Moss Adams is a professional services firm that assists clients, like craft breweries, with growing and managing their business. Its Craft Breweries Market Monitor is a nice recap on the events, trends, and market forces that shaped the industry over the year. Here are five takeaways. Feel free to check out the rest for yourself here.

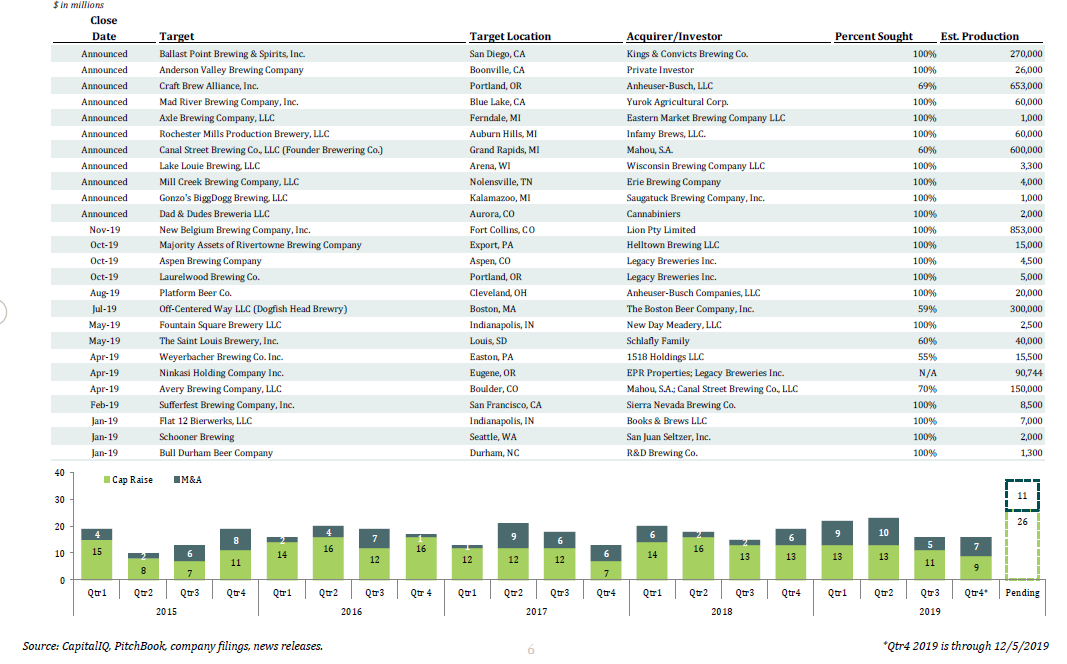

1. M&A uptick

There has been a recent uptick in M&A activity, with some marque brands announcing deals, including Ballast Point (again), New Belgium Brewing and Craft Brew Alliance. However, Kings & Convicts Brewing’s acquisition of Ballast Point was rumored to be completed at a fraction of Constellation’s original purchase price of Ballast Point. Valuation multiples for completed transactions in 2019.

2. Openings vs. closings

Craft brewery openings continue to grow, outpacing prior projections; however, the continued increase of brewery closings reflects the headwinds facing smaller brewers.

3. Health, or whatever

The trend of consumers becoming more health-conscious spurred the explosive growth in the hard seltzer market, causing craft breweries to react with their own, low-calorie, low-alcohol variants such as Lagunitas’ 98 calorie DayTime IPA, Dogfish Head’s 95 calorie Slightly Mighty lo-cal IPA and Ballast Point’s 99 calorie lager. This should help breweries compete with encroaching sales from the hard seltzer and kombucha markets, especially amongst younger consumers.

4. Less alcohol

Currently, the low- or no-alcohol beer category makes up around 5 percent of beer volume worldwide. However, according to a GlobalData report, it is the fastest growing segment in the beer market, achieving a 4 percent compound annual growth rate (CAGR) over the last 5 years, as compared to a 0.2% CAGR for traditional beer over the same time period. Similarly, AB InBev plans to generate around 20% of their overall sales from low- or no-alcohol brands by the end of 2025.

5. Fewer brands, too

Although the trend has been for craft breweries to offer a large portfolio of beers in order to appeal to a wider audience, Mike Stevens, co-founder of Founders Brewery, states the next change in the brewery market is for breweries “to focus on a narrowing handful of brands, not 28 brands, and spending money supporting those core brands.”

Leave a Reply

You must be logged in to post a comment.