Last week was American Craft Beer Week , and Washington, D.C., knew it. From May 13-19, craft beer connoisseurs and breweries alike came together for the eighth annual celebration of more than 2,400 small and independent American craft brewers. Last week, craft brewers also stormed D.C. to let Washington know the facts.

First off, there was Brewers’ Day May 14, and it was hosted by the Beer Institute, which represents the entire beer industry in North America (both craft and Big Beer). It’s an annual fly-in of CEOs and top executives from companies such as Anheuser-Busch, MillerCoors, Heineken USA, Crown Imports and Brooklyn Brewery. They asked Congress to support the Brewers Excise and Economic Relief Act of 2013 (BEER Act), which would reduce the federal excise tax on beer for “all brewers and beer importers,” and which was introduced by Reps. Tom Latham (R-Iowa) and Ron Kind (D-Wis.) with 33 original co-sponsors.

But there were other events going on around town too. Specifically, Jim Lutz, president and CEO of Coastal Brewing Co. in Dover, joined U.S. Senator Chris Coons (D-Del.) for a round table discussion in the Capitol last Thursday on ideas for helping small breweries expand and create jobs. The meeting, which featured leaders from 14 small breweries around the country, was hosted by the Senate Democratic Steering and Outreach Committee to mark American Craft Beer Week.

The Senate is working on another bill that reduces the excise tax on each barrel of beer brewed by small brewers — called the Small BREW Act — and discussion centered on the Senate’s efforts to hear insights from business leaders in the craft beer industry. Those craft brewers brought a lot of facts, like: Industry growth in 2013 was up 15 percent by volume and 17 percent by dollars compared to growth in 2011 of 13 percent by volume and 15 percent by dollars. And craft brewers are credited with sales of an estimated $10.2 billion in 2012, up from $8.7 billion in 2011. Not to mention craft brewers currently employ more than 108,000 people in America.

“American craft breweries have proven to be successful small businesses that create jobs and help fuel our economy,” Senator Coons said in a press release. “It’s important that we provide incentives for these businesses to expand. Coastal Brewing is an example of how a passion for brewing beer can go from a weekend hobby to a thriving business. I thank Jim Lutz for participating in today’s meeting and sharing his insights on how the government can work to boost brewers across the country.”

“As small brewers, we appreciate the work that our legislators put into leveling the playing field,” Jim Lutz, president and CEO of Coastal Brewing said in the same release. “Their vigilance assures us access to unrecognized business opportunities, allowing us to reinvest our resources in the local economy.”

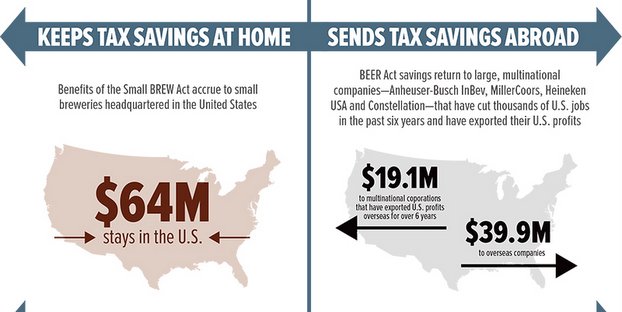

The discussion comes on the heels of the introduction of the Small BREW Act — the Small Brewer Reinvestment and Expanding Workforce Act — which was introduced a couple of weeks ago and would reduce the excise tax on each barrel of beer brewed by small brewers. Senator Coons and Senator Tom Carper are co-sponsors of the bill.

Under current law, brewers generally pay an $18 excise tax on each barrel brewed. Small brewers, currently defined as those that brew fewer than 2 million barrels (bbls) of beer a year, pay a reduced excise tax of $7 per bbl for the first 60,000 bbls of beer they brew each year. The Small BREW Act would reduce the excise tax applicable to brewers producing up to 6 million bbls per year to just $3.50 on the first 60,000 bbls and $16 on additional bbls below 2 million per year.

Of course this bill differs from the BEER Act of 2013. Under that bill, small brewers would pay no federal excise tax on the first 15,000 bbls; small brewers would pay $3.50 on bbls 15,001 to 60,000; small brewers would pay $9 per bbl for every barrel over 60,000 and up to 2 million bbls; and for brewers producing more than 2 million bbls annually, and for all beer importers regardless of size, the federal excise tax rate would be $9 per barrel for every barrel.

To learn more about these two pieces of legislation, read our bigger comparison here.

RT @BavarianAF: Craft brewers briefed senators on the importance of the Small BREW Act last week – Craft Brewing… http://t.co/kBGSeBTcXz

Craft brewers briefed senators on the importance of the Small BREW Act last week – Craft Brewing… http://t.co/kBGSeBTcXz

RT @CraftBrewingBiz: Last week, craft brewers briefed senators on the importance of the Small BREW Act. http://t.co/DbIRDKENo4