Yesterday, the National Beer Wholesalers Association (NBWA) released the Beer Purchasers’ Index (BPI) for April 2020. The COVID-19 crisis has presented the economy and beer market with unprecedented challenges. Getting the right products safely into the right places to meet consumer demand has become more challenging and complicated than ever before.

Data for the April 2020 Beer Purchasers Index was collected from April 6 through April 20, coinciding with the period of temporary on-premise closures and simultaneous increased off-premise volumes sales.

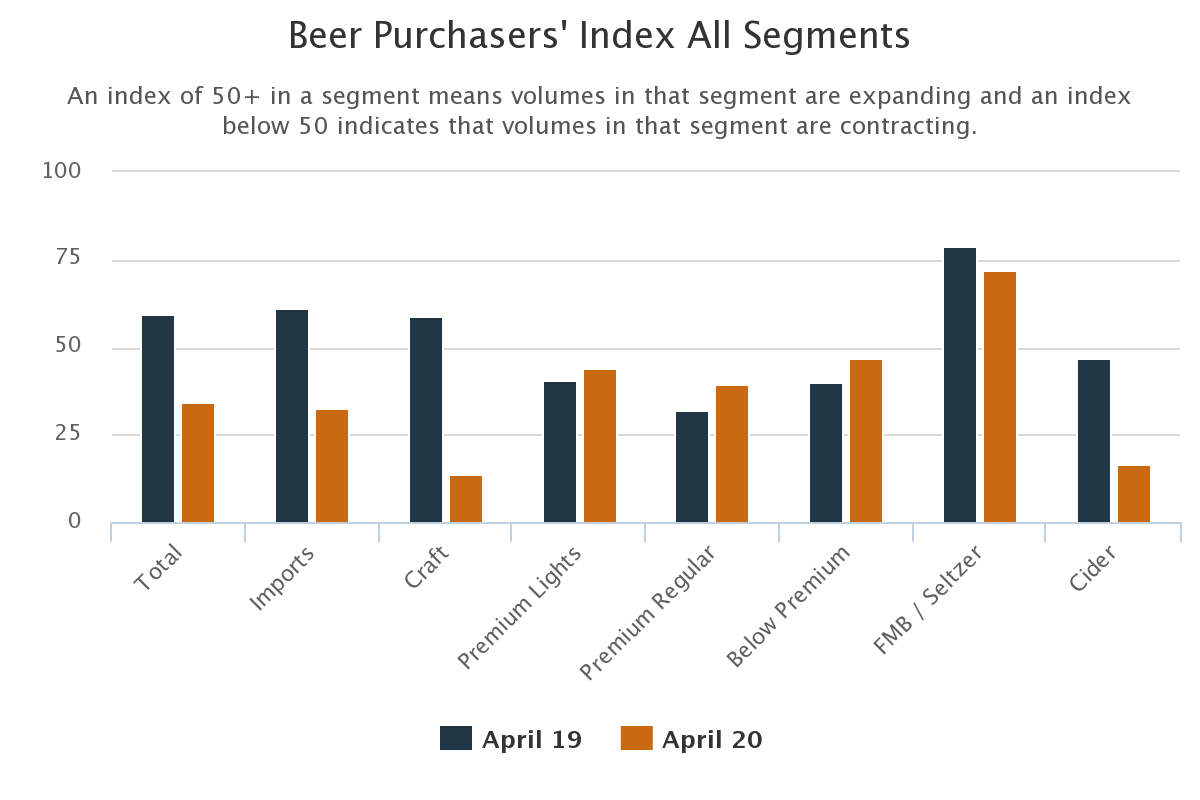

About NBWA’s Beer Purchaser’s Index: BPI is the only forward looking indicator for distributors to measure expected beer demand. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

After beginning the year with expanding beer orders and stalling in March, the BPI registered a reading of 35 for April 2020, indicating a contracting beer market. With on-premise temporarily closed around the country, the high-end segments of imports and craft are reporting record low readings in April. At the same time, domestic premiums and below premiums saw significant jumps and are reporting higher index readings relative to high-end segments. The FMB/seltzer segment is the only expanding category, but it too has slowed down from prior months’ 90+ readings.

With a significant shift in consumer purchases taking place, and many on-premise retail outlets shut down, the “at-risk inventory” index (inventory at risk of going out of code/expiring in the next 30 days) for total beer increased to an unprecedented index reading of 80 in April 2020.

Looking across the segments:

- The rush to bring new seltzer brands to market continues to produce the highest BPI readings across all segments. However, the FMB/seltzer segment retreated from index readings in 80 to 90 range in prior months to 72 in April 2020 and is seven points below the April 2019 reading of 79.

- The craft index plummeted to an all-time low reading of 14 for the month, down from 59 in April 2019.

- The index for imports at 32 is the first time this segment has ever experienced an index reading below 50, suggesting a contraction in beer orders from distributors.

- Premium lights, regulars and below premiums all continue to have readings below 50. However, all three segments reported increases in their index in April 2020 compared to April 2019. More. Importantly, these three segments are reporting higher index readings relative to high-end segments of craft and imports.

- The cider segment took another big hit in April, falling to 17 from 47 at the same time last year.

Leave a Reply

You must be logged in to post a comment.