-year growth during the week ending April 25 — continues to hover in the triple-digits, with sales increasing 307 percent in further months during the ongoing COVID environment.

TapRm

TapRm is a beer distribution platform designed for breweries, retailers and consumers, but it’s only in New York City right now. It combines licensed verticals to launch e-commerce-focused brands in new markets as distributor, retailer, e-commerce store and delivery courier, and then the company shares customer data back to the brands to enable them to make better decisions.

Last year, TapRm announced it had raised $1.5 million to expand its business. The Broe Group, a privately owned, multibillion-dollar value investment group with diversified holdings in 37 North American states and provinces, led the round, and VU Venture Partners, Branded Strategic Hospitality and others joined. Read more about it here.

Bevv com says

@Bottlecapps1 @Drizly @tavour @TapRmBeer Thank you for the shoutout. 🍺🍺🍺🍺🍺🍺