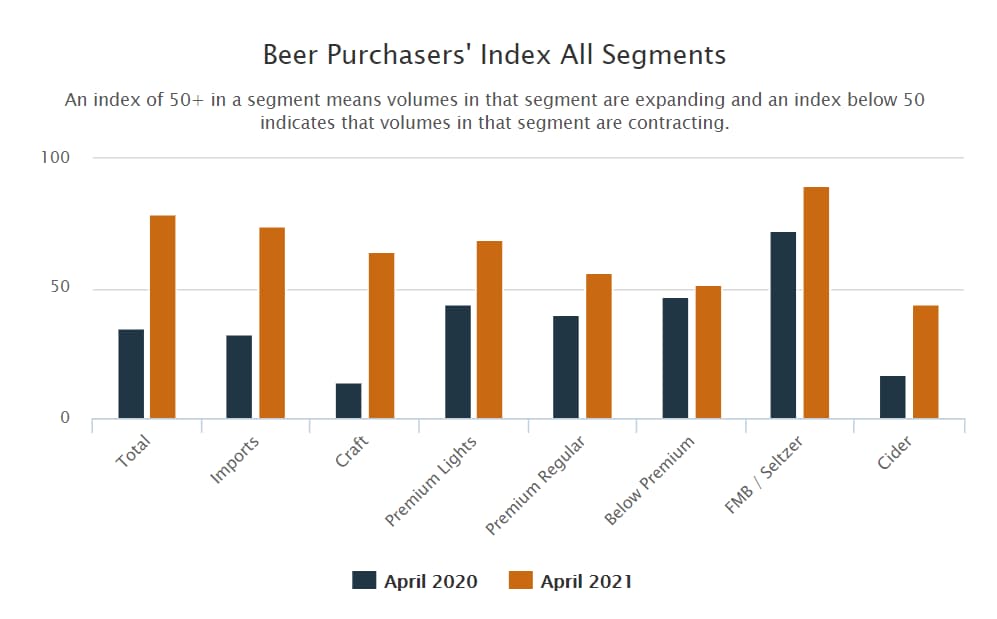

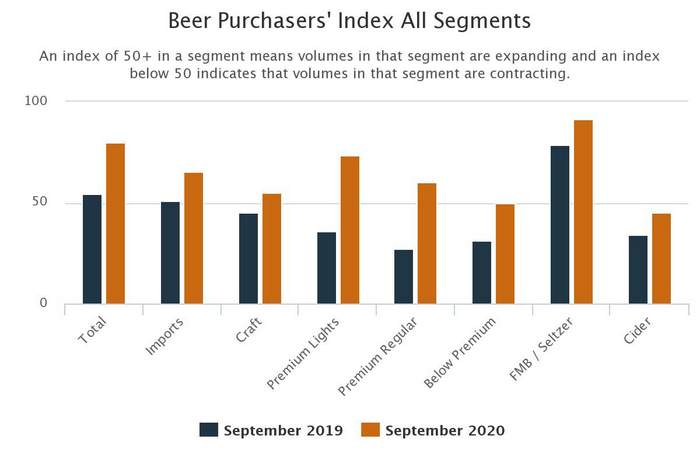

Yesterday, the National Beer Wholesalers Association (NBWA) released the Beer Purchasers’ Index (BPI) for November 2018. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

Yesterday, the National Beer Wholesalers Association (NBWA) released the Beer Purchasers’ Index (BPI) for November 2018. The index surveys beer distributors’ purchases across different segments and compares them to previous years. A reading greater than 50 indicates the segment is expanding, while a reading below 50 indicates the segment is contracting.

The November 2018 Beer Purchasers’ Index is at 48.2 for total beer, which is steady and in line with the November 2017 index at 47.7. The November index reading also closely matches the October 2018 reading last month at 48.3. With all three time periods coming in around the 48 index, the industry appears steady and predictable.

The index is slightly below the critical 50 mark and indicates only slight contractions in total beer orders placed with suppliers. The prevailing trend over the past few years of consumers trading up to higher-end segments shows no sign of letting up in 2018.

Looking across the segments:

- The index for imports continues to indicate expanding volumes with a November index at 69.4 compared to 60.6 in November 2017.

- The craft index at 56.9 is significantly below last year’s reading of 66.9. However, the November index bounces back above the 50 mark and indicates an expansion in the volume in craft beer orders — just not as strong as last year.

- Premium lights, premium regulars and below premiums all posted lower readings compared to the same month last year. These segments continue to lack any significant signs of recovery.

- The flavored malt beverage/progressive adult beverage (FMB/PAB) segment continues to show expansion with a 62.7 index reading. The November reading is significantly higher than last year’s 36.9 reading and continues to post a string of index readings above 60 in 2018.

- The cider segment also continues to expand with November 2018 posting a 57.7 index up from a 24.2 in 2017. This is the segment’s second monthly reading above 50 for 2018.

- The “At Risk” inventory measures for total beer jumped to 53.1 for November. This marks the second time in six months that distributors reported more inventory at risk of going out of code in the next three days. This was driven primarily by slower than expected sales in craft, premium lights and premium regular segments.

The December BPI survey runs from December 10 through December 16. Results will be released to participating distributors on December 17.

Leave a Reply

You must be logged in to post a comment.